ECB to keep policy tight despite weak economy

Q4 Euro-zone Economic Outlook

The euro-zone looks set to underperform the ECB and consensus forecasts over the next 18 months, with a mild recession in the coming quarters looking more likely than not.

Below are excerpts from our latest quarterly Euro-zone Economic Outlook. Access to the complete report, including extensive forecasts and country-level analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Europe Economics coverage.

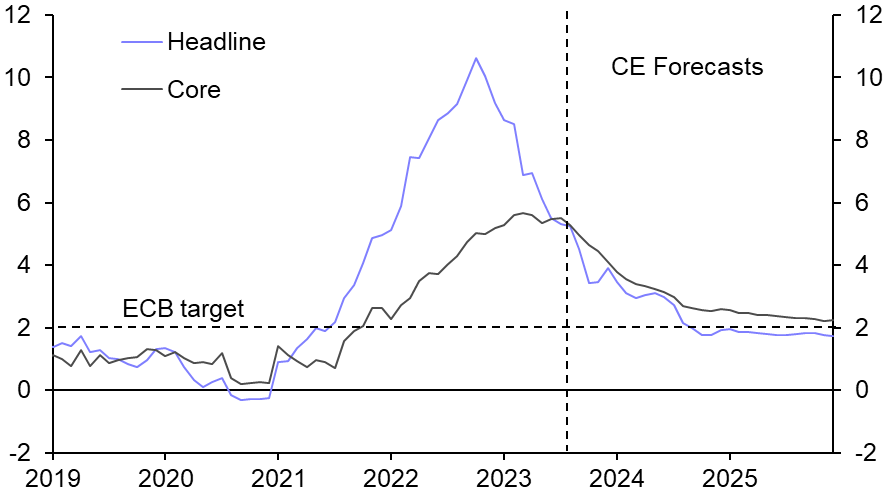

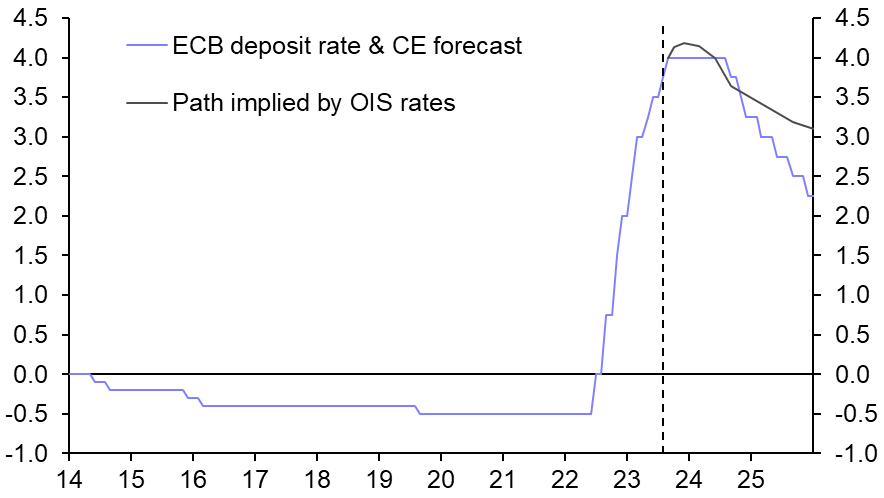

We expect the euro-zone economy to struggle over the next 18 months. Lower energy prices and improved global supply chain conditions should keep headline inflation on a downward trend, despite the recent uptick in oil prices. And we think the core rate will fall from nearly 5% currently to around 3% by mid-2024. But the labour market will remain tight, keeping wage growth fairly high and meaning that the ECB won’t feel confident about hitting its 2% inflation target on a sustained basis until later in 2024. We have pencilled in the first rate cut for September, later than most expect, and forecast the deposit rate to end 2024 at 3.25%.

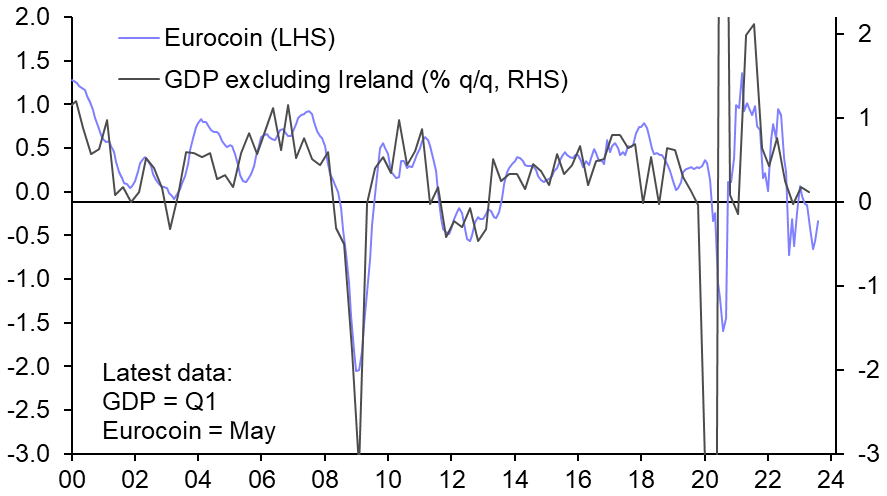

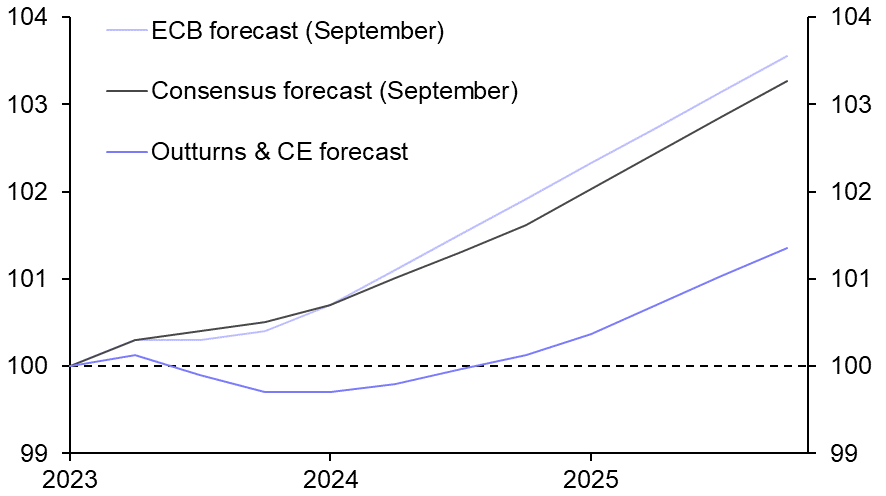

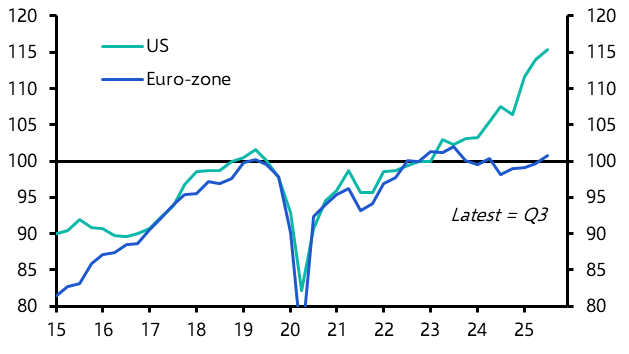

- In the first half of the year, strong tourist numbers supported the services sector while improved global supply chain conditions gave industrial output a lift. Despite this, the economy did little more than stagnate. And the latest data suggest that GDP will contract in Q3. (See Chart 1.)

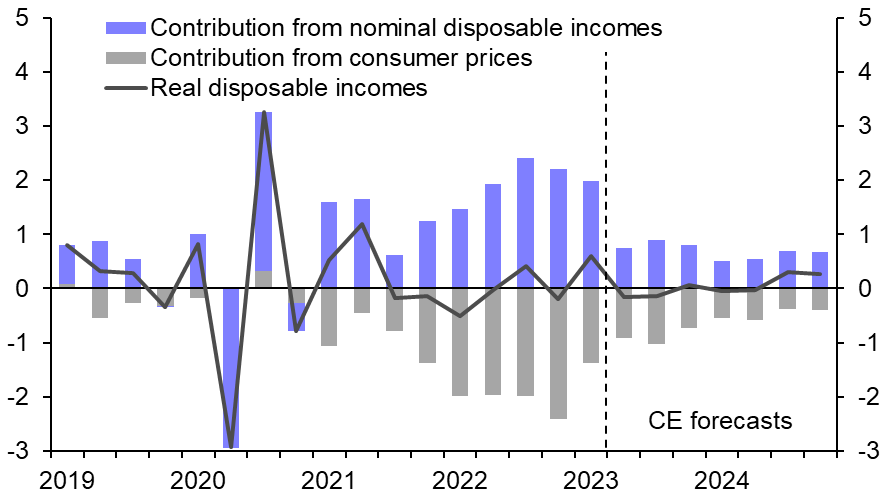

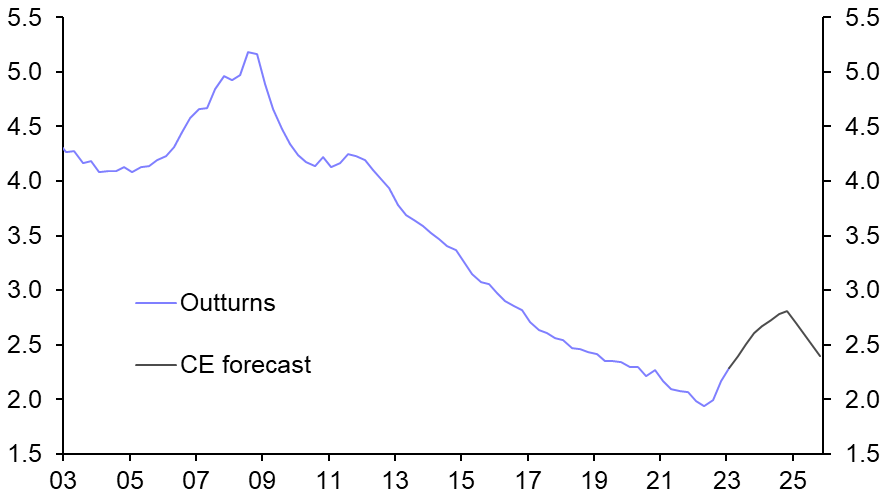

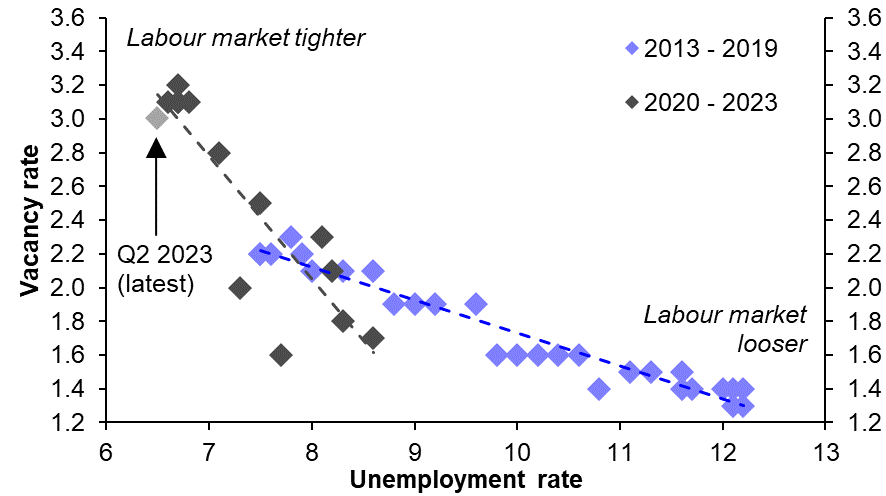

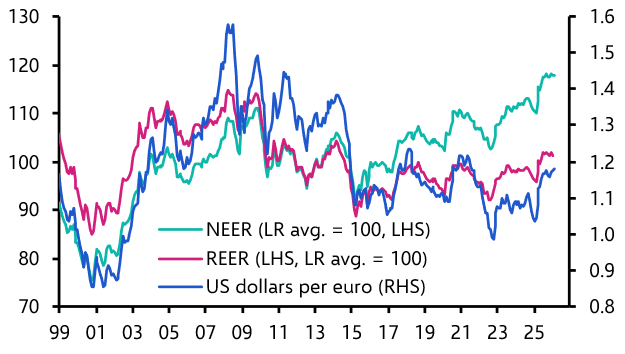

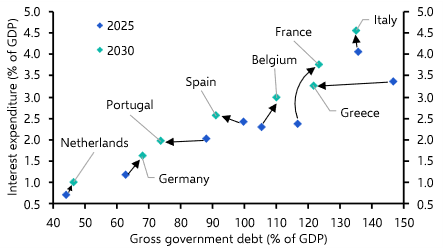

- Admittedly, inflation will be less of a drag on households’ spending power in the coming quarters. But we think this effect will be offset by slower growth in employment and nominal wages, as well as a steady rise in interest expenditure. (See Charts 2 & 3.) Fiscal policy is likely to be tightened next year too. So we think that real household disposable incomes will stagnate and consumption will remain subdued.

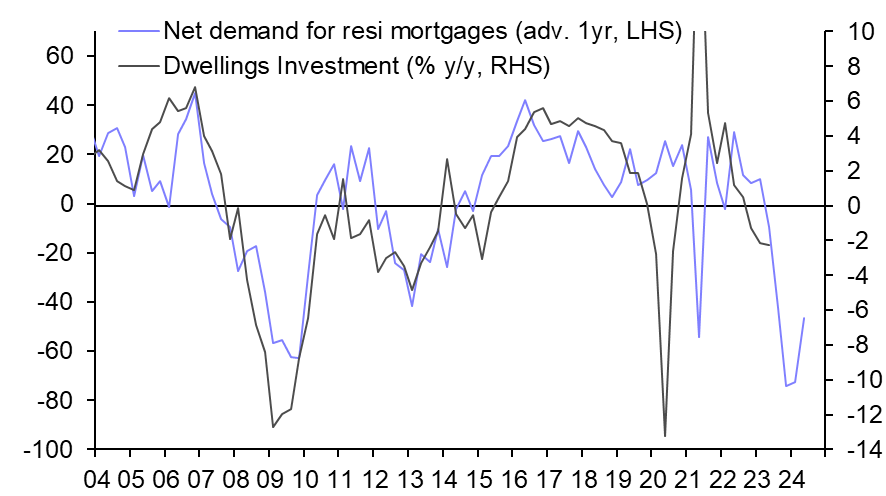

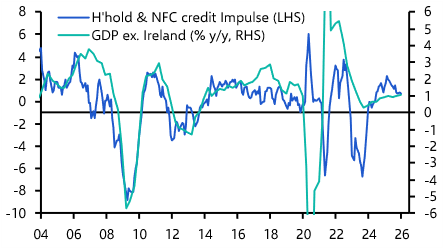

- Investment is likely to fall sharply. Activity in the housing market is particularly weak and consistent with steeps falls in dwellings investment. (See Chart 4.) Higher debt interest costs and low confidence will weigh more heavily on business investment than household consumption. These effects won’t be offset by higher public spending linked to NextGenerationEU. Our forecasts for the euro-zone’s trading partners point to further weakness in exports in the near term too.

|

Chart 1: Euro-zone GDP & Eurocoin |

Chart 2: Aggregate Euro-zone Real |

|

|

|

|

Chart 3: Euro-zone Household Interest Expenditure (% of adjusted disposable income) |

Chart 4: Change in Demand for Loans for House Purchase vs. Dwellings Investment |

|

|

|

- As a result, we think that euro-zone GDP will contract in the second half of the year then recover only slowly thereafter. This puts us well below the consensus forecast. (See Chart 5.) That said, we expect only a mild recession and a small increase in unemployment. That would mean the labour market remaining tight. (See Chart 6.)

- Headline inflation will continue to fall. We forecast core inflation to drop to around 3% by the middle of next year as the effects of lower commodity prices and improved global supply chain conditions feed through. But against a backdrop of a tight labour market, core inflation will decline more slowly after that. (See Chart 7.)

- Against this backdrop, we think it will be some time before policymakers are confident that inflation will fall all the way to 2% on a sustained basis. Accordingly, we forecast the ECB to leave the deposit rate at 4% until next September, which is later than investors and other forecasters anticipate. (See Chart 8.)

|

Chart 5: Euro-zone GDP (Q4 2019 = 100) |

Chart 6: Euro-zone Beveridge Curve |

|

|

|

|

Chart 7: Euro-zone Consumer Prices (% y/y) |

Chart 8: ECB Deposit Rate (%) |

|

|

|

|

Sources: Refinitiv, Capital Economics |

Make faster informed decisions

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.