Another year of sluggish growth

Q1 2024 Middle East & North Africa Economic Outlook

These are some of the key takeaways from our Q1 Middle East & North Africa Economic Outlook, originally published on 13th December, 2023. Some forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated MENA coverage.

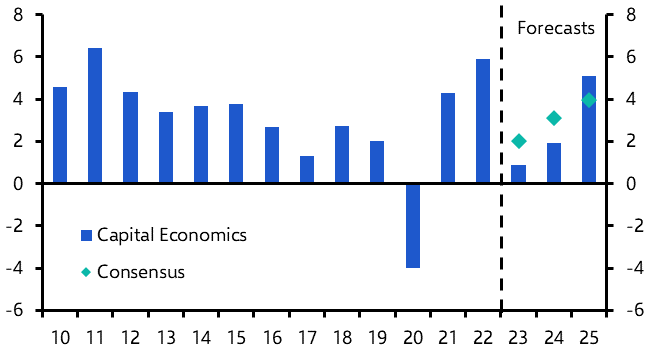

Economic growth in the Middle East and North Africa will strengthen a little in 2024 but is likely to come in well below consensus expectations. OPEC+’s cautious approach to oil policy will keep a lid on economic growth in the Gulf over the first half of next year, although a loose fiscal stance will remain supportive of activity in non-oil sectors. Elsewhere, balance of payments strains mean that Egypt will need to loosen its grip on the currency soon to get its IMF deal back on track. If it doesn’t, a more disorderly currency adjustment that raises concerns about sovereign debt sustainability could ensue.

|

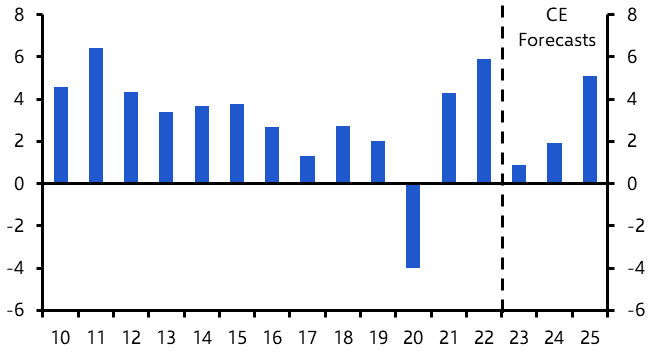

Chart 1: Middle East and North Africa GDP |

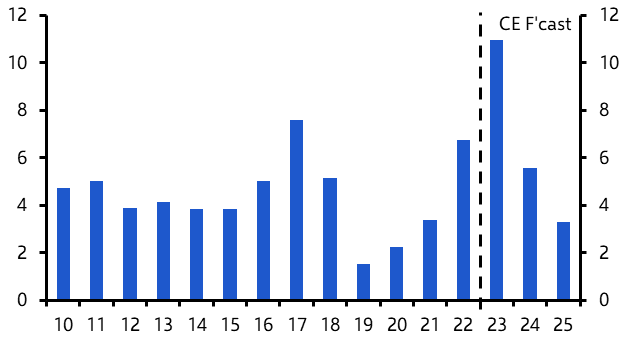

Chart 2: Middle East and North Africa Consumer Prices (% y/y) |

|

|

|

|

Sources: CEIC, Refinitiv, Capital Economics |

Sources: CEIC, Refinitiv, Capital Economics |

- GDP growth in the region will strengthen a little in 2024 but come in well below consensus expectations. OPEC+’s cautious approach to oil policy will keep a lid on growth in the Gulf over the first half of next year, but fiscal policy will remain supportive of activity in non-oil sectors. Elsewhere, balance of payments strains mean that Egypt will need to loosen its grip on the currency soon to get its IMF deal back on track.

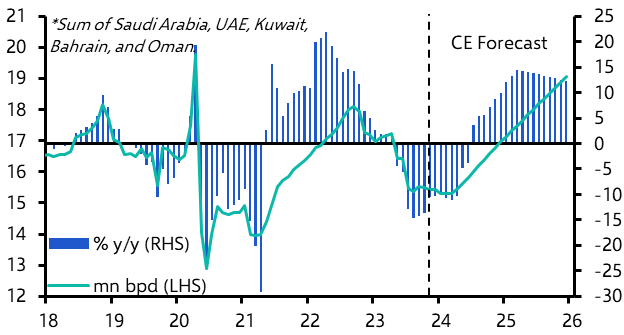

- With Saudi Arabia aiming to keep a floor under oil prices, OPEC+ recently agreed to a further voluntary output cut and the Kingdom rolled over its own 1mn bpd reduction until end-Q1. OPEC+ output will rise gradually over the rest of 2024 (see Chart 3), but oil sectors will remain a drag on GDP through H1 2024. The risk is that Saudi tries to boost prices further by extending its unilateral cut or pushes OPEC+ to reduce output even further.

- Oil prices have slid recently, and we now expect Brent to stay at around $75pb through to the end of next year before falling a little in 2025. (See Chart 4.)

|

Chart 3: Gulf* Oil Production |

Chart 4: Brent Crude ($pb) |

|

|

|

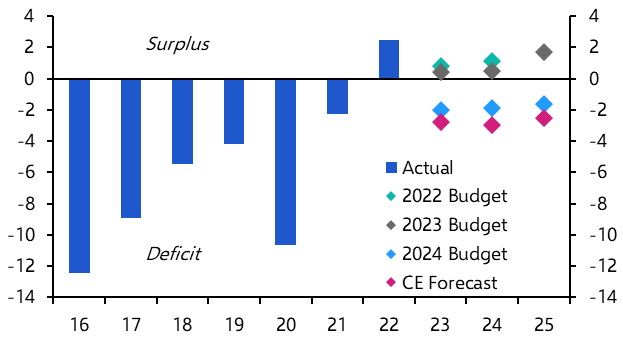

- With oil at those prices, most countries will continue to run twin budget and current account surpluses, allowing fiscal policy to remain supportive. Saudi seems comfortable with running budget deficits. (See Chart 5.) If prices were to continue to slide, though, austerity may come back on the agenda. Cuts to capital spending are likely to be the first port of call.

- Meanwhile, monetary policy in the Gulf will be loosened in line with the Fed. We expect interest rates to start being cut in March and to be lowered by a cumulative 175bp over 2024. While this might take some time to fully feed through to lower debt servicing costs, it will come alongside continued disinflation. (See Chart 6.) This will bolster households’ real incomes and support consumer spending.

|

Chart 5: Saudi Arabia Budget Balance (% of GDP) |

Chart 6: Gulf* Consumer Prices (% y/y) |

|

|

|

- Outside of the Gulf, persistent balance of payment strains will weigh on GDP growth next year. Admittedly, Morocco is a relative bright spot. The hit from the recent earthquake appears to have been limited, the external position is stronger, and the country has IMF support to fall back on. In Egypt and Tunisia, however, the situation is more precarious.

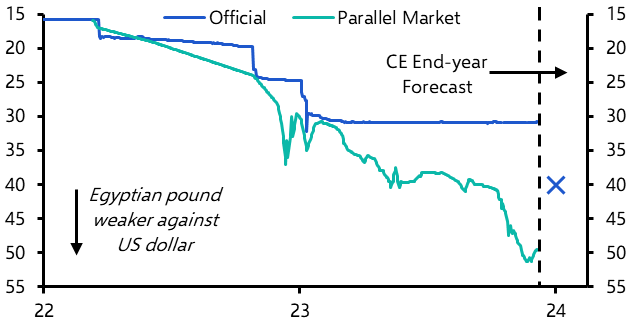

- In Egypt, President al-Sisi’s re-election is a formality and will enable his government to push on with policy reforms. Top of the list is the pound. We think it will be devalued to 40/$ (see Chart 7) but, crucially, there will need to be a credible commitment to a flexible exchange rate. If delivered, this will get investors back and the IMF deal on track. In the near term, though, it means inflation will stay high for longer, the central bank will need to hike interest rates (see Chart 8), and fiscal policy will need to stay tight.

|

Chart 7: Egyptian Pound (vs. $, Inverted) |

Chart 8: Egypt Consumer Prices & Overnight Deposit Rate |

|

|

|

- All of this will weigh on GDP growth. But the bigger risk is if officials don’t shift quickly. This would raise the prospect of a disorderly currency adjustment and possible sovereign default that strains the banking sector.

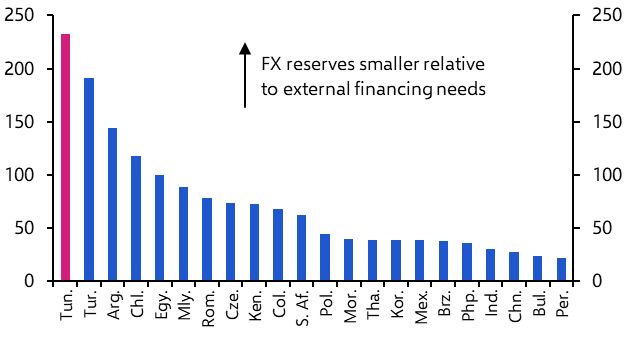

- Elsewhere, Tunisia’s IMF deal remains a distant hope. The dinar looks increasingly overvalued, and President Saied will not want to adhere to the required harsh fiscal reforms before the election. Tunisia’s large external financing needs (see Chart 9) mean that, without external financing, a messy balance of payment crisis and sovereign default looms.

- All told, we expect regional GDP to grow by a below-consensus 1.9% in 2024. 2025 will be much stronger. (See Chart 10.)

|

Chart 9: Gross External Financing Requirements |

Chart 10: Middle East & North Africa GDP (% y/y) |

|

|

|

|

Sources: Bloomberg, CEIC, Refinitiv, Capital Economics |

These extracts are taken from a 16-page report written for Capital Economics clients by James Swanston, Jason Tuvey, Elias Hilmer and William Jackson, originally published on 13th December, 2023.

Get the full report

Trial our services to see this complete 16-page analysis, our complete Middle East & North Africa insight and forecasts and much more