Asset allocation in an equity bubble

Q2 Global Markets and Asset Allocation Outlook

These are just some of the key takeaways from our latest quarterly Asset Allocation and Global Markets Outlook, originally published on 4th April, 2024. Some of the forecasts contained within may have changed since publication. Access to the complete report, including detailed forecasts and near to long-term financial markets analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Global Markets or Asset Allocation coverage.

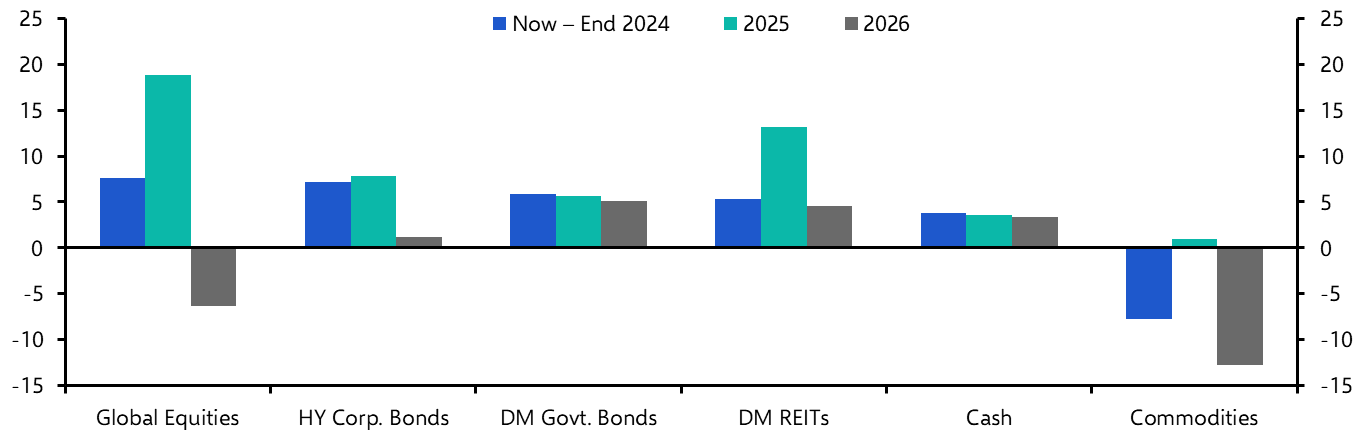

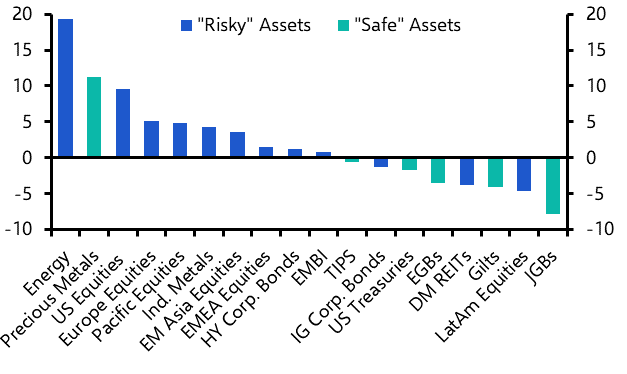

We expect US equities to continue to lead the charge, with the IT sector remaining around the front of the pack. Given our view that central banks will cut rates by more than investors are discounting, we anticipate decent returns from government and corporate bonds over the coming years, though we expect both to lag equities. And we think commodities in general – many of which have fared well so far this year – will struggle over the coming years.

|

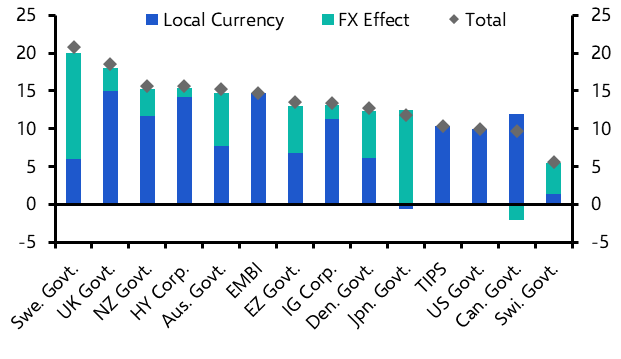

Chart 1: Projected Returns (US Dollars, %) |

|

|

|

Sources: Refinitiv, Bloomberg, Capital Economics |

- We expect “risky” assets, especially equities, to continue to outperform “safe” ones over the next couple of years, as a bubble continues to inflate in the stock market.

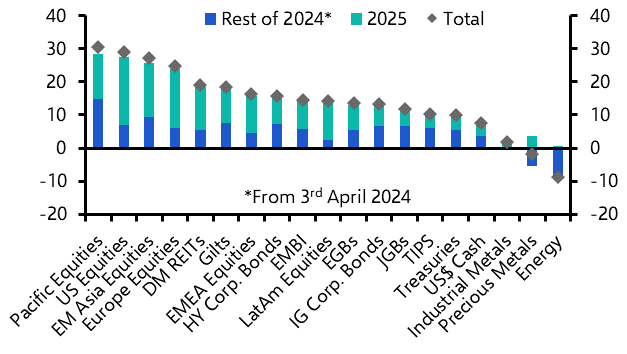

- Last year’s equity market outperformance has carried over to 2024, with most major indices notching up further big gains. The rally in precious metals has continued apace as well, while energy commodities posted the strongest rise on the back of rising oil prices. (See Chart 2.)

- But unlike the end of last year – where equity outperformance came alongside solid gains for most other asset classes – the story this year has been less favourable for other markets. Government bonds have struggled as investors have pared back their expectations for rate cuts. And while this doesn’t seem to have taken much of the wind out of the sails of the broader stock market, it probably explains why equity REITs have fared poorly, and why returns from corporate and emerging market (EM) dollar bonds have been tepid, at best.

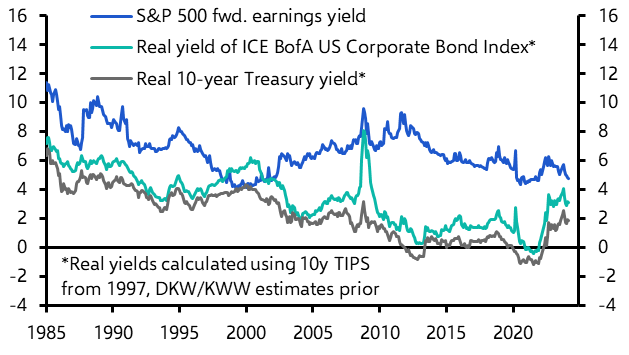

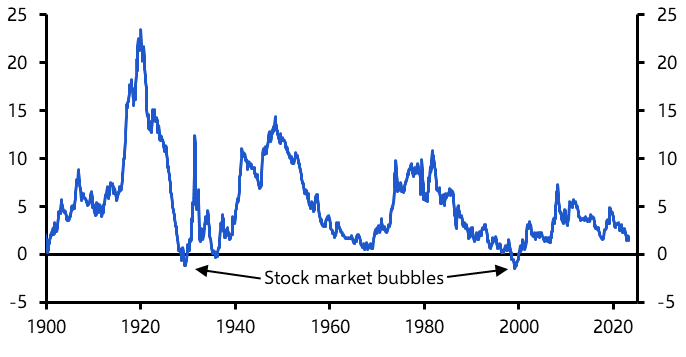

- We think equities will continue to fare especially well over the next couple of years and, in fact, overtake commodities at the front of the pack. (See Chart 3.) Admittedly, equity valuations are, in aggregate, starting to look a little stretched relative to those of other assets. The gap between the forward earnings yield of the S&P 500 and the real yields of other US assets is as narrow as it’s been in some time. (See Chart 4.) But while we do think that a bubble is starting to form in the stock market, we think it could inflate quite a lot more. A similar measure of equities’ relative valuation – Shiller’s Excess CAPE Yield – shows that valuations were more stretched at the peaks of previous bubbles than they are now. (See Chart 5.) In other words, equity valuations could rise yet further relative to those of bonds.

|

Chart 2: Year-To-Date Returns (US$, %) |

Chart 3: Returns Implied By CE Forecasts (US$, %) |

|

|

|

Chart 4: Yields Of Selected Assets (%) |

Chart 5: Shiller’s S&P 500 Excess CAPE Yield (pp) |

|

|

|

|

Sources: DKW/KWW, Refinitiv, Shiller, Capital Economics. |

- But other than the outperformance of equities (and US big-tech equities in particular), we don’t expect the returns we’ve seen since the start of the year to prove to be the benchmark for relative returns over the next couple of years.

- In particular, we expect government bonds generally to make some gains as central banks start to cut rates, albeit meagre ones when compared with those we expect from equities. Japanese government bonds (JGBs) might be an exception; with monetary policy diverging in Japan from elsewhere we think their yields will rise, but because we expect a big rebound in the yen (partly as a result of higher JGB yields) we don’t expect them to fare particularly poorly in common-currency terms. (See Chart 6.) It’s a similar story for Japanese equities, for which we expect poor local-currency returns but competitive ones in US dollars.

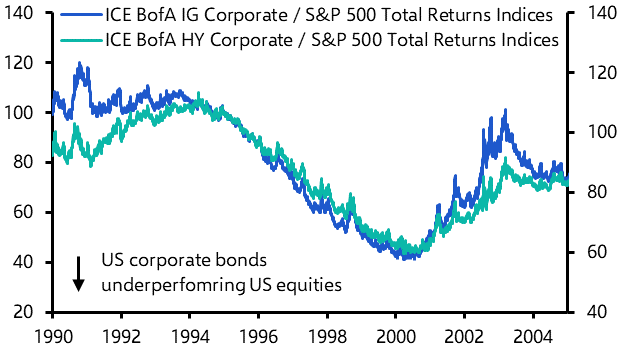

- Looser monetary policy would probably help corporate bonds too. But we don’t expect them to keep pace with equities, given our view that the gains in the latter will be driven by enthusiasm around AI technology. For a start, tech companies have, in general, much smaller weights in bond indices than equity ones. (See Chart 7.) That’s probably why corporate bonds lagged equities during the inflation of the “dotcom bubble” in the early 2000s. (See Chart 8.) What’s more, their spreads over safe assets are already very low in many cases, and therefore probably have limited room to compress further.

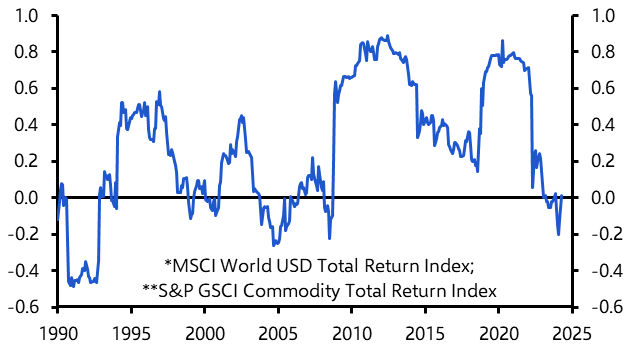

- Finally, we don’t expect commodities to continue to power ahead despite what we think will otherwise be a reasonably supportive environment for risky assets. In some cases, such as major energy commodities, we expect increased supply to match otherwise firm demand. That’s the sort of environment that has often seen commodity prices diverge from those of other risky assets in the past. (See Chart 9.)

|

Chart 6: CE Projected Bond Index Returns (3rd Apr. 2024 to 31st Dec. 2025, US$, %) |

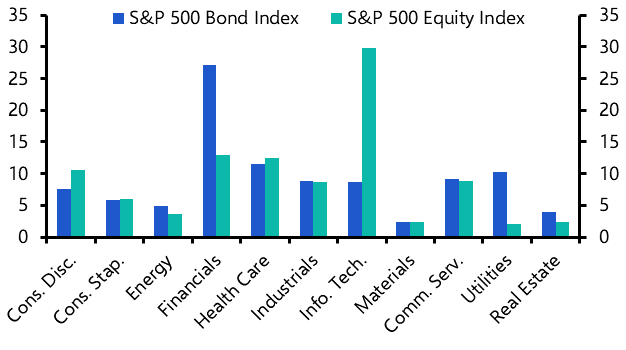

Chart 7: Approximate Weights Of S&P 500 Bond & Equity Indices (%) |

|

|

|

Chart 8: Ratios Of ICE BofA US Corporate To S&P 500 Total Returns Indices (1st Jan. 1995 = 100) |

Chart 9: 2Y Rolling Correlation Of US$ Returns Of Global Equities* & Commodities** |

|

|

|

|

Sources: Refinitiv, Capital Economics. |

The full report includes extensive forecasts and analysis, including:

- Our views on Equities, including why we think they will keep making strong gains over the next year or two, especially in the US, as the stock market bubble fuelled by AI-hype continues to inflate against a backdrop of resilient growth.

- Why we expect government Bonds to fall back a bit. And why we think that corporate bonds will only outperform sovereign bonds by a small amount this year and next, as credit spreads have generally continued to narrow and now seem quite low by historical standards. We also show how EM bonds may benefit from looser monetary policy across the world, but risk premia already appear very low and there are growing threats to fiscal sustainability in some big countries.

- Our outlook for Money Markets, including why we think the DM easing cycle, kicked off by the SNB last month, will broaden out in Q2 with most major central banks starting to cut rates. And our view is that those cuts will happen faster, in general, than investors anticipate. Meanwhile, we expect monetary easing to continue in EMs in general.

These are just some of the key takeaways from a 23-page report published for Capital Economics clients on 4th April, 2024. The report was written by John Higgins, Hubert de Barochez, Thomas Mathews, Diana Iovanel, James Reilly, Ruben Gargallo Abargues and Giulia Bellicoso.

Get the full report

Trial our services to see this complete 23-page analysis, our complete global markets and asset allocation insight and forecasts and much more