Capital values to fall by another 15%, offices to fare worse

Q3 Commercial Property Outlook

This is a sample of our latest quarterly US Commercial Property Outlook, originally published on 29th June, 2023. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated US Commercial Property coverage.

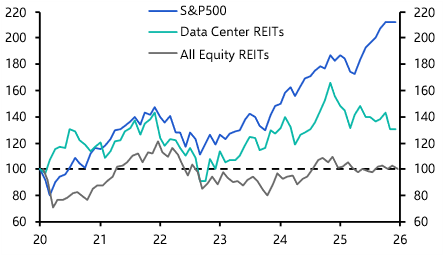

The effects of March’s regional bank failures have yet to come through in the performance data, but transaction volumes have fallen off a cliff. Signs of distress in offices are growing as the sector faces its own credit crunch, with very few lenders willing to provide financing and no sign yet of opportunistic investors. As a result, we think office values will now fall by more than 35% peak-to-trough by the end of 2025 and will not have regained their pre-pandemic levels even by 2040. Our apartment and industrial forecasts are broadly unchanged, where we expect a little more than 20% falls in values. And retail is still the best of the bunch. Here, after this year, we think returns will average 7.5%-8% p.a. in 2024-27, on the back of gradual increases in capital values and income returns of 5.5% p.a.

Investment Market

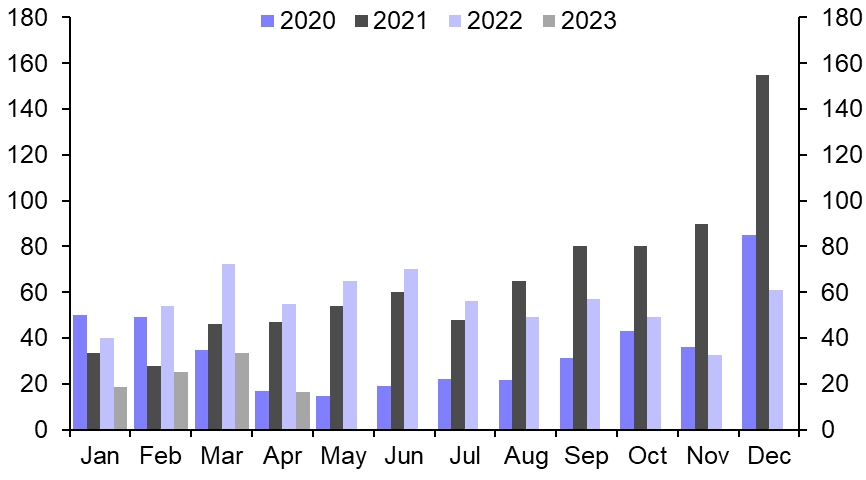

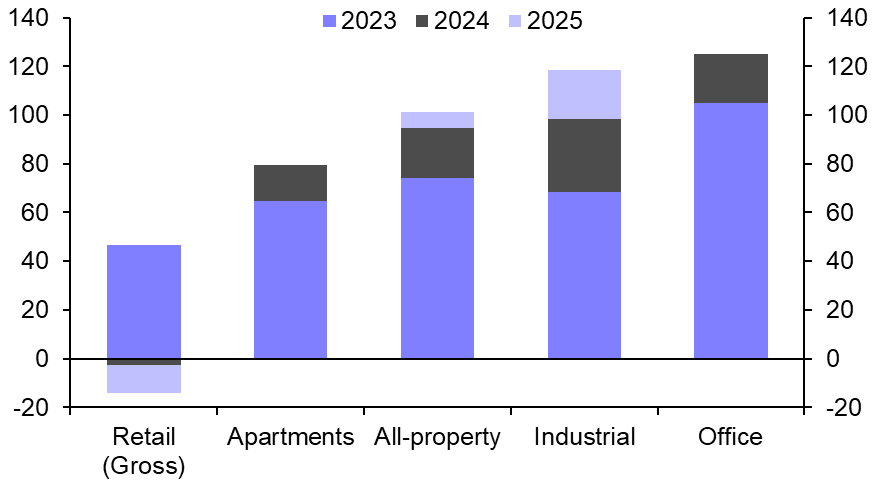

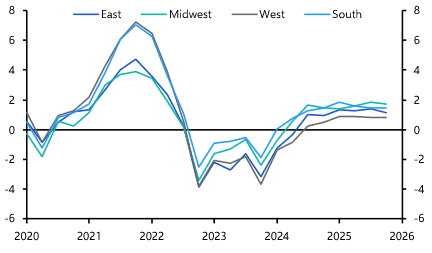

- Deal volumes have dropped sharply since the end of Q1, reflecting a combination of increased investor caution and a tighter debt market. We expect refinancing to be extremely difficult to secure for some assets, particularly offices, where lenders have pulled back almost entirely from the market. With valuations still stretched in all sectors, we think yields have further to climb. We are forecasting a rise of 100 bps across 2023-25, with an increase of 125 bps for offices, but just 30 bps for retail.

Chart 1: Commercial Real Estate Investment Activity by Month ($ bn) |

Chart 2: Yield Shift Forecasts by Sector (Bps) |

|

|

|

|

Sources: NKF, RCA, MSCI, Trepp, Capital Economics |

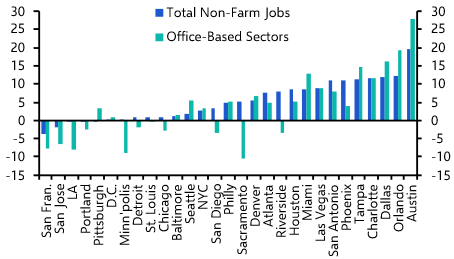

Office Market

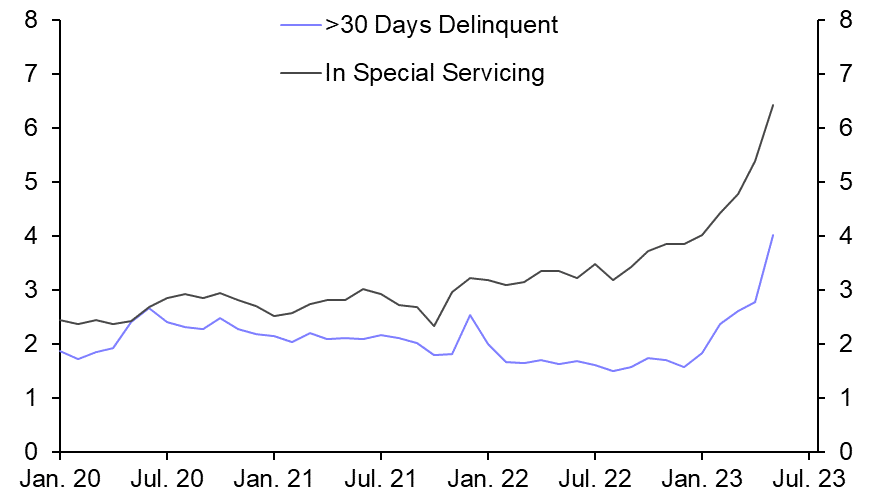

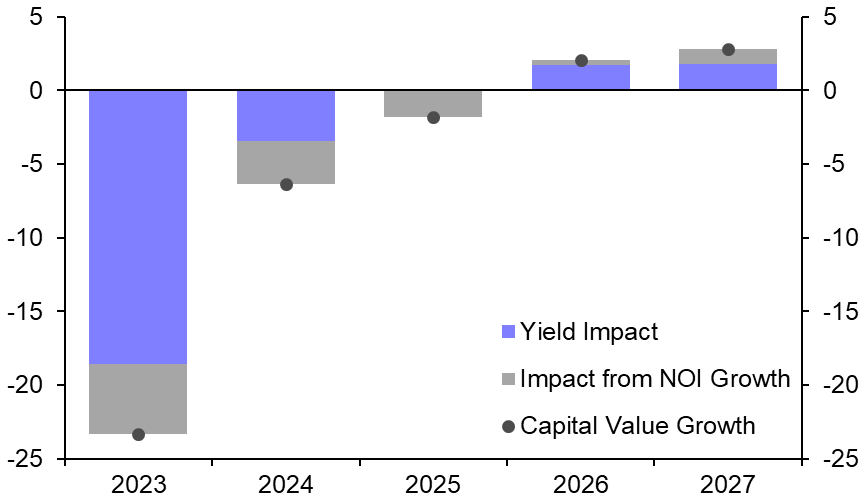

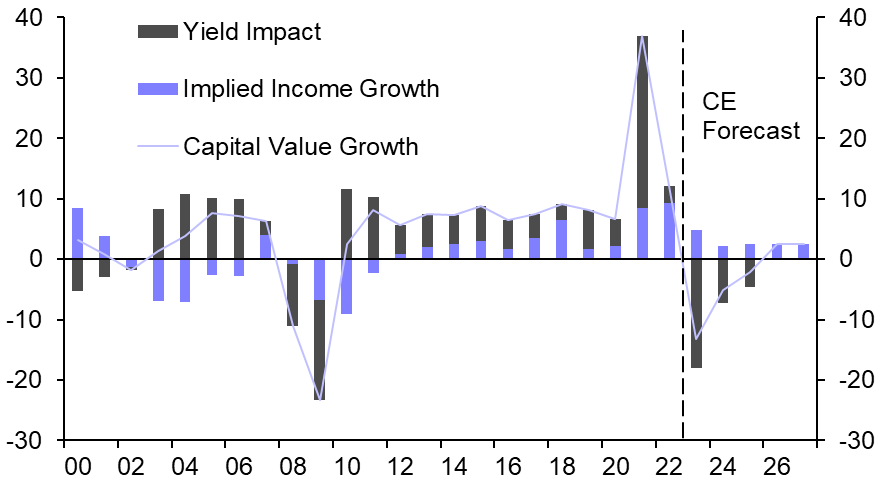

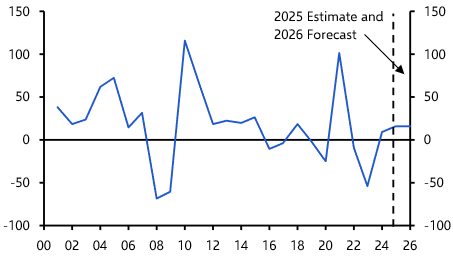

- Distress is growing as firms continue to vacate space (see chart 3.) We expect that to push CMBS delinquency rates higher and for more investors to hand assets back to banks. A further small downgrade to our office forecast this quarter means we now expect a 38% peak-to-trough fall in capital values – and we don’t expect those losses to be recouped even by 2040. Much of this fall is front-loaded this year (see chart 4), with a more-than 100 bps rise in MSCI yields contributing to a hit of over 20% y/y. We expect a combination of further yield rises and falls in operating incomes to keep values declining in 2024-25. As a result, total returns over the 2023-27 period are forecast to average -1% p.a.

Chart 3: Office CMBS in Distress

|

Chart 4: Office Capital Values

|

|

|

|

|

Sources: MSCI, Trepp, Capital Economics |

Retail Market

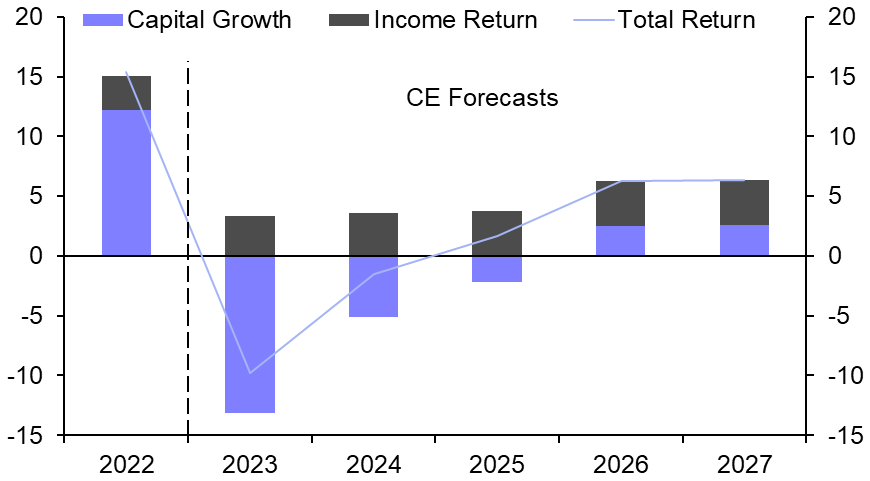

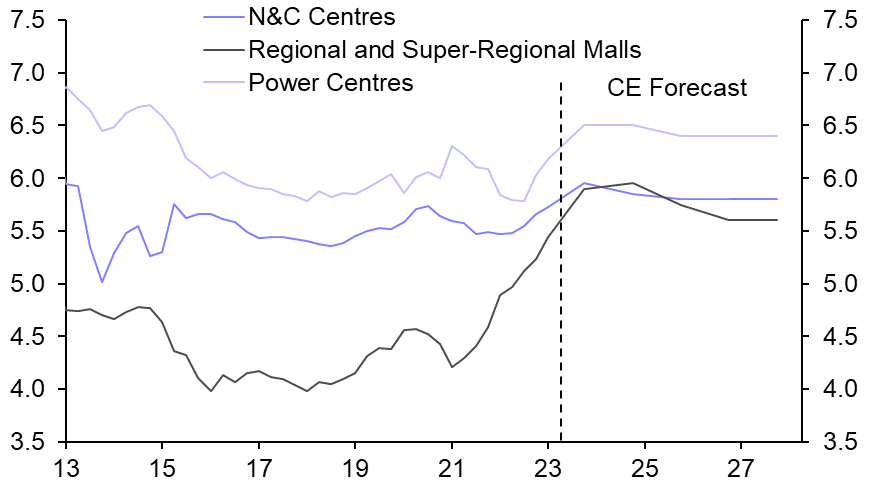

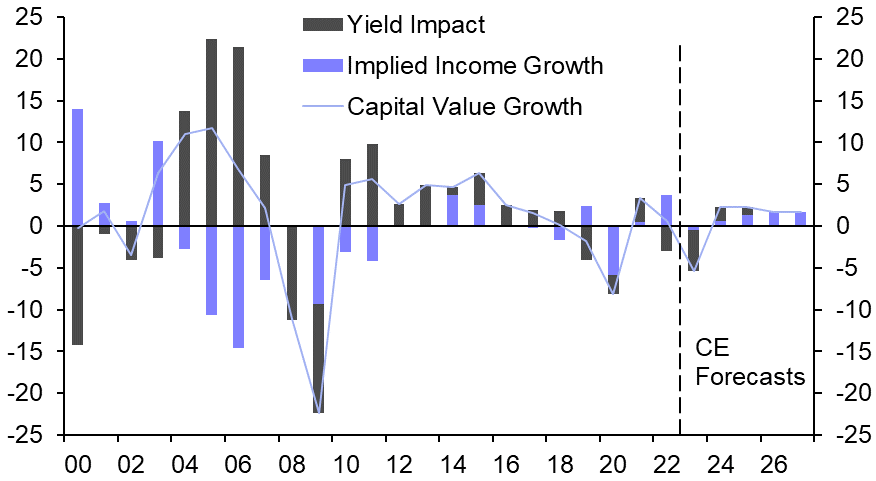

- Retail fundamentals weakened last quarter, but overall the market has been resilient. The poor economic outlook means we expect weaker demand in 2023, but absorption will pick up from next year, pushing vacancy down and rents up. Retail’s big lure is that it has already seen a substantial correction and we think cap rates are nearing a peak. Yields are expected to rise this year, but we think this will be the final year of capital value declines. As such, retail will see capital growth of near 2% p.a. on average between 2024-27, driving total returns of 7.5%-8% p.a.

Chart 5: Retail Gross Yields (%)

Chart 6: Retail Capital Value Contributions

(%-pts)

Sources: MSCI, Capital Economics

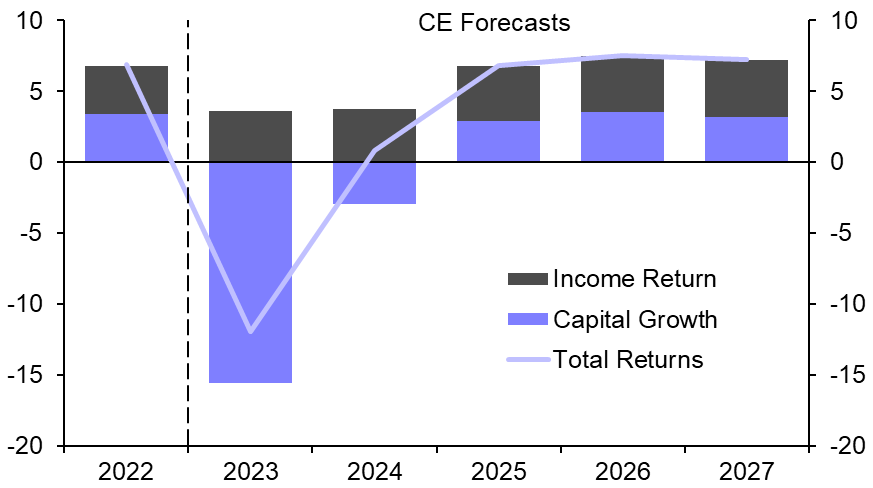

Industrial Market

- Slowing demand will meet heightened supply, meaning vacancy ticks higher and rental growth slows. Industrial yields still have further to rise and we expect they will peak in 2025 before stabilising thereafter. We expect rents to climb by 3% p.a. over 2023-27, but in the short-term that will be outweighed by a sharp cap rate correction, which will see values drop 20% peak-to-trough. This fall will drag total returns into negative territory this year and next, though they move positive again from 2025.

Chart 7: Industrial Capital Value Contributions

|

Chart 8: Industrial Capital Growth, Income Return and Total Return (% p.a.) |

|

|

|

|

Sources: MSCI, REIS, Capital Economics |

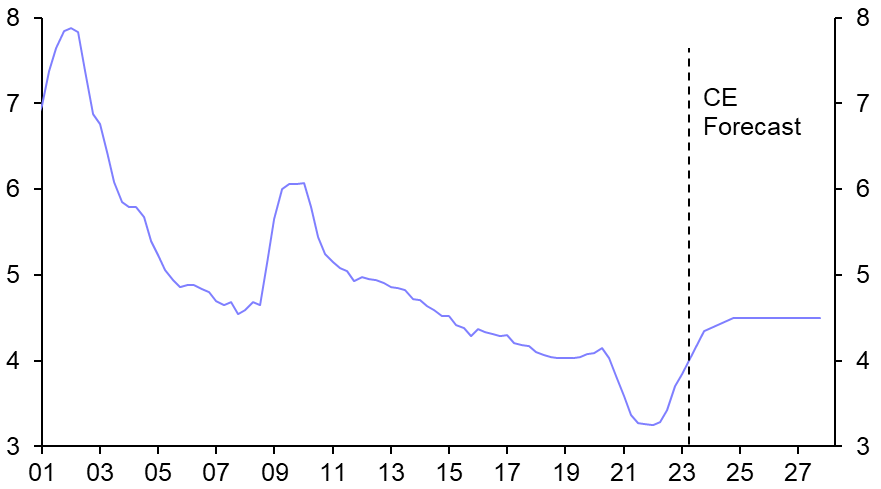

Apartment Market

- Strong new supply and waning demand will cause rent weakness this year and next, with a slight fall in 2023 followed by only a small increase in 2024. Decent growth should resume thereafter. The strength in new supply and the weak Q1 data have led us to nudge down our rental forecast for 2023 to -1.0% y/y. But the driver of performance in the next year or two will be the rise in apartment yields that we are forecasting. This will result in an 18% decline in capital values in 2023-24. From 2025, we expect capital values to grow again, pushing total returns above 7.0% p.a. over 2025-27.

Chart 9: Apartment NOI Yields (%) |

Chart 10: Apartment Capital Growth, Income Returns & Total Returns (% p.a.) |

|

|

|

|

Sources: MSCI, REIS, Capital Economics |

This is a sample of a 13-page report published for Capital Economics clients on 29th June, 2023. The report was written by Kiran Raichura and Charlie Cornes.

Make informed investment decisions quickly

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.