ECB rate cuts will do little to boost growth

Q2 Europe Economic Outlook

These are just some of the key takeaways from our latest quarterly Euro-zone Economic Outlook, originally published on 15th March, 2024. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Euro-zone Economics coverage.

Euro-zone household real incomes will pick up only slowly and consumers will be cautious amid a softening labour market. Moreover, we expect business investment to stagnate due to soft domestic and foreign demand, and governments will tighten fiscal policy further. With inflation on track to reach its target in the second half of the year, the ECB will cut its deposit rate from 4% to 3% by year-end and to around 2.25% by the middle of 2025. While this should help to support activity next year, the effect of rate cuts will feed through only gradually so the boost to growth will be small.

- We think that the euro-zone economy will grow more slowly than most expect over the coming years. Inflation will keep falling but the ECB will only start cutting interest rates in June at the earliest.

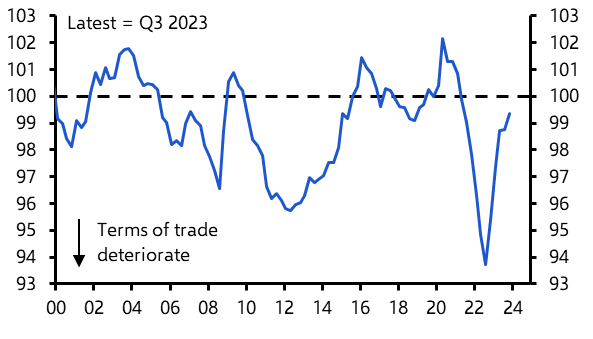

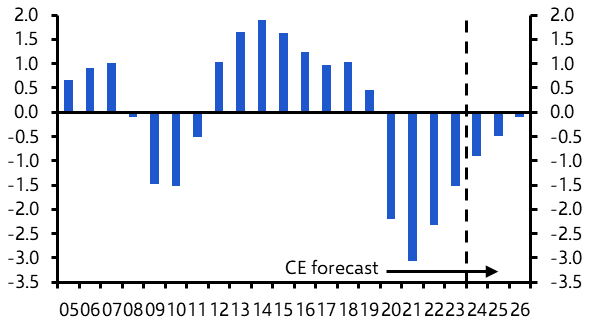

- The negative terms-of-trade shock caused by the surge in energy prices in 2022 has now largely reversed. (See Chart 1.) But just as looser fiscal policy softened the blow from higher energy prices, the gains from lower prices have been offset by tighter policy. And the fiscal stance will be tightened further over the coming years. (See Chart 2.)

|

Chart 1: Euro-zone Terms of Trade |

Chart 2: Euro-zone Primary Structural Budget Balance |

|

|

|

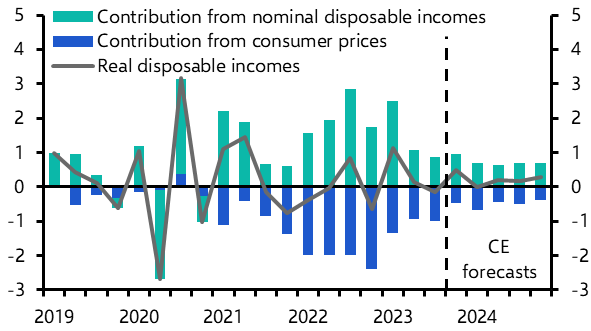

- Meanwhile, aggregate real household disposable income looks set to flat-line as employment stops rising and nominal wage growth slows. This will limit consumption growth. (See Chart 3.) Low consumer confidence and high interest rates suggest that households are unlikely to reduce their savings rate significantly. (See here.)

- The near-term outlook for investment is also poor. The slowdown in the housing market suggests that construction investment will fall. And firms’ demand for credit to fund investment is declining amid low levels of industrial capacity utilisation.

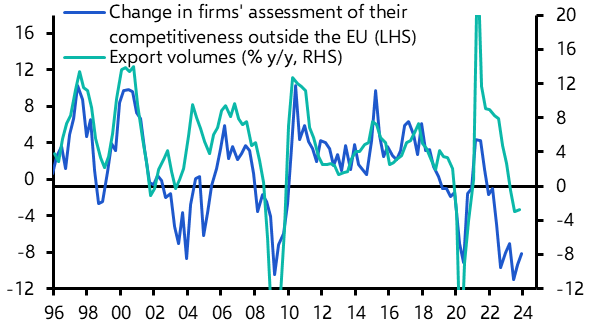

- Meanwhile, firms have reported a huge deterioration in their external competitiveness and exports have fallen in four of the past five quarters. (See Chart 4.) Exports are likely to remain subdued this year before picking up in 2025 and 2026 as global growth improves.

|

Chart 3: Euro-zone Real Household |

Chart 4: Euro-zone Exports |

|

|

|

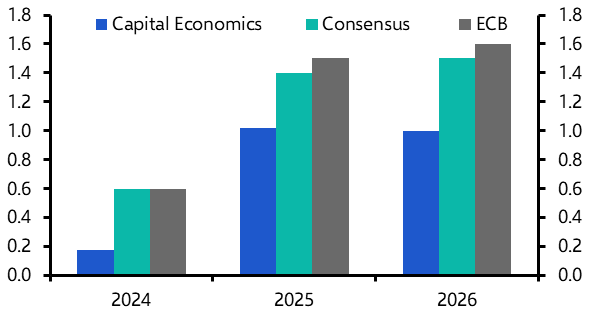

- Bringing all of this together, we expect the economy to grow slowly this year, underperforming the consensus and ECB forecasts. (See Chart 5.) It is likely to remain sluggish over the coming years too as fiscal policy remains restrictive and adverse demographics start to weigh more heavily on growth in the labour force.

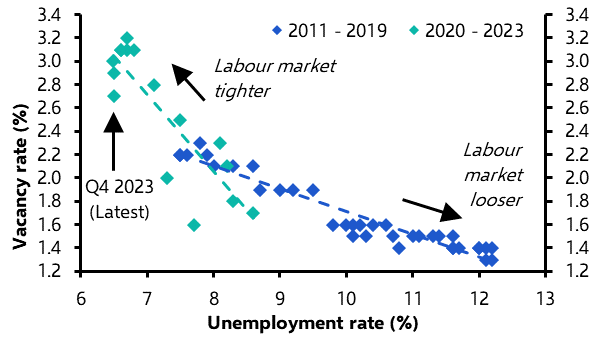

- Admittedly, the economy will eventually get some support from looser monetary policy. But the ECB won’t start cutting interest rates until June at the earliest and is likely to move cautiously, at least to begin with. After all, the labour market is still tight. (See Chart 6.)

|

Chart 5: Euro-zone GDP (% y/y) |

Chart 6: Euro-zone Beveridge Curve |

|

|

|

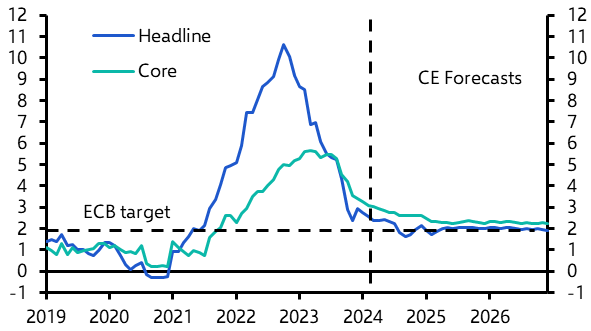

- And while headline inflation might hit 2% in the summer, we expect the core rate to stay higher for longer. (See Chart 7.)

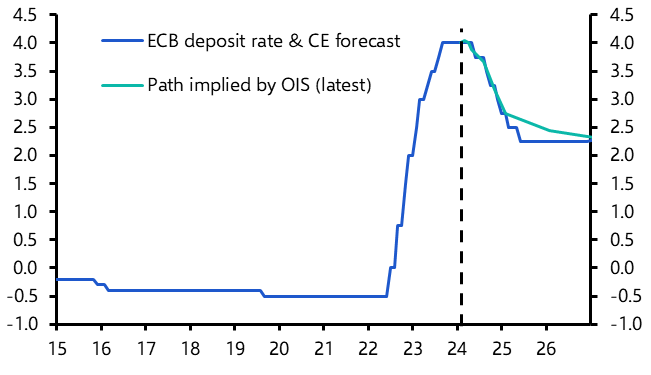

- We are forecasting the deposit rate to fall from 4% currently to 3% by the end of the year and 2.25% early next year. (See Chart 8.) The benefits of lower interest rates won’t be felt until 2025 and the boost to growth will probably be quite small. Even as it cuts rates, the Bank will accelerate QT by ending reinvestments under the PEPP and it may well start selling assets next year.

|

Chart 7: Euro-zone Consumer Prices (% y/y) |

Chart 8: ECB Deposit Rate (%) |

|

|

|

|

Sources: Refinitiv, Focus Economics, ECB, Capital Economics |

- Elsewhere, the Swiss National Bank will be the first major advanced-economy central bank to cut rates in this cycle as inflation in Switzerland is now very low. The central banks of Sweden and Norway should follow suit as inflation in those economies also comes down to target.

More insight and extensive two-year forecasts are available in our full Europe Economic Outlook, including:

- How Germany will start recovering from its recession but will remain the worst performer among major euro-zone economies this year.

- Why slow economic growth is set to make it difficult for France's government to meet its objective to bring the deficit down this year.

- How Italy’s outperformance will end this year as the tax incentives that fuelled its construction boom are phased out.

- How Spain’s high-flying economy will continue to outperform the euro-zone as a whole this year.

These are just some of the key takeaways from a 20-page report published for Capital Economics clients on 15th March, 2024 and written by Andrew Kenningham, Jack Allen-Reynolds, Franziska Palmas, Adrian Prettejohn and Lily Millard.

Get the full report

Trial our services to see this complete 20-page analysis, our complete euro-zone macro insight and forecasts and much more