From the lows of December retail sales to the highs of January payrolls, recent US data has sent mixed signals. But the economy remains in relatively good shape, argues Deputy Chief North America Economist Stephen Brown on the latest episode of the Capital Economics Weekly Briefing. He explores why the idea of a “K-shaped” economy may be overstated, what markets are missing about the productivity growth upturn, and the chances of much lower rates from a Kevin Warsh-led Fed.

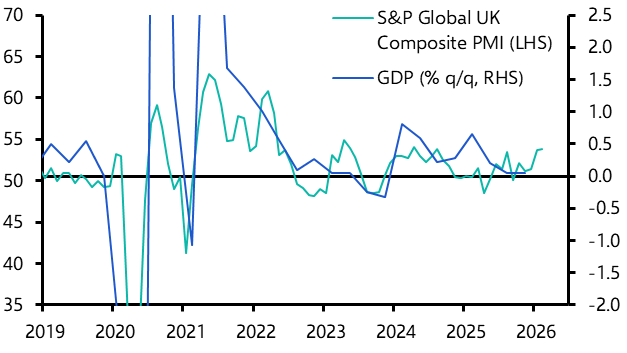

Also on the show, as Keir Starmer’s government reels from one of its toughest weeks yet, Deputy Chief UK Economist Ruth Gregory assesses what a change of leadership could mean for the UK economy and financial markets, but also why the long-term growth outlook may not be as bleak as recent headlines suggest.

AI already making a big contribution to US productivity growth

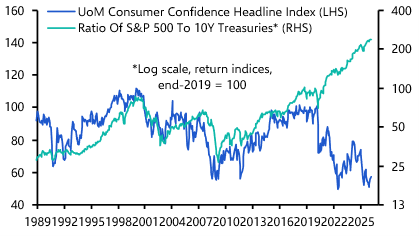

Why we still believe in the AI rally, and the S&P 500

Would a stock market crash cause a global recession?

Can China’s trade surplus rise further?

AI already making a big contribution to US productivity growth

Why we still believe in the AI rally, and the S&P 500

Would a stock market crash cause a global recession?

Can China’s trade surplus rise further?