Odds still favour a mild recession

Q3 US Economic Outlook

This is a sample of our latest quarterly US Economic Outlook, originally published on 11trh July, 2023. Some of the forecasts contained within may have changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium product or to our dedicated US Economics coverage.

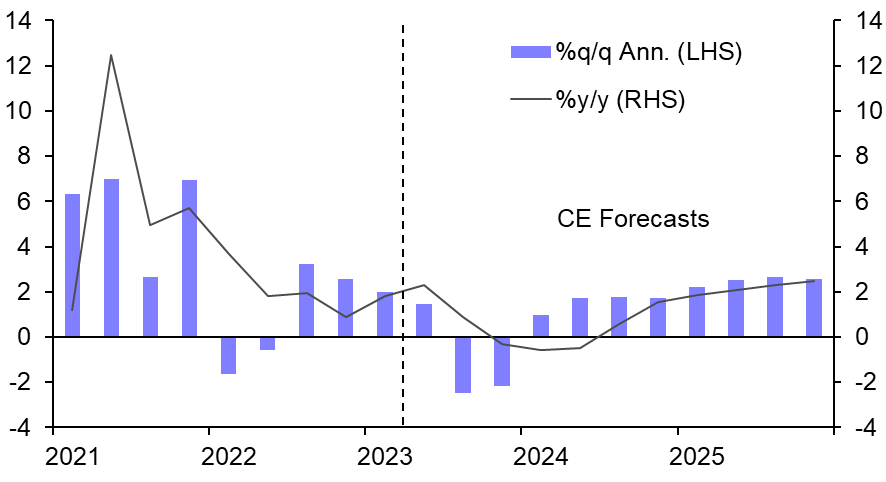

We still think a mild recession over the coming quarters is more likely than not. As the economy weakens and the downward trend in core inflation gathers pace, we think interest rates will eventually be cut more quickly than markets are pricing in. We expect GDP growth to slow from 1.3% this year to only 0.4% in 2024, before looser monetary policy drives a recovery to 2.0% in 2025 (see Chart 1.)

- GDP growth has continued to slow gradually, with recent weakness in consumption growth and net trade being offset by a rebound in investment, as the easing in mortgage rates has seen residential investment stabilise.

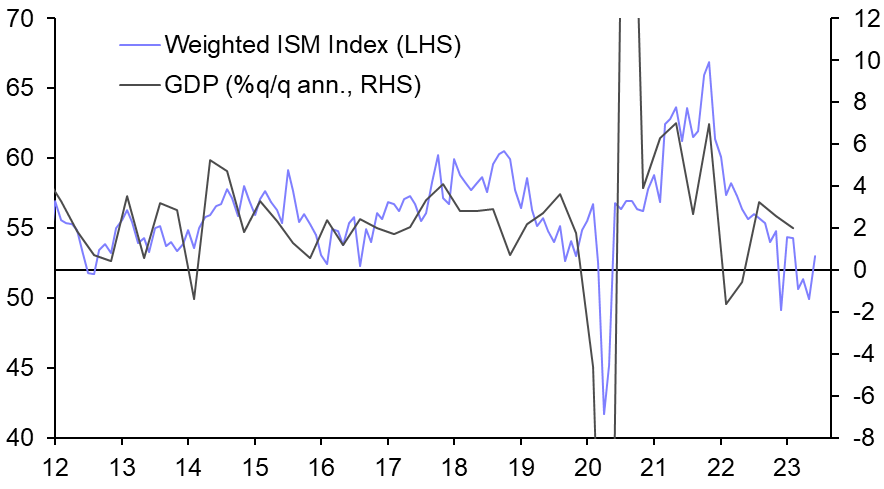

- Nevertheless, higher interest rates are still set to become a bigger drag on other sectors. The ISM activity surveys point to a stagnation in GDP. (See Chart 2.)

Chart 1: Real GDP |

Chart 2: ISM Activity Surveys & Real GDP |

|

|

|

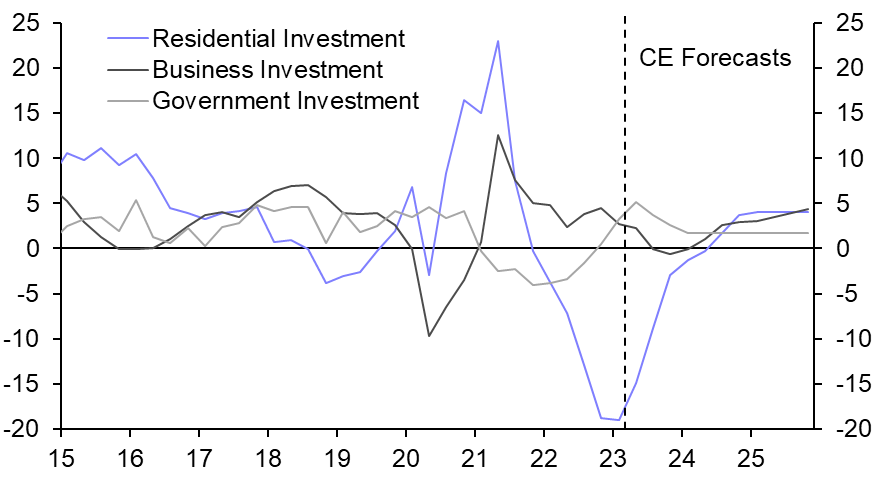

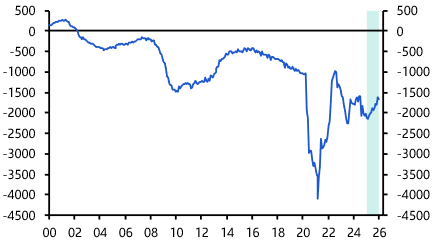

- The downturn in business investment looks set to worsen. (See Chart 3.) The SVB collapse didn’t trigger a full-blown credit crunch, but banks have tightened lending standards significantly, pointing to steeper falls in equipment investment soon.

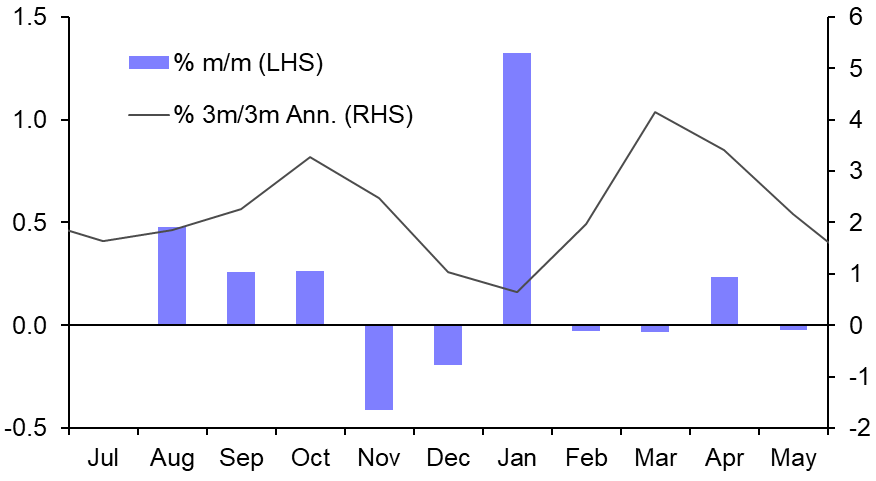

- Consumption has faltered in recent months (see Chart 4), and the rebound in delinquency rates and unusually low saving rate hint that households are also beginning to struggle. Nonetheless, the strength of households’ balance sheets suggests that, similar to the mild recession of 2001, an outright decline in consumer spending is unlikely. Even after the earlier falls in equity and house prices, household net wealth remains well above its pre-pandemic level, while the debt-to-income ratio is close to a 20-year low.

Chart 3: Private Fixed Investment (%y/y) |

Chart 4: Real Consumption |

|

|

|

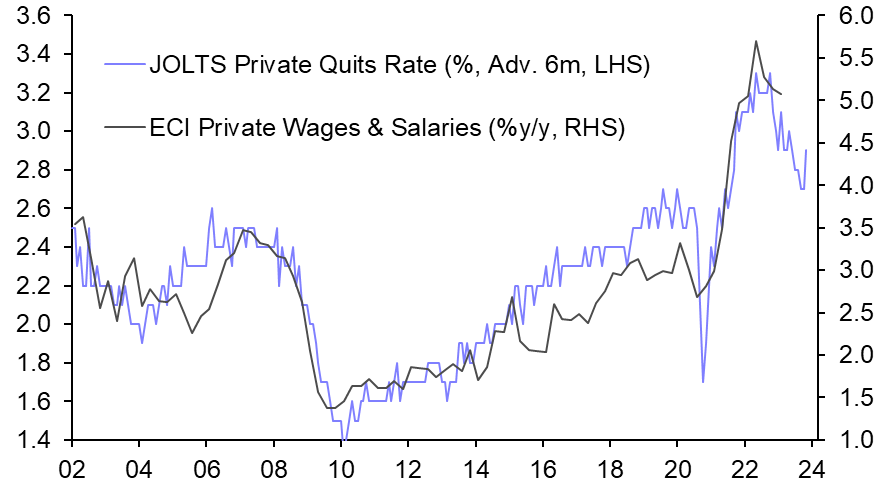

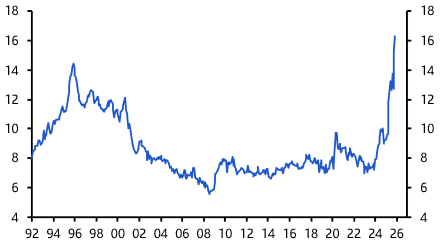

- Consumers are still being supported by the resilience of the labour market, with payroll employment growth still above 200,000 per month. We doubt that strength will continue, however, with signs beneath the surface that labour market conditions are cooling. The job openings rate has fallen to a two-year low while the quits rate isn’t far from its pre-pandemic peak. The latter suggests wage growth will slow to 4.0%-4.5% by year-end. (See Chart 5.)

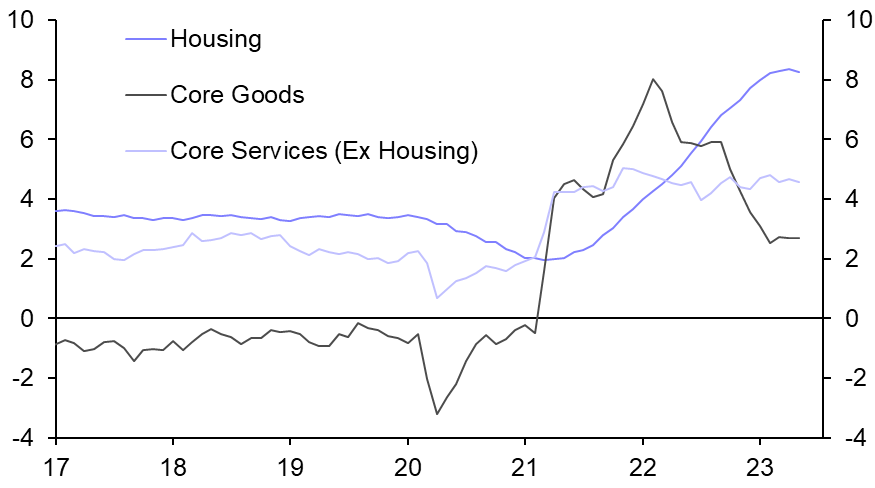

- Falling food and energy prices will continue to pull headline inflation lower, but the decline in core inflation remains painfully slow. That partly reflects the recent jump in used vehicle prices, however, which should reverse soon. The easing in shelter inflation has a lot further to run.

- There are only tentative signs of a decline in inflation for core services ex-housing, which the Fed appears to be tracking most closely. But a continued easing in labour market conditions should trigger a more marked slowdown soon. (See Chart 6.)

Chart 5: Job Quits & ECI Wage Growth |

Chart 6: Core PCE Inflation (%) |

|

|

|

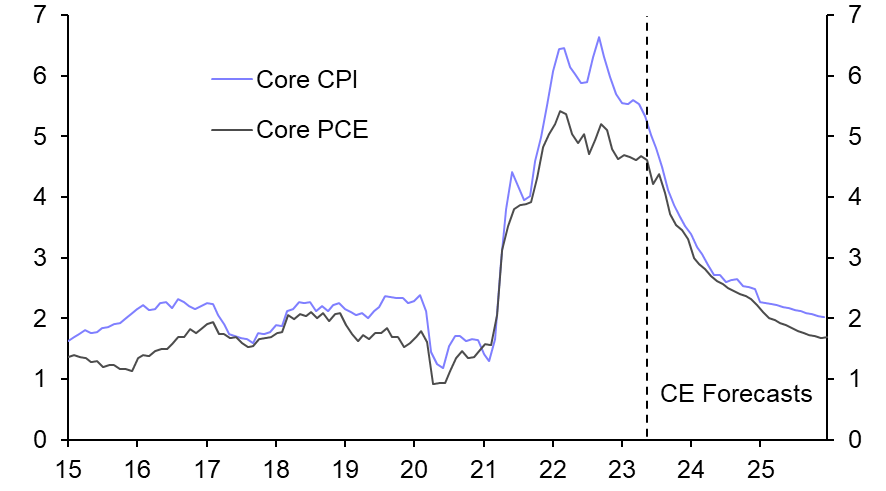

- The upshot is that we still expect the slowdown in core inflation to gather pace. (See Chart 7.)

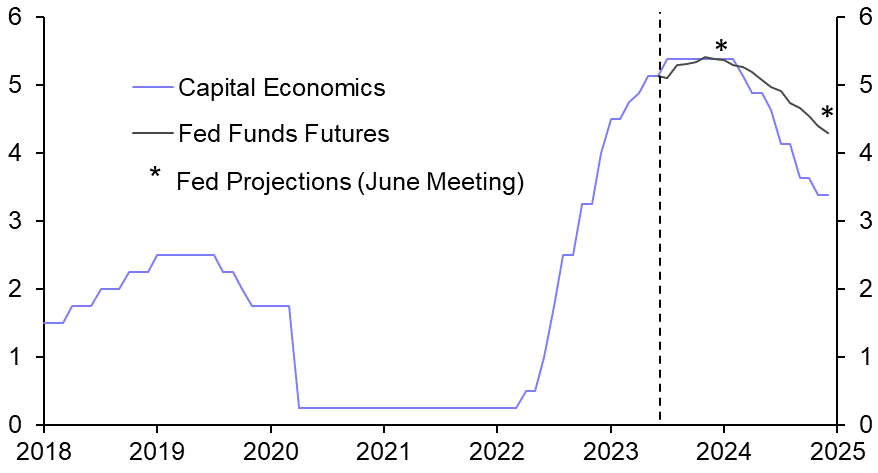

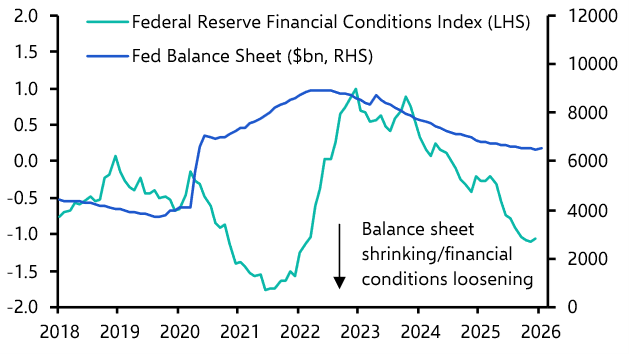

- The Fed has all-but signalled another 25bp rate hike in July, taking the fed funds target range to 5.25%-5.50%. But we expect that to mark the peak, with economic weakness and a sharper fall in inflation convincing officials to call time on their tightening cycle. (See Chart 8.)

- Signs that the real economy is still headed for recession and more progress on bringing core inflation back toward the 2% target should eventually persuade the Fed to begin cutting rates again in the first half of next year. We still anticipate 200bp of policy loosening next year, significantly more than the Fed’s own forecasts or what market expectations imply.

Chart 7: Core Inflation (%) |

Chart 8: Fed Funds Rate Expectations (%) |

|

|

|

|

Sources: Refinitiv, Federal Reserve, NY Fed, CE |

This is a sample of a 13-page report published for Capital Economics clients on 11th July, 2023. The report was written by Paul Ashworth, Andrew Hunter and Olivia Cross.

Make informed investment decisions quickly

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.