Geoeconomics

Geoeconomics is where global politics and macroeconomics intersect. For more than a quarter of a century, Capital Economics has been helping clients understand how geopolitical shifts can affect macroeconomic and market outcomes – from the post-Cold War reordering and US response to 9/11 to, most recently, the breakdown in US-China relations and rise of Trump. This page highlights key geoeconomics analysis and proprietary data and interactive dashboards that help clients quantify the scale of changes.

Key Geoeconomic Analysis

Explore some of our key reports on the major geoeconomic themes today.

DATA DASHBOARD

Trade War - Interactive guide to global tariff impact

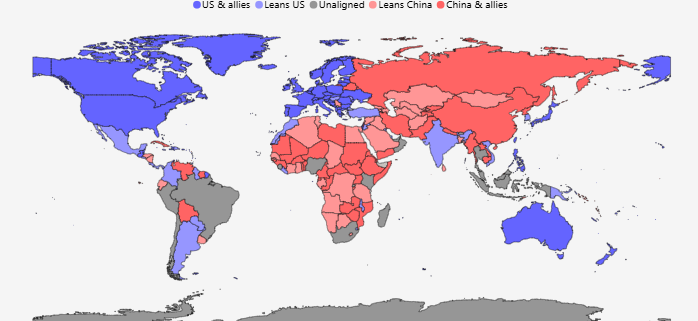

Explore the global fracturing dashboard

Three million data points. 98 charts. One interactive dashboard.

Key Global Geoeconomic Issues

Explore more of our report libraries on the major geoeconomic themes from our curated Key Issues pages.

All analysis

Geoeconomics