The costs of the most aggressive tightening cycle since Paul Volcker ruled the Fed have been laid bare in a new Capital Economics report which warns of a looming global recession.

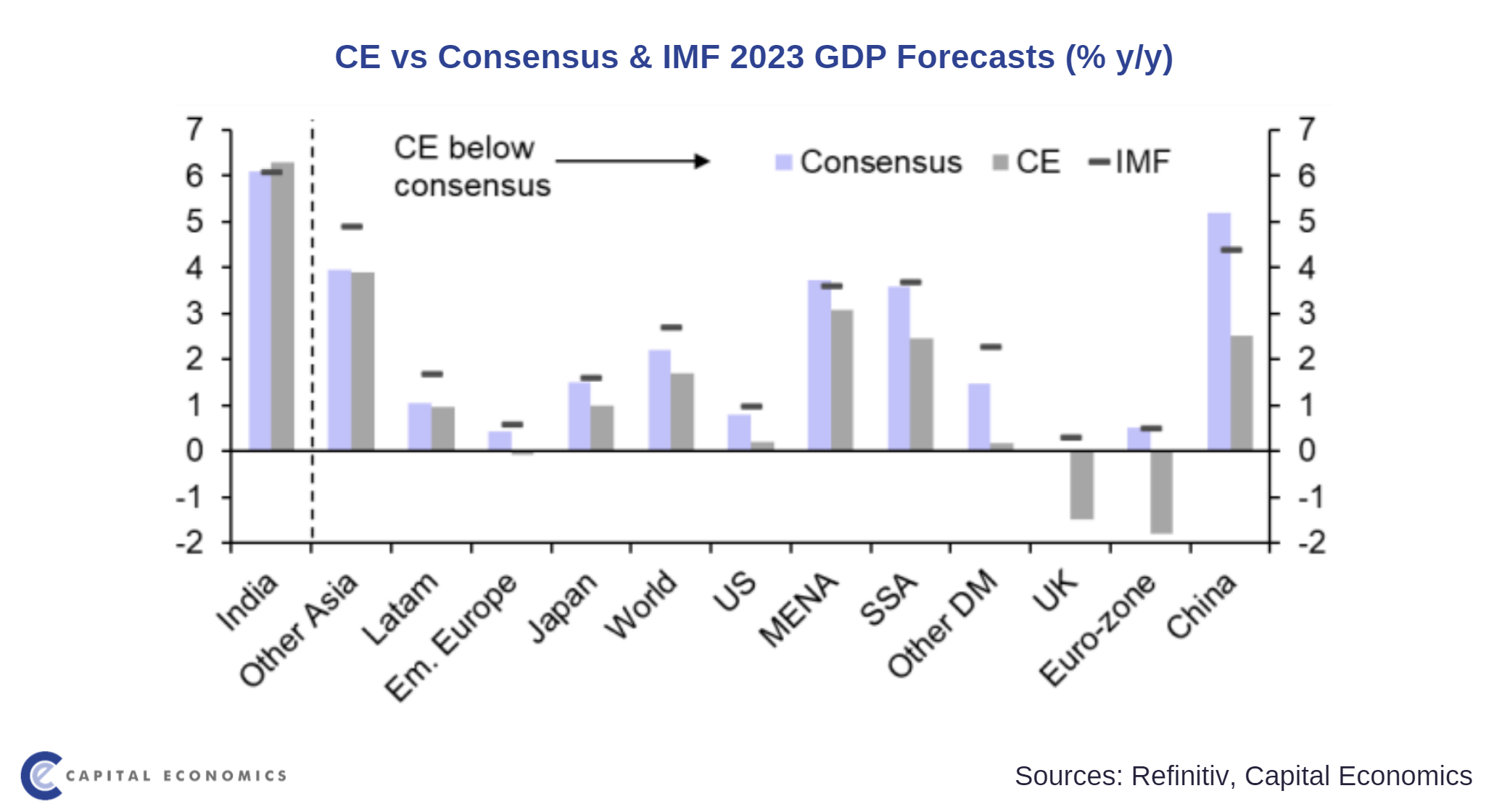

Our Q4 Global Economic Outlook presents our newly-downgraded forecasts for major advanced and emerging economies, showing how we are mostly below the analyst and IMF consensus.

The report explains how persistent inflationary pressure and the central bank response is set to do “serious damage to the world economy,” according to authors Jennifer McKeown, Ariane Curtis and Simon MacAdam.

While we have cut our global GDP growth forecast to just 1.7% for 2023 – meeting the IMF’s old definition of a recession as sub-2.5% growth – some economies will be hit harder than others. These include the euro-zone, which will suffer from both higher rates and a massive terms of trade shock from the fallout from the war in Ukraine.

The report why central bankers will need to remain vigilant to price pressures, despite an inevitable fall in headline inflation next year, but also looks ahead to easing inflation and weakening economic activity clearing the way for them to turn supportive before long.

That said, the report warns that risks are skewed to the downside, both linked to the extent that rates may have to rise to conquer inflation but also the threat of higher rates “breaking” something in the financial system.

Learn more about our latest global economic forecasts and accompanying downside risks by downloading our Q4 Global Economic Outlook.