A recurring fear in sell-side research and market commentary this year has been that a combination of tightening by the Federal Reserve and a strong US dollar will precipitate a wave of debt crises in emerging markets. It’s a fear that has been misplaced; we’ve always been sceptical that Fed tightening and a strong dollar would cause debt problems in EMs for the simple reason that dollar debt burdens in the emerging world are generally much lower than in the past. What’s needed is a new way of thinking about emerging market debt risks.

Wind the clock back several decades and EM debt crises were often caused by excessive borrowing in foreign currencies. When investors eventually realised that the situation was unsustainable, they would rush for the exits and countries would be hit by a “sudden stop” in capital flows. This would trigger a foreign currency liquidity crisis. The exchange rate would subsequently plummet, causing the local currency value of foreign-denominated debt to soar, thus turning a liquidity crisis into a solvency crisis. This was the story of most EM crises, from Mexico in 1982 to South East Asia in 1997.

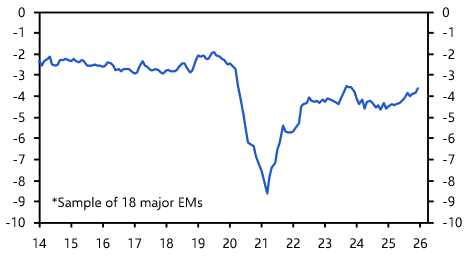

But structural changes and the development of domestic bond markets mean that most EM borrowing now takes place in local currencies. Data from the Bank for International Settlements suggest that in aggregate there is currently around $80trn of outstanding debt across emerging markets. But by our estimates, only a little more than $6trn is denominated in foreign currencies. The vast majority is local currency-denominated debt. What’s more, it’s the local currency part of the EM debt pile that has increased the most over the past decade or so.

There are parts of the emerging world that still suffer from the so-called “original sin” of borrowing in foreign currencies and are now either facing, or are experiencing, crises. This includes Sri Lanka, Ghana and, the perennial debt malcontent, Argentina. But the inescapable truth is that most EM borrowing now takes place in local currencies. We therefore need a new framework for assessing debt risks in emerging economies that takes us beyond the Fed and the dollar. What’s more, since the increase in borrowing over the past decade or so has mostly been by households and businesses, we need to focus increasingly on private rather than sovereign debt vulnerabilities.

Guided by this golden rule

There are two sources of potential risk to consider. The first is that a rapid increase in local currency private debt causes financial stability problems in and of itself (one example might be that a sudden expansion of mortgage lending inflates housing bubbles). The second is that sharp increases in domestic interest rates cause an otherwise sustainable burden of local currency debt to become unsustainable. These two things often interact, with a rapid expansion of credit appearing sustainable until such time that interest rates increase.

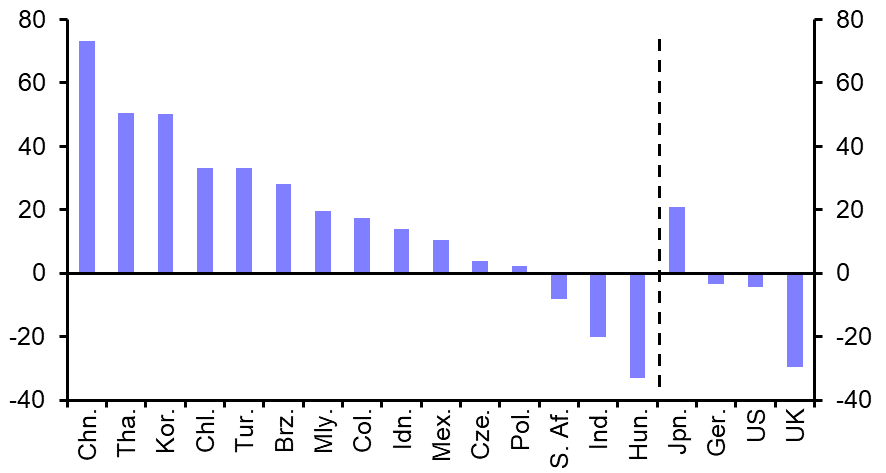

In a recent Focus report we assessed the private sector debt landscape in emerging economies using this framework. More than a decade ago we developed our “golden rule” of EM debt. This holds that if the ratio of private sector credit-to-GDP increases by more than 30%-pts within the space of a decade then debt problems tend to follow. As things stand, three countries currently break the Golden Rule: China, Thailand and Korea. (See Chart 1.)

|

Chart 1: Private Sector Debt Ratios (% of GDP, Change 2010 to Q1 2022) |

|

|

|

Sources: BIS, Capital Economics |

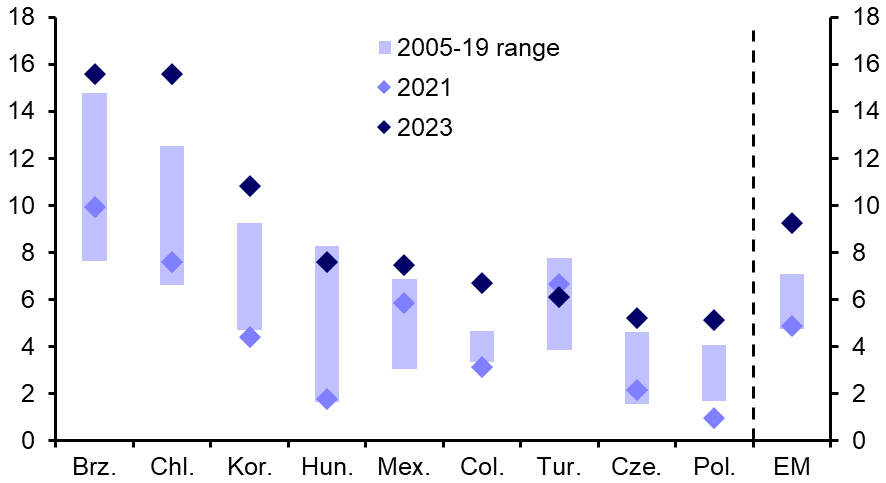

We also modelled how changes in interest rates over the past year or so will affect private sector debt servicing costs. Based on our analysis, the debt interest service ratio (the share of income devoted to servicing debt) will increase most in Brazil, Chile, Korea, Hungary and Mexico. (See Chart 2.)

|

Chart 2: Private Sector Debt Interest Service Ratios (Interest Paid as a % of Augmented Disp. Incomes) |

|

|

|

Sources: Refinitiv, BIS, National Sources, Capital Economics |

Taken together, this helps to identify the group of countries on which we should focus: China, Brazil, Chile, Korea, Hungary, Mexico and Thailand.

Concern naturally centres on China given the sheer size of its debt pile and the global importance of its economy. But several important factors reduce the risks of a systemic crisis: the banks are backed by the government, domestic savings are high, and capital controls should prevent a crisis from being triggered by deposit flight from the banking system. The structure of China’s financial system makes it unique, but it illustrates the importance of borrowing in local rather than foreign currency: because the government controls the supply of the currency it has many more levers to pull in order to mitigate debt risks. In countries where debt vulnerabilities stem from hikes in interest rates, central banks could in the extreme choose to tolerate higher inflation if they believed that the alternative of running tighter monetary policy posed a substantial risk to financial stability.

Not out of the woods

None of this is to say that private debt surges in these EMs won’t create some pain. China’s debt overhang will take decades to work through and is one reason to expect long-term productivity growth to decline. Debt restructurings are likely to become more common, particularly in the property sector, and will cause bouts of market turbulence.

China’s debt boom is concentrated in the corporate sector but elsewhere it is households that are responsible for most of the borrowing. This is likely to produce a period of extreme weakness in consumer spending, particularly in Chile and Colombia, where household savings rates are very low and will need to rise.

Non-performing loans are likely to rise across all EMs that have experienced debt surges and, while banking sectors look well capitalised in aggregate, it’s possible that individual institutions may run into trouble. What’s more, the build-up of debt in these economies makes them vulnerable to other shocks. For those in Latin America, a key risk is that global commodity prices drop back, causing the terms of trade to deteriorate and real incomes to weaken and making the debt situation worse. For Hungary, another global price shock could force the National Bank to choose between tightening policy further to dampen inflation and protecting financial stability.

As the global economy slides into recession, EM investors need to pay particularly close attention to how the debt landscape in these economies is unfolding. But focussing on the strength of the dollar and the actions of the Fed risks as a trigger for problems misses the bigger picture: most EMs have learnt the lessons of the 1980s and 1990s crises. The problems now lie in local currency debt and rising domestic interest rates. We’re not expecting explosive debt crises in the major EMs like those seen in past decades. But higher debt burdens and higher interest rates will result in weaker GDP growth.

In case you missed it:

David Oxley, the head of our Climate Economics coverage, explained why the push for biodiversity won’t compensate for reducing gross greenhouse emissions. Backed by a Databank composed of thousands of climate-related data series, our new Climate Economics coverage aims to highlight to clients the macro and market risks around the global climate challenge.

Since launching in October, the coverage has already explored the geoeconomics undermining efforts to control methane emissions, has shown why COP27 was bound to disappoint and explained what Brazil’s presidential election means for deforestation.

In the pipeline are work on China’s role in the climate debate and the building out of new interactive dashboards that provide granular emissions data for the world’s biggest economies. To find out more about how to receive Climate Economics in your subscription, send me an email or contact your account manager.