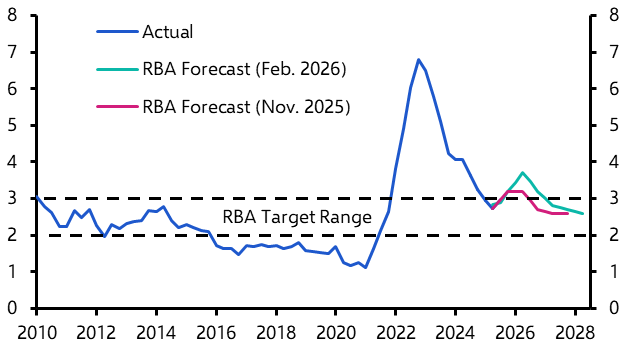

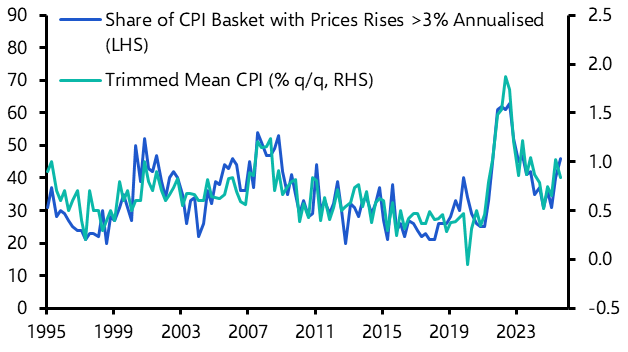

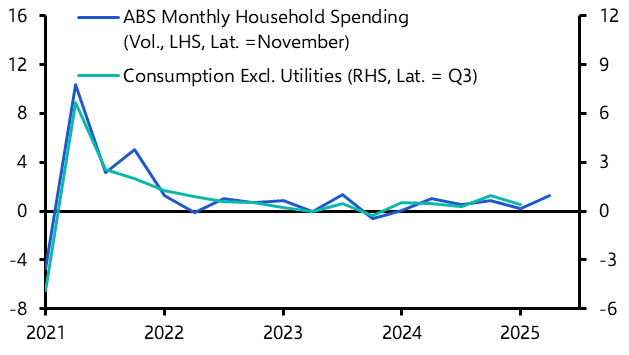

The Reserve Bank of Australia has consistently advocated a cautious approach to policy easing. But with economic momentum fading and the labour market showing signs of softening, the case for unwinding its restrictive monetary stance is growing. In that light, the June quarter CPI release could be pivotal in shaping the path of interest rates.

Our ANZ and Markets economists hosted a special post-CPI release briefing on the inflation outlook, the likely direction of policy, and what it all means for the Australian economy and financial markets.

Start date:

You must be logged in to view this Drop-In. If you do not have a subscription, please get in touch with events@capitaleconomics.com