"Higher for longer" won't survive economic weakness

Q4 Global Economic Outlook

This is a sample of our Q4 Global Economic Outlook, originally published on 3rd October, 2023. Some forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Global Economics coverage.

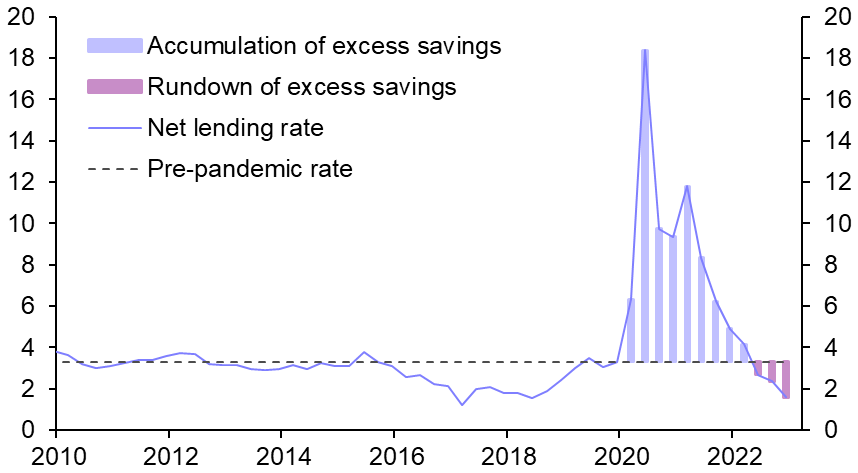

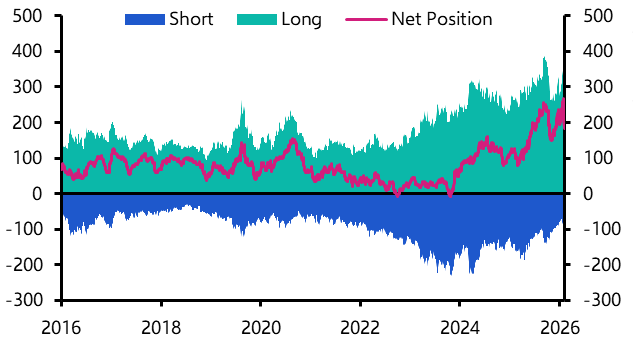

- While recessions have not yet taken hold to the extent that we had feared, this seems to reflect temporary factors. Households in some DMs have run down the savings accrued thanks to supportive fiscal policy during the pandemic. (See Chart 1.) Producers have been able to work off backlogs now that shortages are a thing of the past. And both benefitted from lower commodity prices earlier in the year.

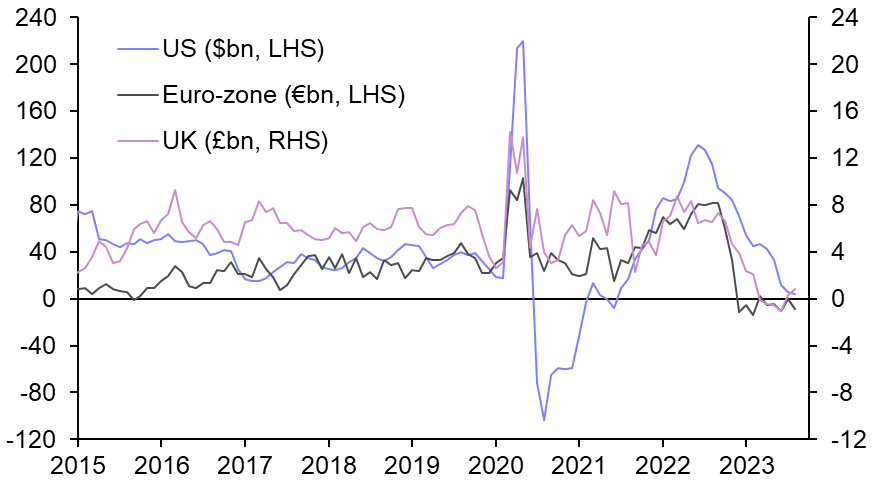

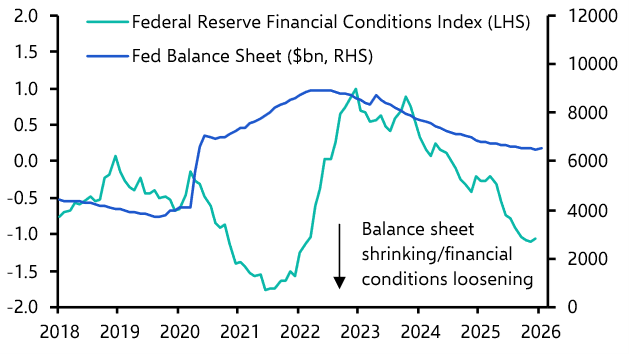

- But none of those props will last and it is increasingly clear that previous monetary policy tightening is doing its work. Financial conditions have tightened dramatically and credit growth has weakened or even turned negative across advanced economies. (See Chart 2.)

|

Chart 1: DM Average Household Saving as % of Income |

Chart 2: Net Bank Lending to the Private Sector (3MMA) |

|

|

|

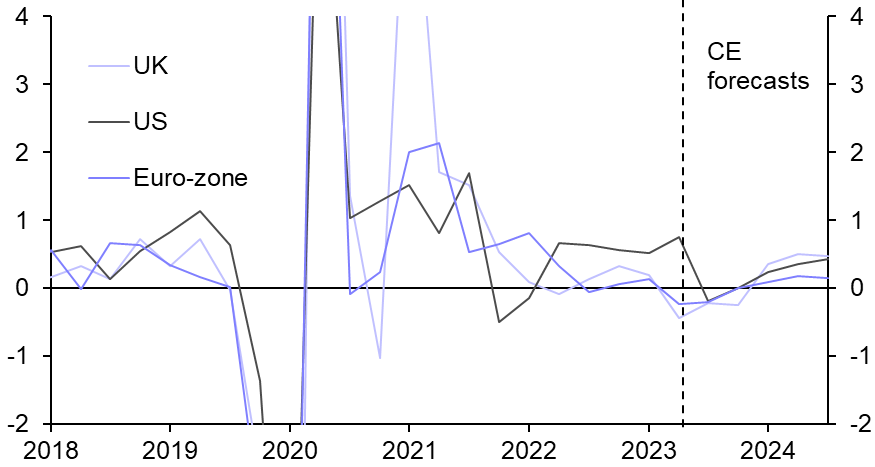

- While aggregate consumer spending is holding up okay, our measure of interest rate-sensitive spending is already weakening and is set to weaken further. We still anticipate recessions across most of Europe and suspect that US GDP will contract too. (See Chart 3.)

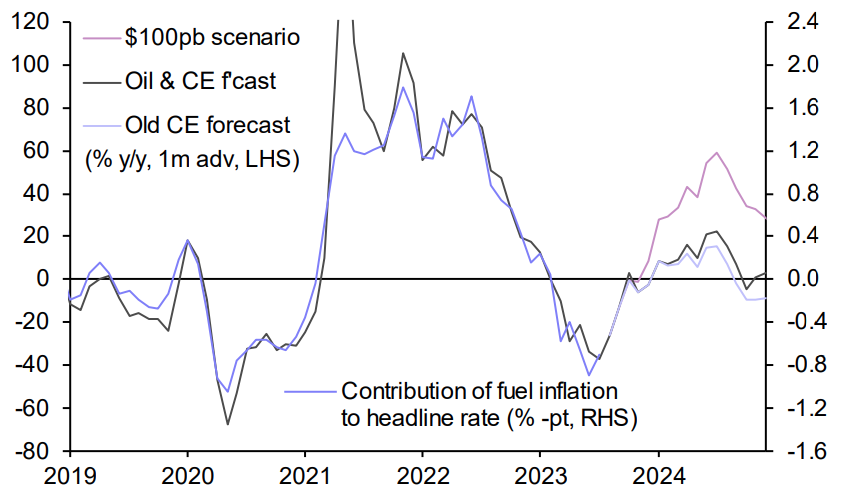

- Recent increases in energy prices will boost headline inflation in advanced economies a little. (See Chart 4.) But we expect this impact to be easily offset by a continued reduction in core inflation. This is particularly true in the US, where a let-up in labour market tightness is already weighing on wage growth.

|

Chart 3: GDP (% q/q) |

Chart 4: Oil Price & Fuel Contribution to DM Inflation |

|

|

|

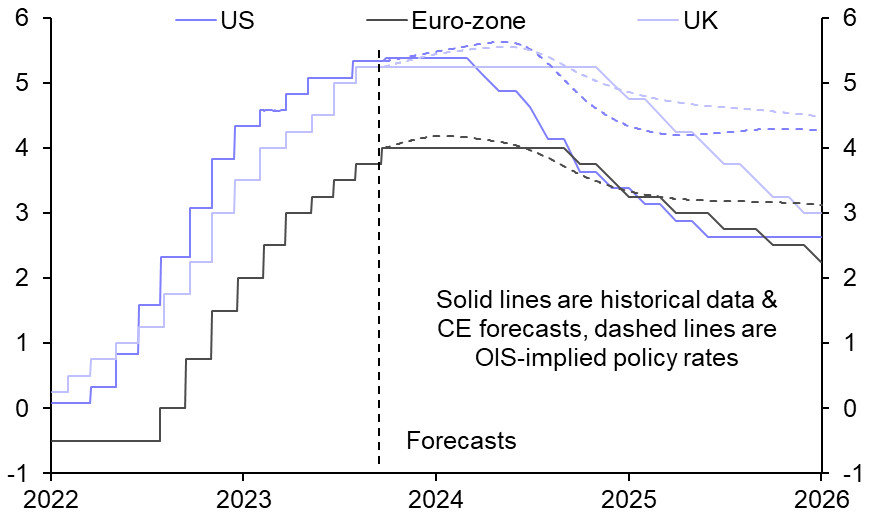

- Accordingly, we doubt that the Fed, the ECB or the Bank of England will deliver the final interest rate hikes that markets anticipate and the Fed is likely to cut rates far sooner than expected. Relatively sticky wage growth will mean that rates have to stay at their peaks for a little longer in Europe, but when cuts do come we think they will be more aggressive than is typically assumed. (See Chart 5.)

- After a period of stagnation, China should experience a modest cyclical recovery thanks to a step-up in policy support. But strong structural headwinds mean that the improvement will not last for long and positive global spillovers will be limited. There may even be adverse effects if resilient demand from China boosts commodity prices further.

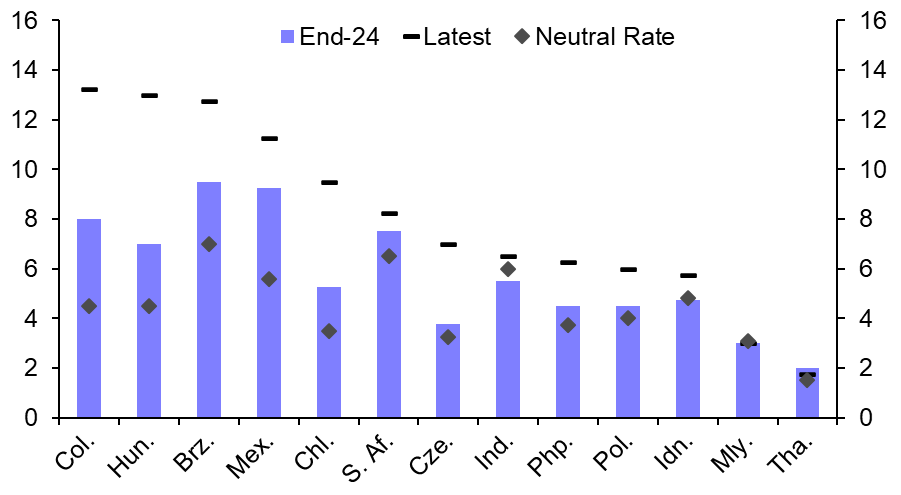

- Elsewhere in Emerging Markets, leading indicators suggest that activity has started to weaken after a solid start to the year. Weakness in DMs will weigh on exports and fiscal policy is set to be tightened in several areas. One key exception is India, which should benefit from a pre-election fiscal boost and continue to lead the pack of major economies. Generally speaking, in the same way that they led the rate-hiking cycle, EMs will remain at the forefront of policy easing. (See Chart 6.)

|

Chart 5: DM Policy Interest Rates (%) |

Chart 6: EM Policy Interest Rates (%) |

|

|

|

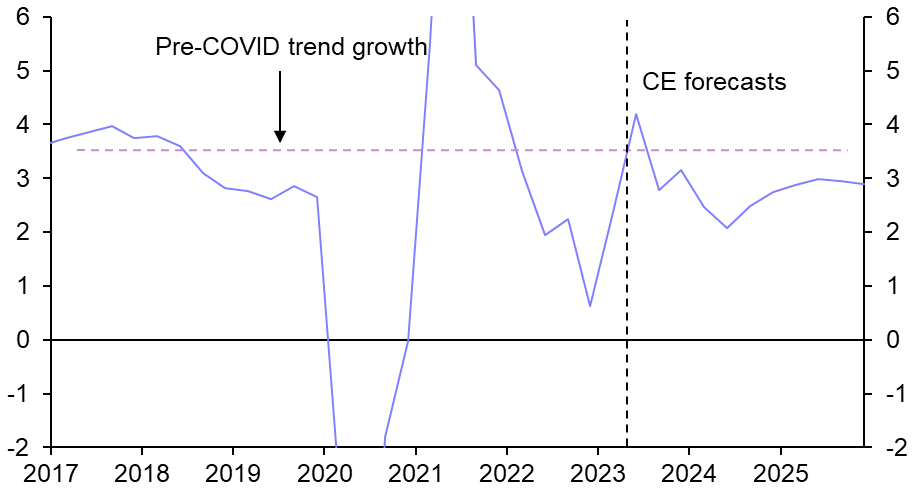

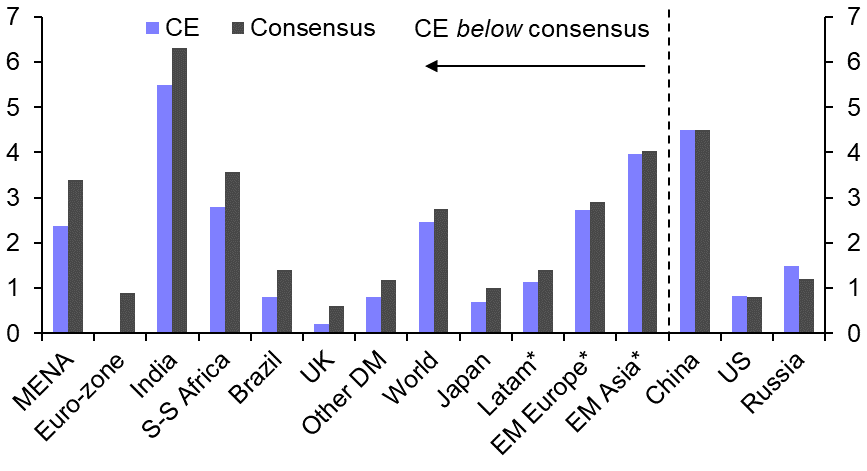

- In all, we expect a global economic expansion of 3.1% this year to be followed by below-trend growth of 2.5% in 2024 and a modest recovery in 2025. (See Chart 7.) Most of the weakness will come around the turn of this year. Our projections are generally below consensus, with the exception of Russia. (See Chart 8.) The key downside risk globally is that inflation persists for longer than we expect, forcing central banks to raise interest rates further. That said, it seems to us equally plausible that a sharp fall in inflation could provoke more rapid policy loosening, allowing some borrowers to sit out this tightening cycle altogether.

|

Chart 7: Global GDP (% y/y) |

Chart 8: CE vs. Consensus 2024 GDP Forecasts (% y/y) |

|

|

|

|

Sources: Refinitiv, S&P Global, Bloomberg, Capital Economics |

From a report written for Capital Economics clients by Jennifer McKeown, Simon MacAdam, Ariane Curtis and Lily Milard, originally published on 3rd October, 2023.

Make faster informed decisions

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.