Our UK team hosted a 20-minute online briefing to unpack the latest CPI data, discuss the implications for inflation and policy and explain how they shape our non-consensus Bank Rate view. The team address key issues, including:

- The forces likely to drive disinflation from October onwards;

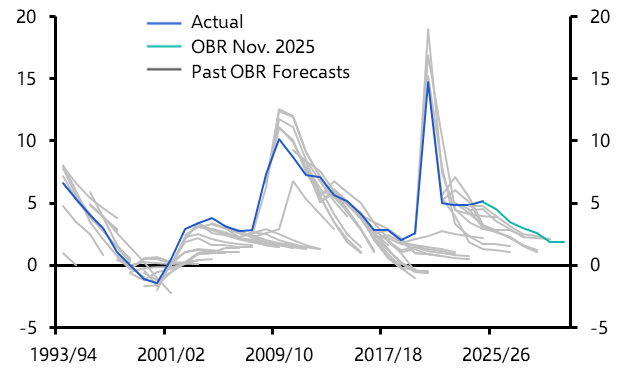

- How the Chancellor’s November Budget could influence the inflation path;

- How our UK inflation forecast underpins our view that Bank Rate will fall more than most expect in 2026.

Start date:

You must be logged in to view this Drop-In. If you do not have a subscription, please get in touch with events@capitaleconomics.com