ECB to keep policy tight despite recession

Q2 Euro-zone Economic Outlook

Below are excerpts from our latest quarterly Euro-zone Economic Outlook. Access to the complete report, including extensive forecasts and country-level analysis, is available as part of a subscription to our CE Advance premium product or to our dedicated Euro-Zone Economics coverage.

The euro-zone economy is set to perform much worse than consensus forecasts suggest over the next two years, with a recession looking likely. That is mainly because monetary policy and bank lending conditions are tightening. We expect household consumption to decline because, after accounting for rising interest expenditure, disposable incomes will fall. Moreover, the low level of consumer confidence suggests that the saving rate will rise. Investment looks sure to fall too, led by a sharp downturn in the construction sector. Meanwhile, headline inflation will decline sharply as the contribution from past increases in energy and food drop out of the year-on-year rate. But core inflation will come down much more slowly, not least because there will continue to be little or no spare capacity in the labour market. Assuming that the recent turmoil in the banking sector does not escalate, the ECB will raise interest rates further and keep them high for longer than is currently discounted in the markets. That said, once it starts to cut interest rates in 2024, we suspect that it will move faster than most expect.

Economy to struggle under the weight of high interest rates

- The euro-zone looks set for two years of weak growth, with a recession more likely than not. Core inflation will come down only gradually, so monetary policy will remain tight until well into next year.

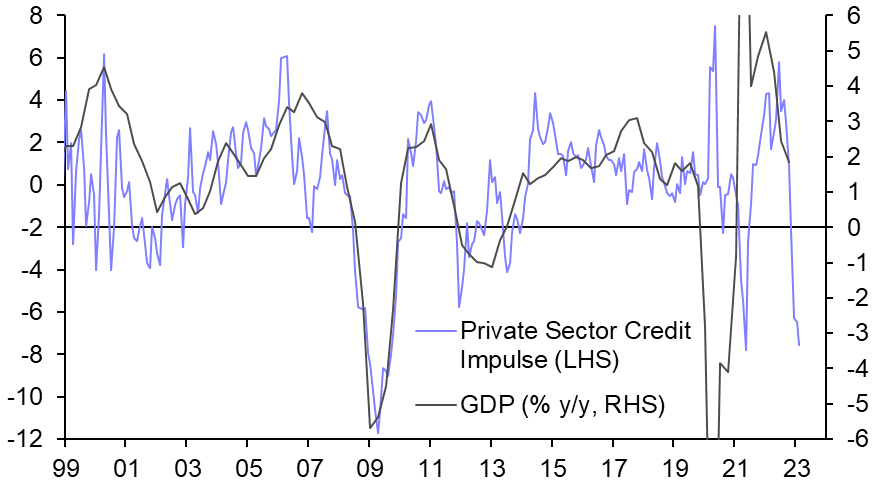

- After stagnating in Q4, GDP probably increased slightly in Q1 so the euro-zone avoided a recession over the winter. But while the business surveys have held up fairly well recently, the money and credit data have been extremely weak. (See Chart 1.) We think things will get worse as the impact of higher interest rates intensifies and banks prioritise stability over growth.

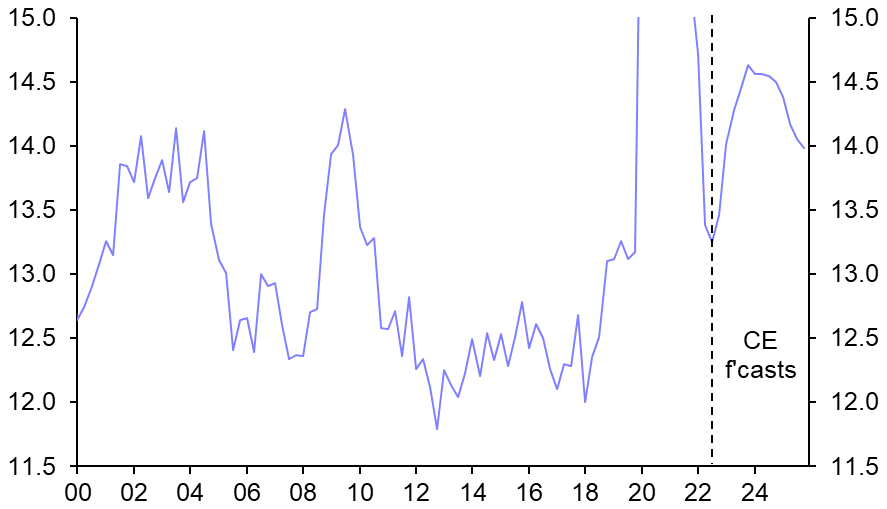

- After accounting for rising interest expenditure, households’ real disposable incomes are set to fall further this year than they did last year. Higher interest rates will also weigh on spending power in 2024. And the low level of confidence suggests that they may save a larger share of their incomes too. (See Chart 2.)

- We think the global banking sector problems are unlikely to turn into a sustained or systemic banking crisis in Europe. However, stresses in the banking sector will cause financial conditions to tighten more than they otherwise would do.

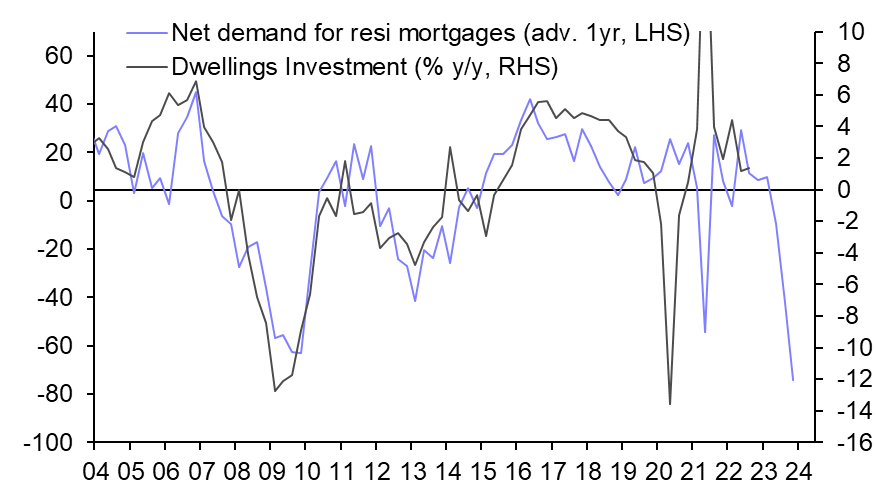

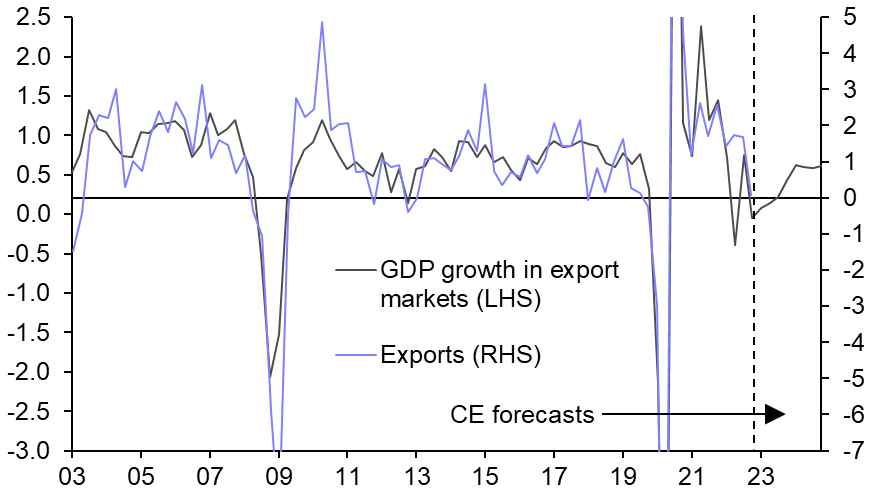

- Investment is also likely to fall, with the latest data on mortgage demand pointing to huge declines in residential investment (see Chart 3) as house prices decline. And export growth will be subdued this year as the global economy enters recession before picking up in 2024. (See Chart 4.)

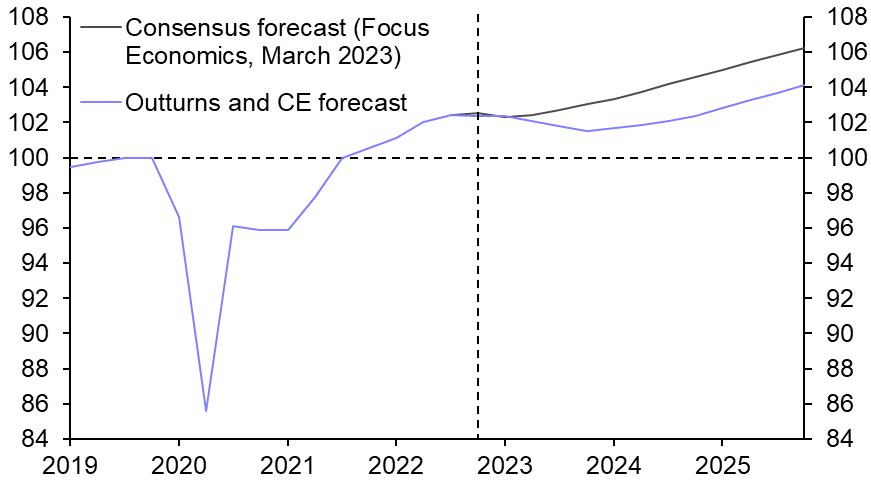

- The big picture is that we think the euro-zone economy will perform very poorly over the next year or two, with a recession likely this year. That puts us well below the consensus forecast which assumes that the economy returns to trend growth from Q3 this year. (See Chart 5.)

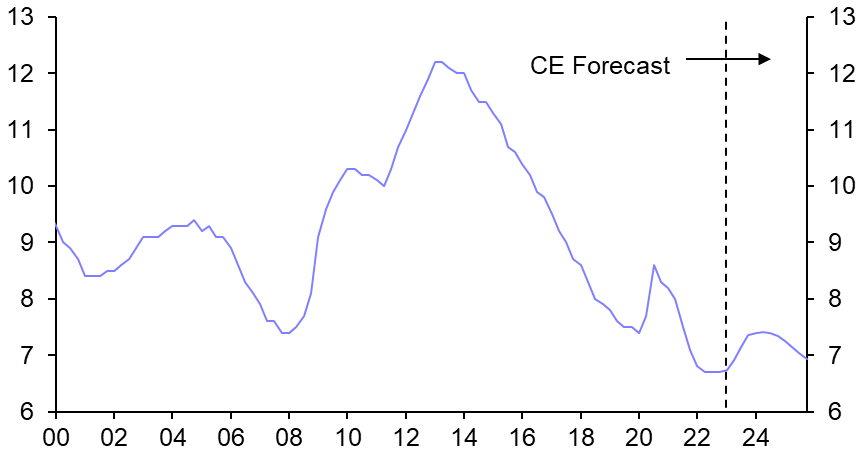

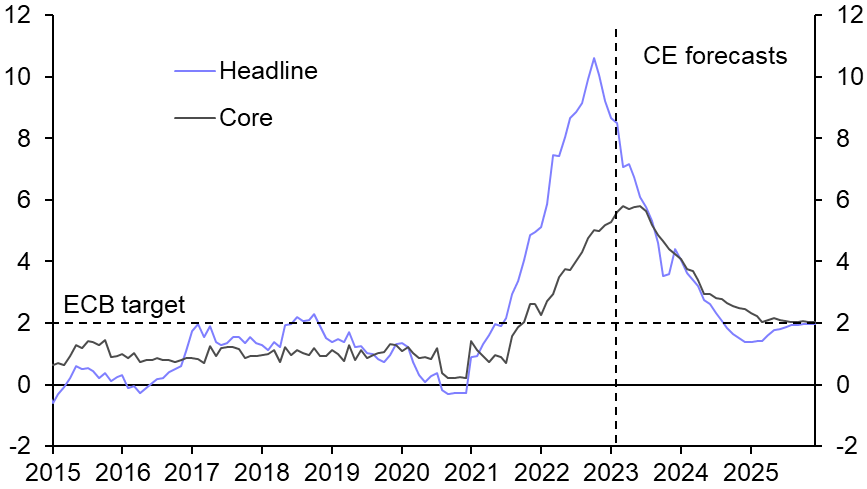

- The heat is likely to come out of the labour market only slowly as the unemployment rate creeps up. (See Chart 6.) So underlying price pressures will ease rather than plummet, keeping core inflation above 2% until 2025. (See Chart 7.)

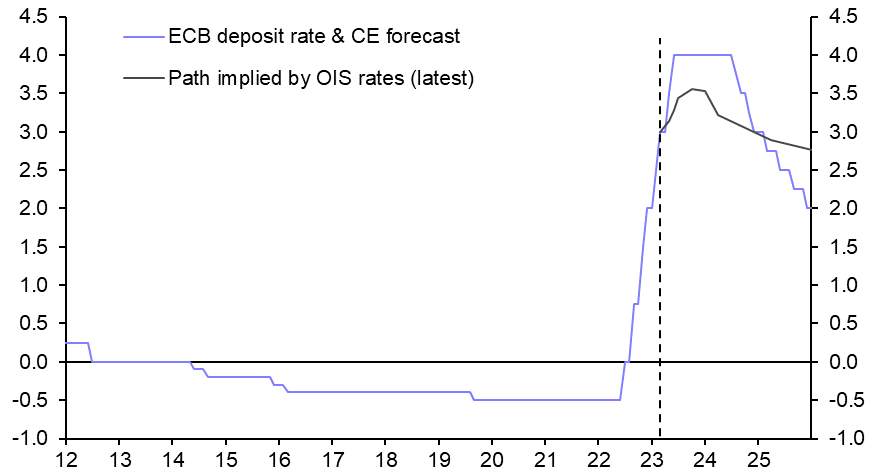

- As a result, we forecast that the ECB will raise its deposit rate to a peak of 4% by the middle of this year. Investors appear to have come round to our view that we won’t see rate cuts until 2024. But once the Bank does start cutting, we suspect that it will move more quickly than investors currently assume, taking the deposit rate to its neutral level of around 2% by the end of 2025. (See Chart 8.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sources: Refinitiv, Capital Economics |

This content is based on a report for Capital Economics clients written by Andrew Kenningham, Jack Allen-Reynolds, Franziska Palmas, Adrian Prettejohn, Giulia Bellicoso and Anna Padt published on 28th March, 2023.

Make faster informed decisions

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.