Q4 2022 Global Markets Outlook

Looming global recession another threat to risky assets

Our Q4 Global Markets Outlook explains why we think equities and corporate bonds will struggle next year, even as government bond yields fall on the back of less hawkish monetary policy stances.

The latest edition of the Global Markets Outlook quarterly report sets out our key views and forecasts for developed and emerging market government and corporate bonds and equities and addresses key issues, including:

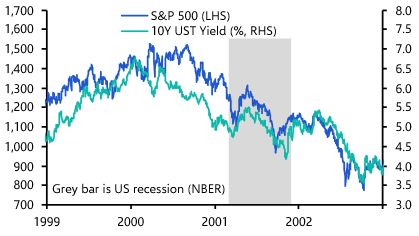

- Why we think the macroeconomic outlook poses more downside risk to global equities and corporate bonds;

- Why we don't expect falling government bond yields to support "risky" assets;

- When we think risky assets could rally on a sustained basis.

Download a complimentary copy of this report now to help prepare for market turning points.

Get the Global Markets Outlook

Download a free copy of the report

Report authors

-

Thomas Mathews

Senior Markets Economist

Thomas Mathews is a Senior Markets Economist focusing on bonds and equities as part of our Global Markets Service. Prior to joining Capital Economics in 2020 he worked at the Reserve Bank of Australia, in both financial markets and economics departments.

-

Diana Iovanel

Markets Economist

Diana Iovanel is an Economist in the Global Markets team at Capital Economics. She joined the firm in August 2022 from bfinance, where she worked in investment manager selection across asset classes, with a focus on equity and fixed income.

-

Jennifer McKeown

Chief Global Economist

Jennifer McKeown is Chief Global Economist at Capital Economics. She leads a team of economists focusing on global themes and oversees the research published within the Global Economics Service. She also works closely with the Chief Economists of our various regional services to shape the global view and to draw out the key implications of our forecasts.

-

Filippos Papasavvas

Markets Economist

Filippos joined Capital Economics in September 2022 as an Economist in the Markets team. Previously he had four years of experience working as a Europe Economist and a commodity Analyst.

About our Global Markets coverage

Our Global Markets coverage provides detailed analysis and independent forecasts for global financial markets, covering both advanced and emerging economies. It includes forecasts for the major asset classes based on our economic views and analysis of fundamental value.

Multi award-winning research

Our work has been widely recornised by several independent and authoritative organisations

Frequently quoted by major publishers and news agencies