Despite soft landing, inflation rapidly normalising

Q1 2024 US Economic Outlook

This is a sample of our latest quarterly US Economic Outlook, originally published on 6th December, 2023. Some of the forecasts contained within may have changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated US Economics coverage.

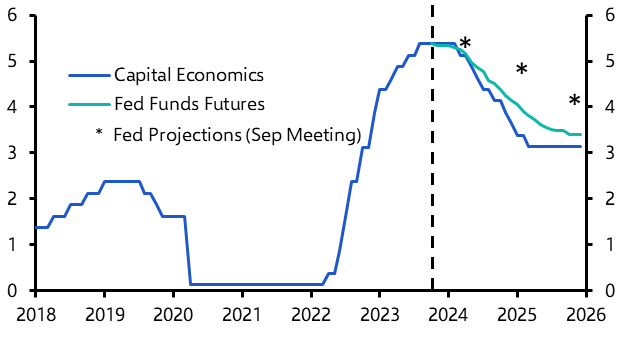

As core inflation is on track to return to the 2% target by the middle of next year, we expect the Fed to cut interest rates by 25bp at every meeting next year from March onwards, with rates eventually falling to between 3.00% and 3.25% in early 2025.

The lagged impact of previous monetary tightening will continue to feed through for the next few quarters, however, pushing GDP growth well below potential. But we expect the economy to narrowly avoid a recession, and rate cuts should fuel a pick-up in GDP growth starting in the second half of next year.

- As core PCE inflation is on track to return to the 2% target around the middle of next year, we expect the Fed to cut interest rates by 25bp at every meeting next year from March onwards. The fed funds rate will eventually fall to between 3.00% and 3.25% in 2025.

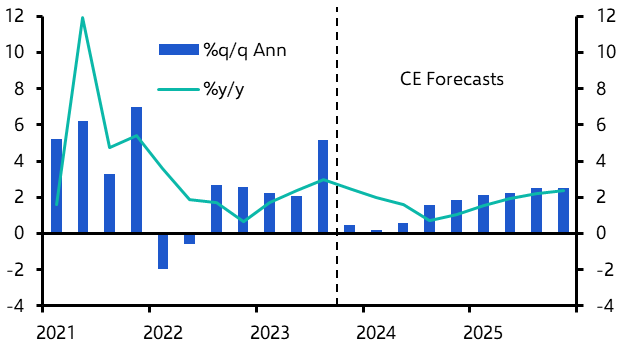

- The lagged impact of previous monetary tightening will continue to feed through for the next few quarters, pushing GDP growth well below potential. (See Chart 1.) We expect GDP growth to slow from an above-potential 2.4% in 2023 to 1.3% in 2024, before easier monetary policy drives a rebound to 2.0% in 2025. Households will remain partly insulated from the impact of earlier interest rate hikes, with consumption growth slowing only modestly from 2.2% this year to 1.8% next.

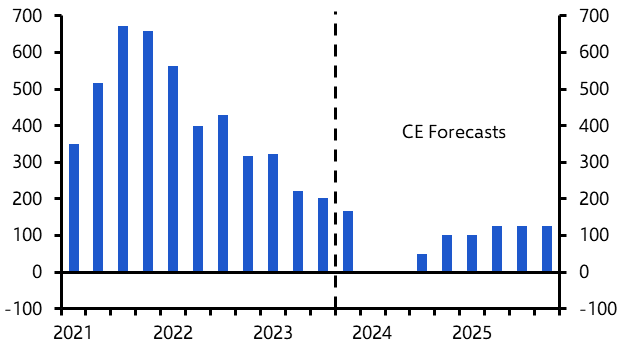

- But we expect business investment growth to slow from 4.0% to 1.0% and a marked slowdown in the pace of inventory accumulation should weigh heavily on GDP growth over the next few quarters. With mortgage rates now falling, most of the downward adjustment in residential investment is now behind us. But, given the prevalence of fixed-rate debt, we expect the economy to narrowly avoid a recession. In addition, the easing in financial conditions that has already begun – as expectations of Fed easing build – will flip the monetary impulse from a strong headwind to a tailwind in the second half of next year. As GDP growth slows to a crawl, we also expect employment to all-but stagnate. (See Chart 2.)

|

Chart 1: Real GDP |

Chart 2: Change in Non-Farm Payroll Employment (000s, M’th Ave) |

|

|

|

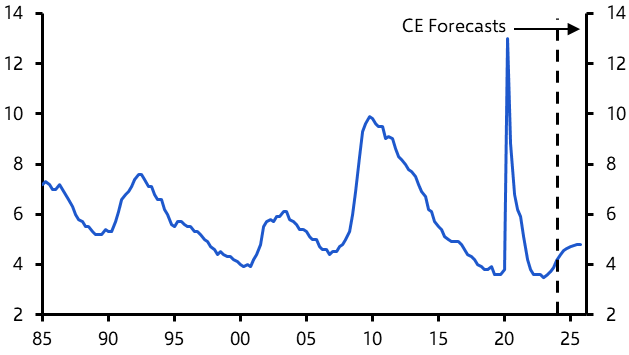

- The downward trend in employment growth will continue, with non-farm payrolls likely to stagnate over the coming quarters. Alongside the recent resurgence in the labour force, that means the unemployment rate should continue to edge higher and put further downward pressure on wage growth. Slowing GDP growth combined with still-robust labour force growth should push the unemployment rate up to almost 5%. (See Chart 3.)

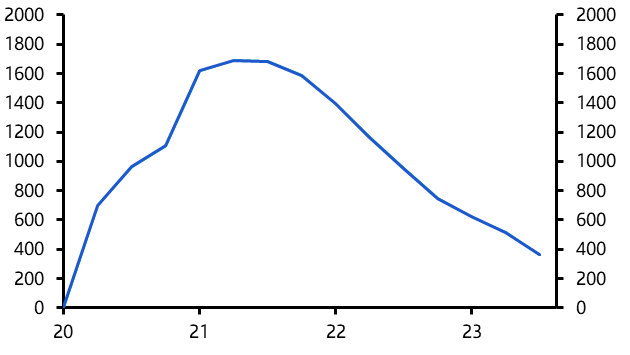

- Despite the Fed’s aggressive interest rate hikes, GDP growth has remained unusually robust in 2023, even accelerating to a 5.2% annualised pace in the third quarter. New credit growth has slowed markedly, but both households and businesses have benefitted from the prevalence of legacy fixed-rate debt taken out at unusually low rates over the past decade. As a result, the costs of servicing existing debts are barely back to 2019 levels. Households have also enjoyed the cushion of excess savings accumulated during the pandemic. As our own estimates of show, however, those excess savings will probably be exhausted by early next year. (See Chart 4.)

|

Chart 3: Unemployment Rate (%) |

Chart 4: Households’ Excess Saving ($bn) |

|

|

|

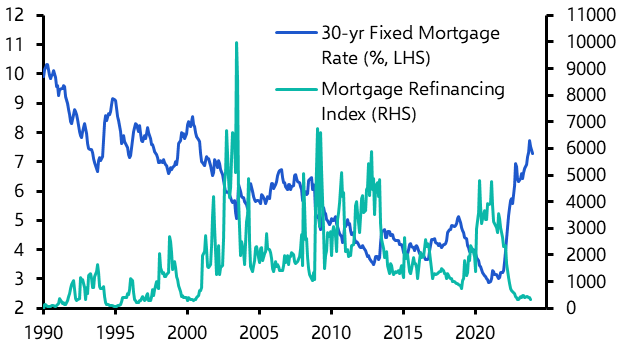

- Moreover, that low-rate legacy debt could end up being a double-edged sword because it means that, as the Fed begins to cut rates next year, we won’t see the usual surge in refinancing. (See Chart 5.) In other words, monetary policy will have lost some of its potency on the way down as well as the way up. With the underlying Federal budget deficit rebounding to around 7.5% of GDP over the past 12 months, there would appear to be little prospect of any fiscal stimulus next year either to supplement monetary loosening.

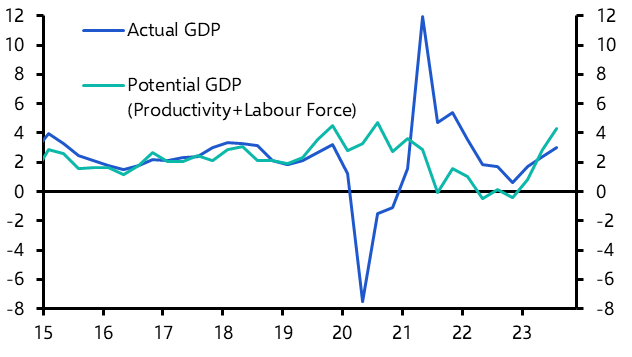

- Despite the strength of demand growth, inflation has nevertheless slowed sharply, as global supply shortages have eased and the domestic economy’s supply side has expanded at an even faster pace. (See Chart 6.)

|

Chart 5: Mortgage Rate & Refinancing Index |

Chart 6: Actual & Potential GDP (%y/y) |

|

|

|

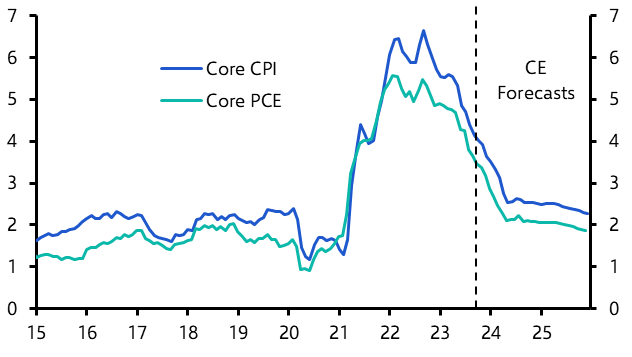

- We expect core PCE inflation to be back to the 2% target by mid-2024. (See Chart 7.)

- With core inflation rapidly normalising and monetary policy likely to be a little impotent on the way down too, we anticipate that the Fed will have to cut interest rates more aggressively than markets currently believe. (See Chart 8.) We expect a cumulative 175bp in cuts in 2024 with a final 50bp coming in early 2025. With inflation returning to the 2% target by mid-2024, however, even the aggressive policy loosening that we envisage would still leave the real rate at 1%.

|

Chart 7: Core Inflation (%) |

Chart 8: Fed Funds Rate Expectations (%) |

|

|

|

|

Sources: Refinitiv, Federal Reserve, CE |

- Finally, the stakes could not be higher for next year’s presidential election – with the expected head-to-head rematch between Joe Biden and Donald Trump offering starkly contrasting polices on trade, the environment and international relations. The outcome is still very uncertain and, given the low approval ratings of both candidates, there is scope for third-party independent candidates to shake up the race.

This is a sample of the 13-page US Economic Outlook prepared for Capital Economics clients, published on 6th December 2023 and written by Paul Ashworth, Andrew Hunter and Olivia Cross.

Get the full report

Trial our services to see this complete 13-page analysis, our complete US macro insight and forecasts and much more