Look to beds, sheds and retail for best returns

UK Commercial Property Outlook

Q4 2024

Commercial property yields and capital values have stabilised in recent months, which has encouraged investors to dip their toes back into the sector. But the recovery is set to be a weak one.

These are just some of the key takeaways from our latest quarterly UK Commercial Property Outlook, originally published on 22nd August, 2024. Some of the forecasts contained within may have changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium service or to our dedicated UK Commercial Property coverage.

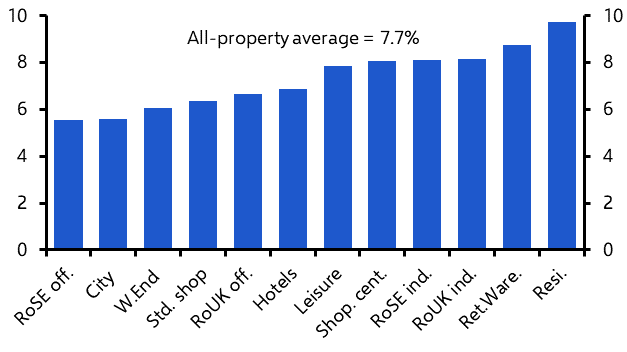

The recovery of the UK's commercial property market is set to be a weak one. Admittedly, we expect rental growth will be a decent 3% p.a. over 2024-28 at the all-property level. But with little prospect of any yield compression on the horizon, capital value growth will be limited and all-property total returns will average around 7.5% p.a. As well as the in-favour industrial and residential sectors, investors looking for a better return should also focus on retail, where strong income returns and the reappearance of rental growth will help total returns match those for industrial.

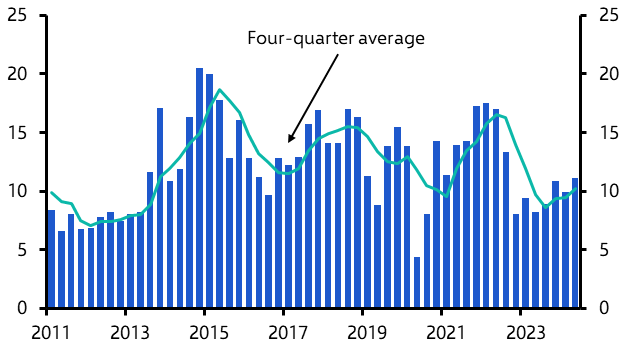

- Commercial real estate investment has turned the corner and is on track to meet our forecast for a rise of around 20% y/y in 2024. (See here.) Investment averaged £10.2bn a quarter in the year to Q2 2024, up 5% on a year earlier and the highest underlying total since the start of 2023. (See Chart 1.) Falling interest rates, loosening credit conditions and a stabilisation in capital values have all helped to attract investors back into the sector.

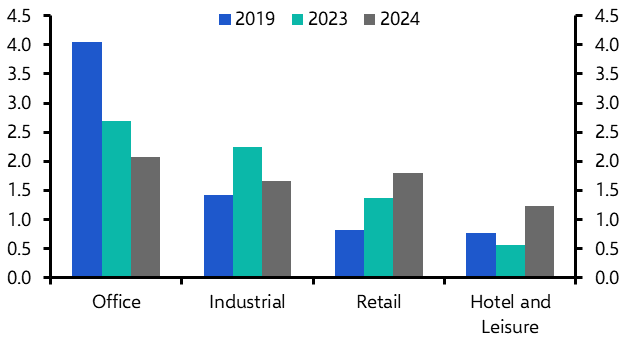

- The improvement has been driven by the hotel and leisure, and retail sectors. Indeed, in the year to Q2 investment was still lower than a year earlier in the office and industrial sectors. (See Chart 2.)

|

Chart 1: Commercial Property Investment (£bn) |

Chart 2: Investment by Sector (% y/y, 4-Qtr Avg.) |

|

|

|

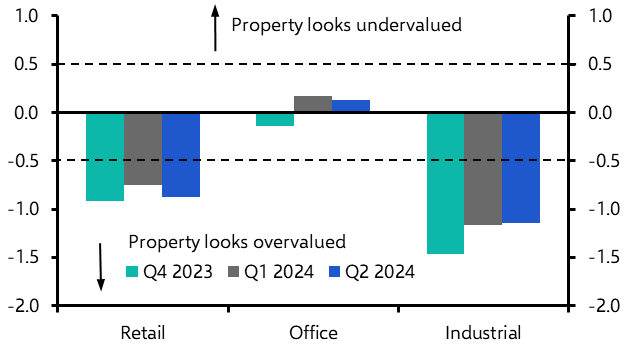

- In part, the strength of the retail investment recovery will reflect its improving rental outlook. (See here.) But we suspect investors are also attracted to valuations in the sector following a 40% fall capital values since 2015. Admittedly, on our methodology the overall retail sector still looks overvalued, although to a lesser extent than industrial. (See Chart 3.) But within that shops and shopping centres are fairly and undervalued respectively, and those sectors have driven the rise in transactions.

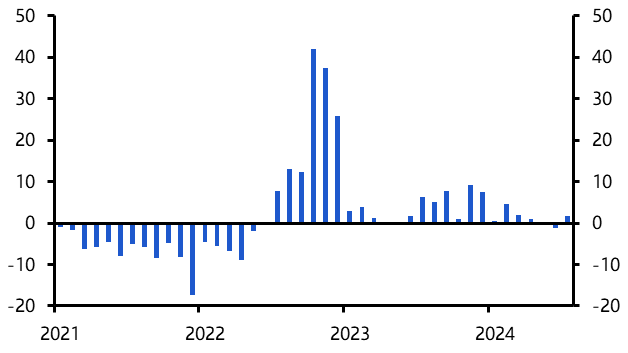

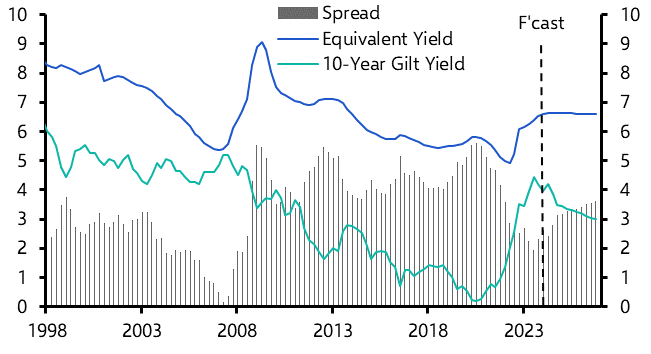

- A stabilisation in yields and capital values will also have given investors the confidence to re-enter the market. According to the monthly MSCI data, all-property equivalent yields have been stable since March, with a rise of only 4bps in the five months to July. (See Chart 4.) A decline in the 10-year gilt yield to 3.8% has relieved the upward pressure on property yields and we expect risk-free rates will fall further over the next couple of years, to 3.5% by end-24 and 3.25% by end-25.

|

Chart 3: Property Valuation Scores (%) |

Chart 4: All-Property Yields (Bps, m/m) |

|

|

|

- But even with risk-free rates falling back we expect yields to be more-or-less flat in most sectors over the next five years. (See here.) After all, the spread against the 10-year gilt is still narrow by past standards, and a period of flat yields as alternative asset yields rise is therefore required to bring that spread to a more sustainable level. (See Chart 5.) At 6.7% by end-28, all-property yields will still be close to today’s level of 6.6%.

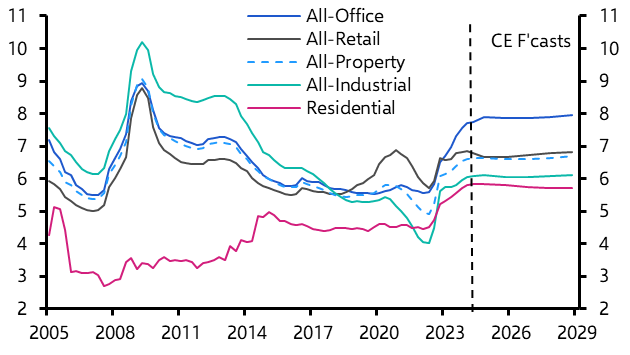

- That picture is similar across the major property sectors. Indeed, the only sector where we expect any fall in yields over the next five years is residential, where superior rental performance helps justify a small decline from 2025. (See Chart 6.)

|

Chart 5: All-Property Equivalent Yield & 10-Year Gilt Yield (%) |

Chart 6: Property Equivalent Yields by Sector (%) |

|

|

|

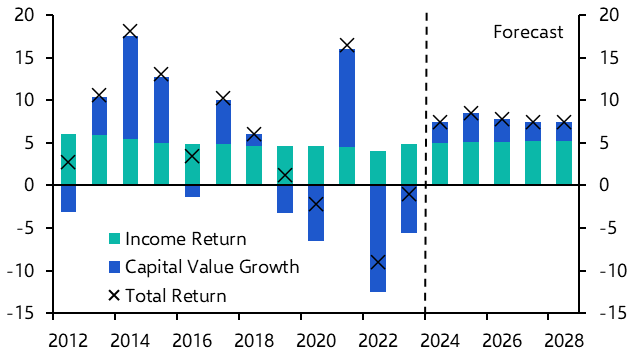

- That means capital value growth over the forecast horizon will rely on rental growth and therefore be modest compared to past recoveries. (See Chart 7.) We forecast growth of 2.6% p.a. at the all-property level over 2024-28, a very slight upgrade from our previous forecast of 2.4% p.a.

- All-property total returns will return to positive territory in 2024 with a rise of just under 7.5%. But the lack of capital value growth means returns across the forecast horizon will rely on income returns and are modest by past standards. We expect all-property returns of 7.7% p.a. over 2024-28, a marginal upgrade on our previous view thanks to slightly stronger rental growth.

- Stronger rental growth means the residential sector is set to comfortably outperform with total returns of 9.7% p.a. over 2024-28. (See Chart 8.) Sectors with stronger income returns, such as retail warehouses, will also do better. Offices will continue to underperform, although within that new, prime buildings will do better.

|

Chart 7: All-Property Total Returns, Income Return and Capital Values (% y/y) |

Chart 8: Sector Returns (% p.a., 2024-28) |

|

|

|

|

Sources: LSH, Refinitiv, MSCI, Capital Economics |

- Office Market – A slowdown in jobs growth is compounding the impact of remote work, with office demand still weak compared to pre-COVID-19 levels. But within the sector demand for new, prime buildings with the best sustainability ratings is holding up and that has helped turnaround the City market to some extent. However, the office sector as a whole will continue to struggle with total returns of 6% p.a. over 2024-28.

- Retail Market – Retail sales have continued their recent volatility, but as real incomes have recovered consumer confidence has improved. Consumer spending is therefore set to drive economic growth over the next couple of years, which will support rental growth. Coupled with flat yields that will finally lead to a recovery in capital values. A high income return will help all-retail total returns average 8% p.a. over 2024-28, in line with industrial and only behind residential.

- Industrial Market – Logistics demand has stabilised following the volatile period during and after the COVID-19 pandemic, and we expect it to remain close to current levels for the next couple of years. Combined with a rapidly shrinking pipeline that will help bring vacancy rates down and provide support to rental growth, as will the recovery in consumer spending. Total returns of 8% p.a. over 2024-28 are second only to residential.

- Residential Market – Annual growth in market measures of residential rental growth, such Zoopla, have been slowing for a few quarters now and that looks set to continue. But concerns around affordability seem overdone and a sharp fall in rent growth is unlikely. Supply is also set to remain tight and given the usual lags between market measures of rent and the MSCI index, rental growth is set to remain close to 6% y/y over the next couple of years. That will boost capital values and total returns, which at just under 10% p.a. over 2024-28 are the best of all the sectors.

- Leisure and Hotels – Spending on leisure services contracted during the cost-of-living crisis and is only set to recover slowly, limiting rental growth. Hotels have been insulated to some extent by the return of foreign tourists and rents there will grow at a respectable 2.1% p.a. over 2024-28. But a low income return means hotel total returns will average just under 7% p.a. over that period, lagging leisure at just under 8% p.a.

This is a sample of a 17-page report published for Capital Economics clients on 22nd August, 2024. For the full report, including in-depth sectoral analysis and comprehensive five-year forecasts, request trial access to our coverage by clicking the button below.

Get the full UK commercial property picture

The full 17-page Outlook includes in-depth sectoral insight and comprehensive five-year forecasts.

Get complete access today.