Harry Truman famously asked aides to find him a one-handed economist because all of his “‘say on the one hand this. . .’, but ‘on the other hand that. . .’”.

The president’s quip has become synonymous with a profession that is prone to hedging its bets. Most of the time this is justified – and is something we fiercely resist at Capital Economics. But right now the global economy is particularly difficult to read, making it especially easy to fall into the Truman Trap.

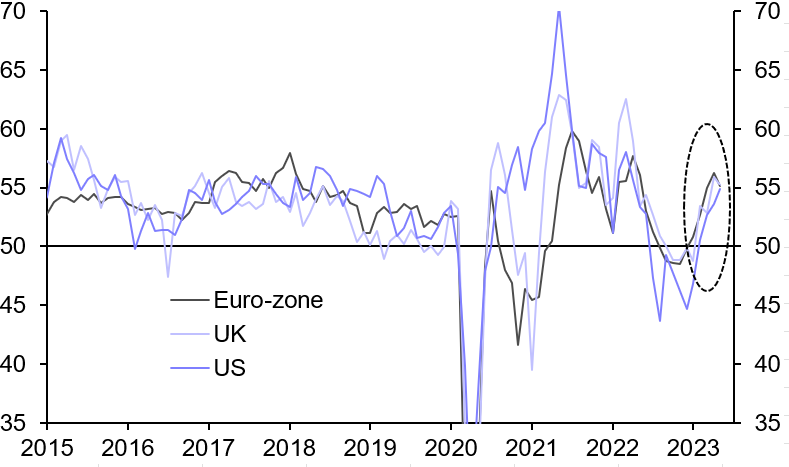

Take the latest data. Service sectors – which typically account for 70-80% of GDP in most economies – appear to be growing strongly. Admittedly, the ISM non-manufacturing index in the US fell back last month. But the service sector PMIs for the US, UK and euro-zone are all comfortably above the crucial 50-mark, which is supposed to separate expansion from contraction. (See Chart 1.) Meanwhile, our latest China Activity Proxy shows that the service sector is sustaining the post-COVID rebound there.

| Chart 1: Service Sector PMIs |

|

|

| Sources: Markit |

At the same time, labour markets are extremely tight. The unemployment rate in the euro-zone has fallen to a record low of 6.5%, while US firms added another 339,000 jobs in May and job openings have started to rise once again.

Accordingly, while core inflation rates in the US and euro-zone have begun to ease a little, they remain well above the Federal Reserve and European Central Bank’s comfort zones. And core inflation in the UK has continued to trend up. None of this screams economic weakness, let alone recession.

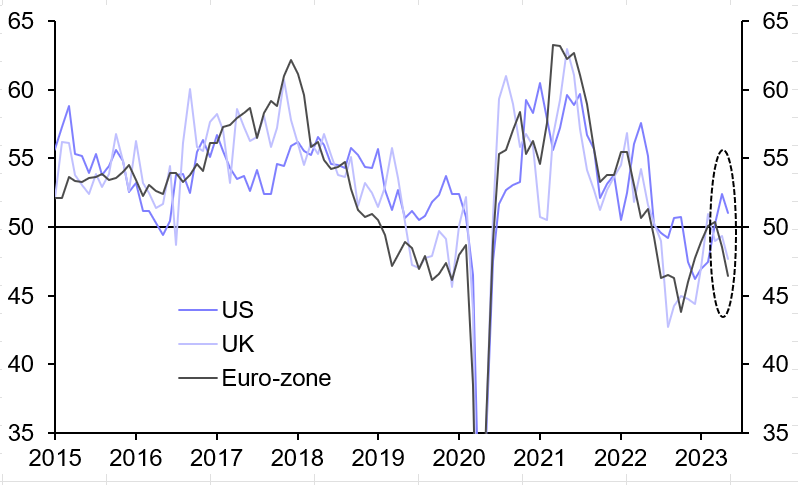

But set against this, manufacturing sectors – which are typically a better bellwether of global activity – are struggling. Manufacturing PMIs in the US, euro-zone and UK fell in May and are now consistent with a contraction in manufacturing output in major advanced economies. (See Chart 2.)

| Chart 2: Manufacturing PMIs |

|

|

| Source: Markit |

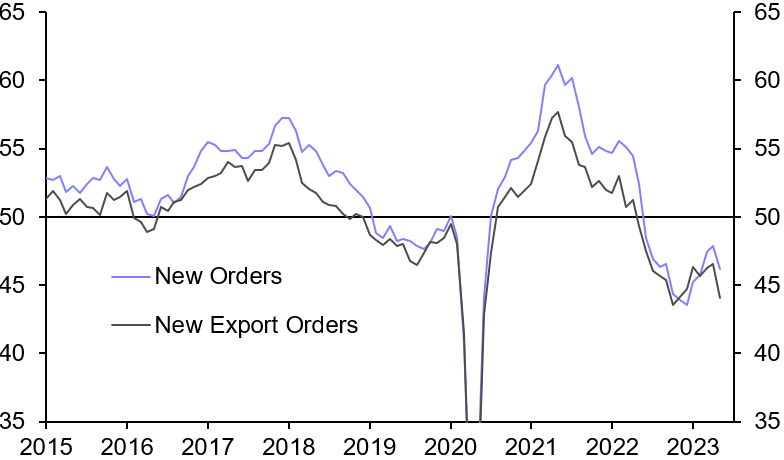

Crucially, this weakness is being driven by a drop-back in new orders balances, suggesting future demand is faltering. (See Chart 3.)

| Chart 3: Advanced Economy Manufacturing PMIs - New Orders and New Export Orders Balances |

|

|

| Source: Markit |

Reflecting this, world trade is falling. According to our estimates, global trade volumes dropped by just under 1% q/q in the first quarter of this year.

Finally, labour markets may not be quite as strong as the headline data suggest. In the US, the strong payrolls number from the so-called “establishment” survey (which surveys firms) contrasts with a sharp fall in employment reported in the household survey, which is used to calculate the unemployment rate. Accordingly, the unemployment rate jumped from 3.4% in April to 3.7% in May – meaning that in just one month the US is now close to breaching the “Sahm rule”, which states that a 0.5%pt increase in the unemployment rate from a cycle low is a near-faultless indicator of recession.

At the same time, while unemployment in Europe is extremely low by regional standards, households are suffering a huge squeeze in real incomes. As a result, while the euro-zone has experienced the mildest of recessions so far (GDP fell by 0.1% q/q in the fourth quarter of last year and first quarter of 2023), consumer spending has declined by 1.3% over the past two quarters. Look under the hood and economies suddenly look less resilient.

So what’s going on and what comes next?

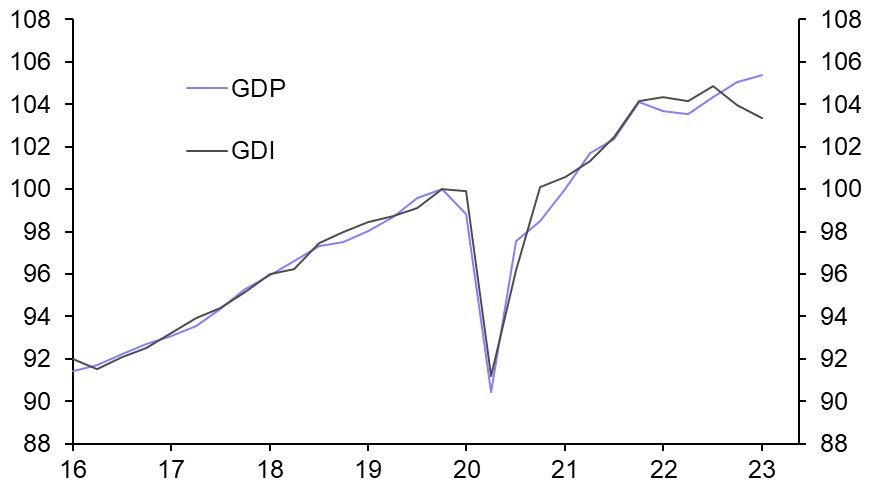

The first point to make is that, while the differences are especially marked right now, it’s not unusual for economic data to send conflicting messages. There has been much discussion of the divergence between the data on US GDP (gross domestic product) and US GDI (gross domestic income). The two series should in theory be the same – one measures the amount of production, while the other measures the income from that production. But in the first quarter they diverged: the GDP data showed positive (albeit sub-trend) growth of 1.3% q/q annualised, while the GDI data showed a contraction of 2.3%. (See Chart 4.)

|

Chart 4: US GDP & GDI (Q4 2019 = 100) |

|

|

|

Sources: Refinitiv |

However, there was similar divergence between the two series in 2020 that was ultimately revised away in subsequent releases. Back then, the truth turned out to be somewhere between the two series. We suspect a similar outcome is likely this time around.

A second point to note is that the legacy of the pandemic is still affecting consumer and business behaviour, which in turn is being reflected in the economic data.

The current weakness in manufacturing is unsurprising given the surge in demand for manufactured goods during the pandemic. As demand has since normalised and inventory has been rebuilt along supply chains, production has suffered.

Similarly, the experience of lockdowns is probably playing some role in the strength of services. It is notable that the strongest sub-sectors in services are leisure, hospitality and transport. So despite a squeeze in real incomes across developed economies, consumers are prioritising social activities and travel. Moreover, savings that were accumulated during the pandemic have helped cushion the blow to incomes and sustain the post-pandemic rebound in services for longer than would otherwise have been the case.

The legacy of the pandemic will also shape what comes next. To put it in technical terms, this cycle is weird. Indeed, it is questionable whether it should even be thought of as a cycle in the conventional sense at all. The past three years has been a period of extremes: an extreme hit to output, an extreme injection of policy stimulus, an extreme shift in consumer spending patterns, an extreme increase in prices, and finally an extreme tightening of monetary policy. These extremes have consequences that are now playing out in different ways across different sectors and economies.

In such circumstances, the degree to which central banks need to squeeze demand to bring down inflation is unclear. So too is the response of households and firms to higher interest rates — and therefore aggregate demand to tighter policy. Old models of the economy no longer work. All of this would get poor old Truman turning in his grave. To mollify him, the one thing we can be sure about is that monetary policy operates with a lag — and that the full effects of the substantial increase in interest rates over the past year have yet to be fully felt.

Institutions including the IMF, OECD, European Commission and Bank of England have spent the past month or so removing recessions from their economic forecasts. I take a different view: the recent stickiness of core inflation and the likelihood of further interest rate increases in the US, euro-zone and UK in the coming months make a downturn at some point in the future more rather than less likely.

Call it the logic of policy tightening: the post-pandemic economy may be a puzzle, but the most likely outcome is that recessions have been postponed rather than cancelled.

In case you missed it:

- The Sunday Times gave extensive coverage to new work by Deputy UK Chief Economist Ruth Gregory which identifies phases of UK economic underperformance since the pandemic to forecast at least two more years of this trend.

- Ariane Curtis from our Global Economics team discusses the strength in interest rate-sensitive spending seen in our proprietary indices, but also explains why it won’t last.

- We were the only forecaster to accurately call the outcome of recent meetings of both the Reserve Bank of Australia and the Bank of Canada. We’re holding an online briefing on G10 central bank June decisions – including a review of the Fed and preview of the Bank of England – shortly after the ECB meeting on Thursday. You can register here for that session.

Click here: Contact us