Q3 US Commercial Property Outlook

Property values on course to fall by more than 25%

We think this summer could be the bottom for transactions, but we still see valuations needing to fall by another 12% from Q1 levels.

These are just some of the key takeaways from our latest quarterly US Commercial Property Outlook, originally published on 11th June, 2024. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated US Commercial Property coverage.

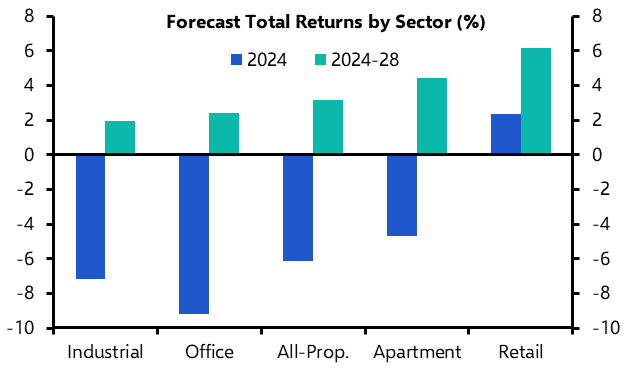

The market remains in the doldrums, with the mood negative and activity weak. The additional 12% fall from Q1 levels that we think valuations still need to undergo would predominantly come through in cap rates, which we don’t think have adjusted sufficiently to the higher rate environment. We expect another 80 bps of cap rate rises before they reach a peak, most of which will be this year. Importantly, when the recovery comes, it will be weak. As a result total returns will average just 3% p.a. over 2024-28, rising to 5.5% if 2024 is excluded. Retail is our top performer at 6% p.a. in 2024-28, with office and industrial trailing at just 2-2.5% p.a. Apartments split those sectors, at 4.5% p.a.

US CRE Outlook: A guide in charts

|

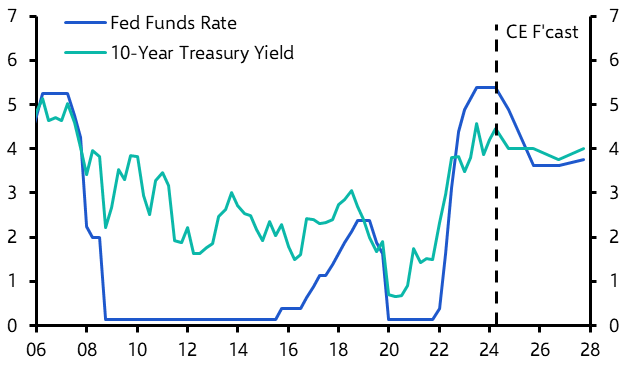

Chart 1: We still expect the Fed to begin cutting rates this year, but the Treasury yield will stay elevated. |

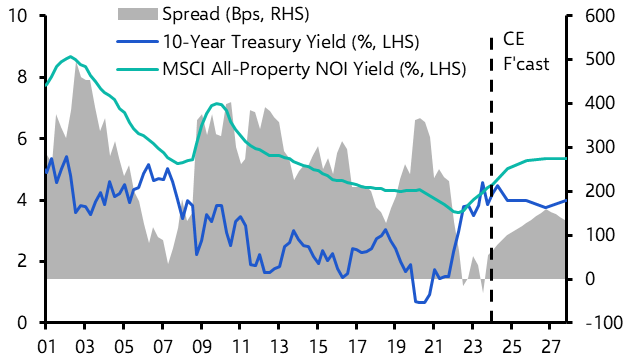

Chart 2: Real estate cap rates need to go up to rebuild yield gaps, suggesting a further rise of 80 bps to come. |

|

|

|

|

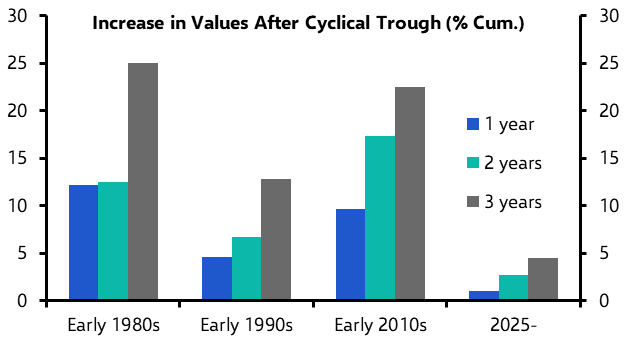

Chart 3: But Treasury yields staying high implies the recovery from late 2025 will be the weakest on record. |

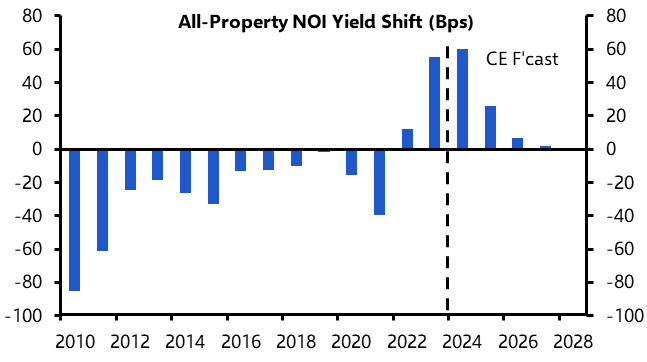

Chart 4: This means after rising further in 2024 and 2025, we expect NOI yields will be fairly stable. |

|

|

|

|

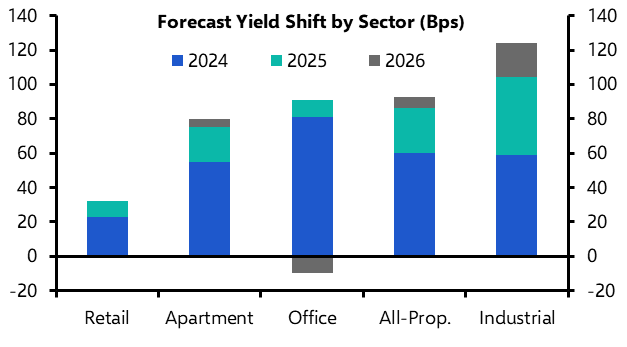

Chart 5: While offices see the largest yield rises in 2024, industrial and apartments lead the way thereafter. |

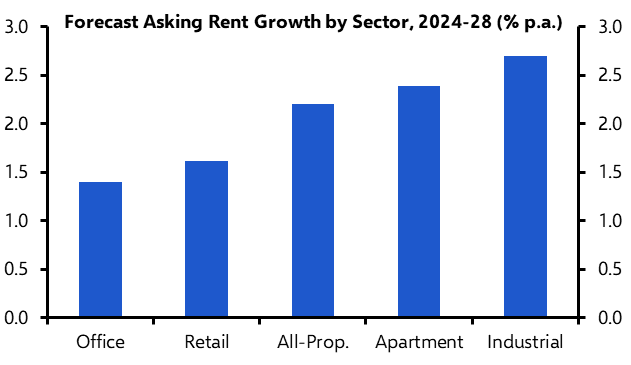

Chart 6: That’s despite our forecasts for better rent growth in those two sectors over the coming years. |

|

|

|

|

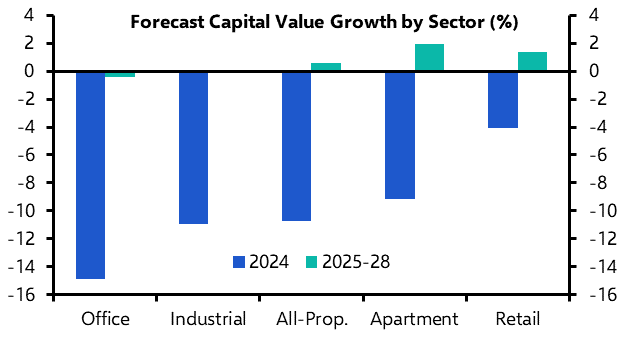

Chart 7: The recovery in values from 2025 will be strongest for apartments, followed by retail. |

Chart 8: But retail’s smaller fall this year and higher income return means it tops the table for total returns. |

|

|

|

|

Sources: MSCI, NCREIF, Refinitiv, CE |

Investment Market

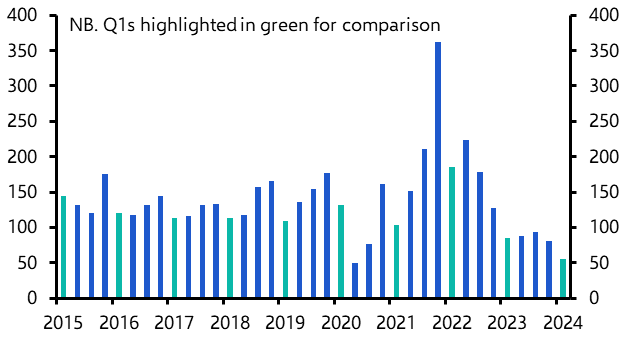

- As expected, Q1 transactions were way down on recent peaks, 35% below Q1 2023 and a whopping 70% below Q1 2022. The $55bn transacted in Q1 was the lowest quarterly total since the pandemic-affected Q2 2020. (See Chart 9.) Worse still, April’s $15.6bn transacted was actually lower than in April 2020.

- Investment therefore remains on track to be very weak in H1, lower even than last year’s H1 outturn. (See here.) We remain optimistic that Q2 or Q3 should mark the bottom of this cycle, but this is partially dependent on valuations being marked down more rapidly than in Q1.

- Anecdotal evidence suggests that sluggish value falls stem from lenders and investors not wanting to realise losses on assets at what they see as the low point of the cycle. (See more here.)

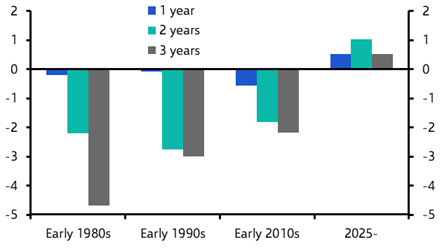

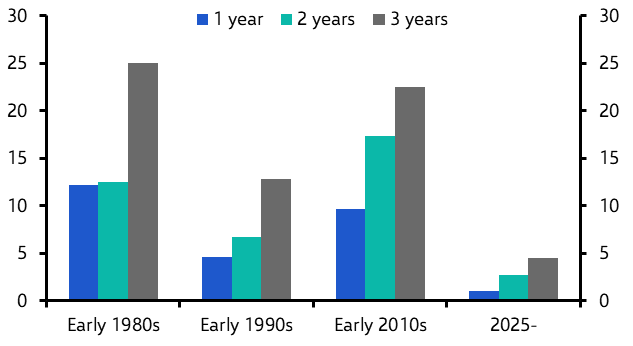

- But we don’t expect a sharp drop in Treasury yields in this cycle, which has traditionally spurred the recovery in values. (See Chart 10.) On top of this, the poor outlook for offices will weigh on the all-property figures. We therefore don’t expect a particularly strong recovery in values over the next few years. (See Chart 11 and here.)

- We’ve previously noted the vast quantities of capital being raised to take advantage of market weakness. And there are signs of that starting to be deployed. But this still needs realistic pricing from sellers in order to bring about a major pickup in activity. As more assets are brought to market by motivated sellers, we expect more clarity on pricing to come through and to bring expectations between buyers and sellers closer.

- That divergence remains because appraised values are yet to fully reflect the rise in bond yields of the past few years. Those bond yield rises mean that even though cap rates have risen, property to bond yields spreads are still close to long-term lows. And even though the Fed is likely to cut rates this year and next, we expect Treasury yields to hold around 4% over the coming years. As a result, we think cap rates still have further to rise. (See Chart 12.)

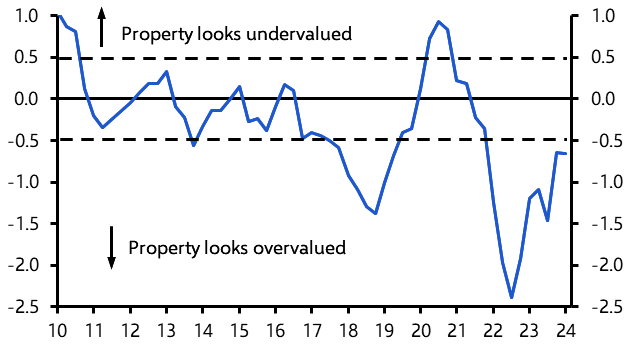

- Furthermore, our proprietary measures of valuations also show real estate to be overvalued when priced against a basket of alternative asset yields. (See Chart 13 and here.) As a result, despite another 10 bps rise in all-property NOI yields in Q1, we think they still need to rise by over 80 bps. We predict the majority of that will be this year, with a climb of 50 bps over Q2-Q4 and then a further 25 bps in 2025. (See Chart 14.)

- That keeps our expectations for cap rate rises above the consensus, which is predicting the NCREIF cap rate to rise by just 20 bps this year and another 20 bps in 2025. That difference also explains why, at minus 6% and plus 1.5% respectively, we are forecasting lower total returns than the consensus in both 2024 (minus 4%) and 2025 (plus 4%). (See here.)

- Our forecasts also leave us below the path implied by the all-equity REIT index, which suggests that capital values should stabilise this year. Instead, our forecasts point to a nearly 11% value decline in 2024 before stabilizing later next year. (See here and Chart 15.)

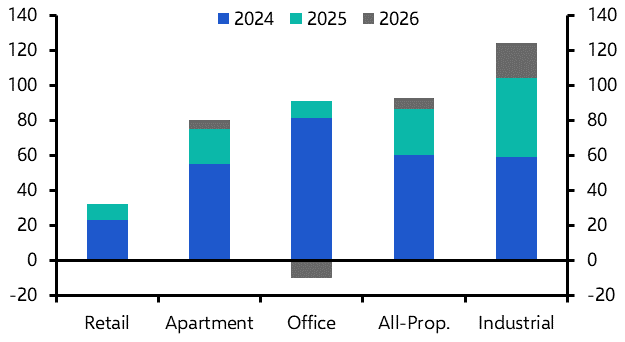

- At the sector level, we still expect the largest increase in NOI yields this year in the office sector. But we think the relatively quick write-off of value in that sector means that industrial and apartments will see larger rises in 2025-26. (See Chart 16.) That forecast reflects our analysis showing particularly stretched pricing, with solid rent growth not strong enough to offset the narrow yield gaps over Treasuries in those sectors.

|

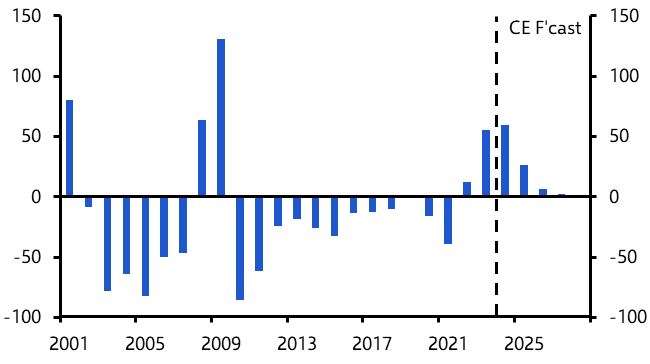

Chart 9: Commercial Real Estate Investment ($ bn) |

Chart 10: US 10-year Treasury Yield (Difference from Market Peak, %-pts) |

|

|

|

|

Chart 11: Increase in Values After a Cyclical Trough |

Chart 12: Commercial Real Estate to Bond Yield Spreads |

|

|

|

|

Chart 13: CE All-Property Valuation Scores |

Chart 14: All-Property NOI Yield Shifts (Bps) |

|

|

|

|

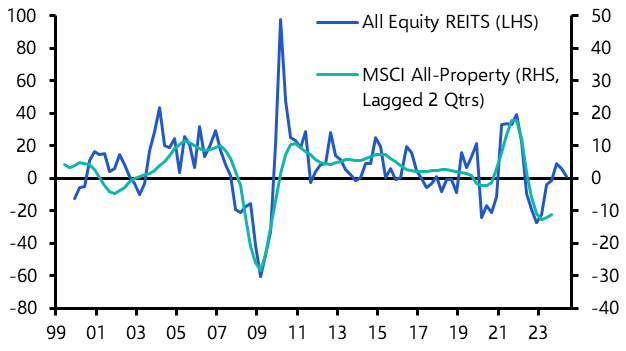

Chart 15: REIT Price Index and Direct Market Capital Values (% y/y) |

Chart 16: Yield Shift Forecasts by Sector |

|

|

|

|

Sources: CBRE, MSCI, Newmark Research, Refinitiv, CE |

Click below to get comprehensive forecasts and full sectoral analysis, including:

- Office Market – Why we expect measures of contracted office space to continue falling throughout the forecast period as leases expire and firms downsize. This will increasingly impact NOIs. Cap rates have further to rise, almost all of which we expect to come through this year. Together, that means office values will fall 15% in 2024 and 4% in 2025, before a very meek recovery and total returns average just 2.5% p.a. over the five year horizon.

- Retail Market – Retail demand will soften this year due to the cyclical slowdown, but after a tougher 2024, we think vacancy will drop back in 2025, spurring rental growth. With cap rates already close to their peaks, we think retail values will fall by just 4% this year, before stabilising next year. This sets retail out as the only sector forecast to see positive total returns this year and the top performer over 2024-28 with average annual returns of 6%.

- Industrial Market – Demand should pick up later this year, but strong completions will mean that vacancy rises to over 6%, before stabilising over the next couple of years. Rent growth will therefore slow, but should still average 2.5%-3.0% p.a. over the forecast. We continue to think the sector needs to see a substantial re-pricing though, with another 125 bps in cap rate rises forecast. This will weigh on values and returns, leaving average annual returns at just 2% over the 2024-28 period.

- Apartment Market – Even though demand looks strong this year, it continues to be outpaced by supply. We expect that to persist through to mid-2025 before vacancy tops out. Rents will still grow, but they will only accelerate when new supply drops back from late 2025. With the sector still looking overvalued, we think values will fall by 10% from end-2023 levels. A weak recovery means that over the five year forecast we think returns will reach just 4.5% p.a.

These are just some of the key takeaways from a 13-page report published for Capital Economics clients on 11th June, 2024. The report was written by Kiran Raichura, Imogen Pattison and Thomas Ryan.

Get the full report

Trial our services to see this complete 13-page analysis, our complete US commercial property insight and forecasts and much more