Q3 Europe Economic Outlook: On the mend

The euro-zone has come out of a long period of stagnation and will expand at a moderate pace over the coming two years.

These are just some of the key takeaways from our latest quarterly Euro-zone Economic Outlook, originally published on 20th June, 2024. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Euro-zone Economics coverage.

The euro-zone's recovery will be faster in some southern economies, such as Spain, than in core economies, notably Germany, while the outlook for France is now clouded by political risk. Meanwhile, inflation will continue to trend down in the coming months, but only slowly. Services inflation will be particularly sticky, given that the labour market remains tight and higher wage inflation is still feeding through. Against this backdrop the ECB will proceed cautiously with its easing cycle, reducing its key policy rate by around 25bp every three months until it has fallen to around 2.5%.

- Headline and core inflation will continue to trend down this year and next, allowing the ECB to cut interest rates a little more quickly than is discounted in the markets.

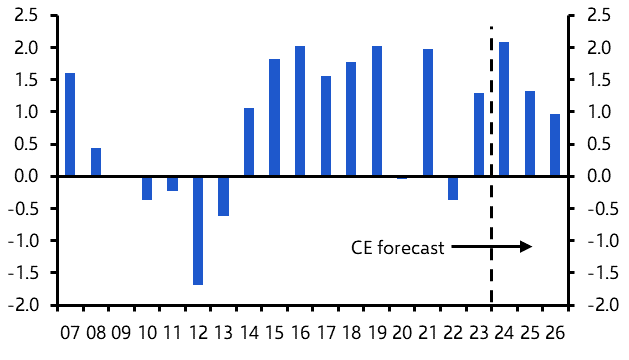

- Real household incomes look set to keep rising strongly (see Chart 1), supporting consumer spending. And after a difficult year for exporters in 2023, the surveys show an improvement in export orders recently. This is at least partly due to a pick-up in foreign demand. So exports should post decent rates of expansion in 2024 and beyond.

- Nevertheless, we think that euro-zone GDP will underperform the consensus forecasts over the coming years. Surveys suggest that investment across the region will remain subdued, and we expect a decline in Italy’s booming construction sector later in 2024.

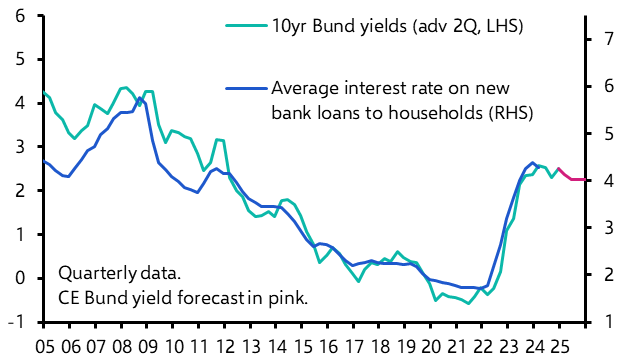

- What’s more, looser monetary policy will do little to boost GDP growth. Policy rates will fall only gradually and remain a lot higher than before Covid. And cuts are discounted in the markets, so they are already reflected in the interest rates charged by banks. This suggests that lending rates won’t fall far. (See Chart 2.)

|

Chart 1: Euro-zone Real Household |

Chart 2: Bund Yields & Average Interest Rate |

|

|

|

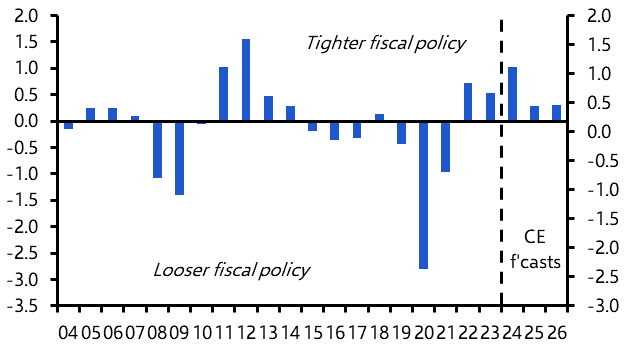

- Tighter fiscal policy will weigh on GDP growth too. (See Chart 3.)

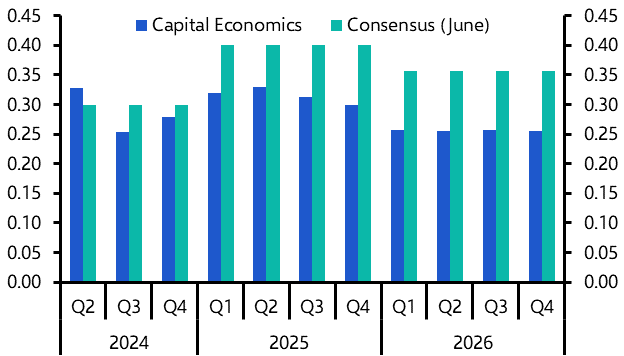

- By 2026, the economy should return to its trend rate of growth, which we think is slower than many assume. (See Chart 4.) Cumulatively, our forecasts imply that euro-zone GDP will grow by 1% less than the consensus expects by the end of 2026.

|

Chart 3: Change in Euro-zone Primary |

Chart 4: Euro-zone GDP Forecasts (% q/q) |

|

|

|

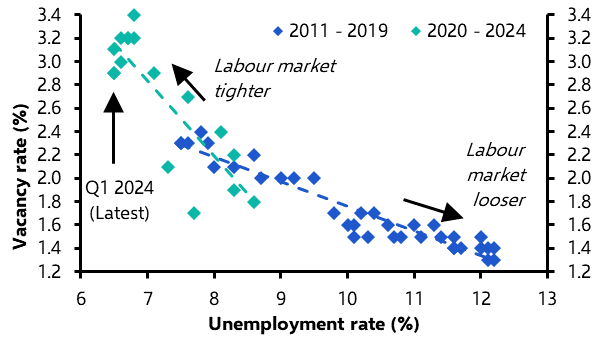

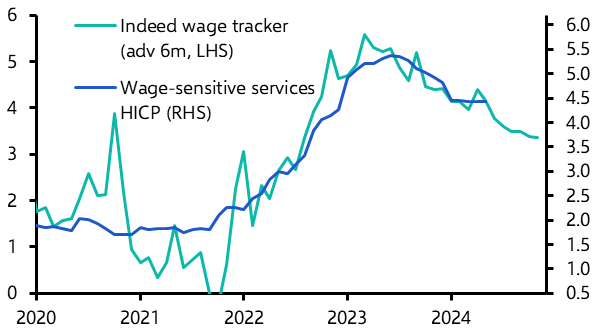

- Even so, the labour market remains tight (see Chart 5) and official measures of wage growth were surprisingly high in Q1. Timelier data point to a slowdown in Q2, suggesting that wage-sensitive services inflation will continue to decline, albeit gradually. (See Chart 6.) Core goods inflation will probably fall a little further too in the coming months.

|

Chart 5: Euro-zone Beveridge Curve |

Chart 6: Euro-zone Indeed Wage Tracker |

|

|

|

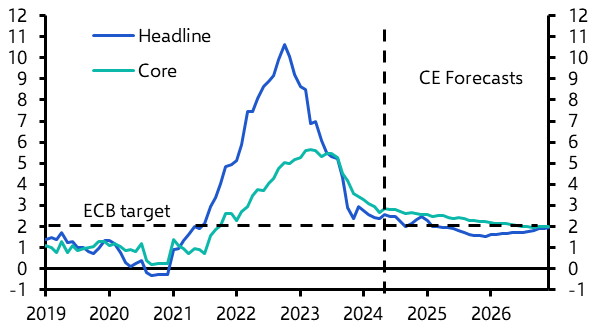

- To borrow the ECB’s phrase, the headline inflation rate will be “bumpy” in the coming quarters due to movements in energy and food inflation. But we think that it will be close to 2% in 2025 as a whole. And if oil and natural gas prices decline as we expect, energy inflation will be negative and drag the headline rate below the target in the second half of 2025 and into 2026. (See Chart 7.)

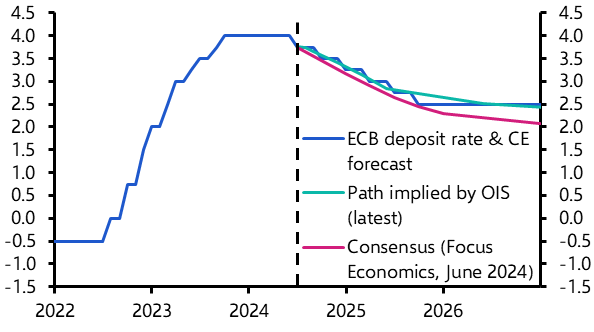

- We’ve pencilled in one 25bp cut per quarter until the deposit rate reaches 2.5% in September 2025. That’s very close to what is priced into the market, but slightly fewer cuts than expected by the consensus among economists. (See Chart 8.) The Bank will continue to shrink its balance sheet and it wouldn’t be surprising if policymakers brought forward their plans to accelerate QT.

|

Chart 7: Euro-zone HICP (% y/y) |

Chart 8: ECB Deposit Rate (%) |

|

|

|

|

Sources: Refinitiv, Focus Economics, ECB, Capital Economics |

More insight and extensive two-year forecasts are available in our full Europe Economic Outlook, including:

- How Germany is now out of recession, but with external and domestic demand still subdued, the economic recovery will initially be weak.

- Why the prospect of the National Rally or New Popular Front forming a government has increased risks to France’s public finances.

- Why Italy’s growth will slow sharply over the rest of this year as the construction boom goes into reverse. Meanwhile, the public finances will remain a source of vulnerability.

- How fast growth in Spain over the last two years has been enabled by rising tourist expenditure and high immigration. Spain should continue to outperform for some time thanks to rapid employment and consumption growth.

These are just some of the key takeaways from a 24-page report published for Capital Economics clients on 20th June, 2024 and written by Andrew Kenningham, Jack Allen-Reynolds, Franziska Palmas, Adrian Prettejohn, Lily Millard and Pollyanna Hall.

Get the full report

Trial our services to see this complete 24-page analysis, our complete euro-zone macro insight and forecasts and much more