If you’re looking for evidence of the negative hit from Donald Trump’s tariffs, you’ll struggle to find it in the hard data. Group Chief Economist Neil Shearing is on The Weekly Briefing from Capital Economics minutes after the release of the US employment report for April to talk about how economies have been holding up in the weeks since the ‘Liberation Day’ announcement. In his conversation with David Wilder, he addresses the key issues of the moment, including:

- What Q1 US GDP data and port data aren’t telling us about the negative hit to impact on economies from tariffs;

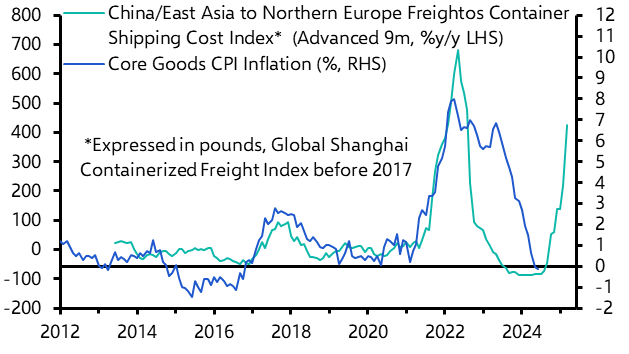

- Whether markets have become too complacent about the tariffs impact;

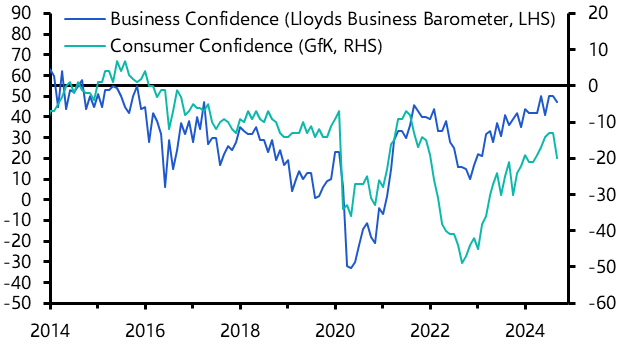

- How the tariffs threat will influence the Federal Reserve and Bank of England at their meetings in the coming week.

Plus, ahead of a key OPEC+ meeting on Monday, David Oxley and Olivia Cross from our Commodities & Climate desk talk about what recent signals from Saudi officials could mean for already-weak oil prices.

Events and analysis referenced in this episode:

Global Drop-In: The Fed, Bank of England and ECB – Making sense of the latest rate decisions

Data: Central Bank Hub

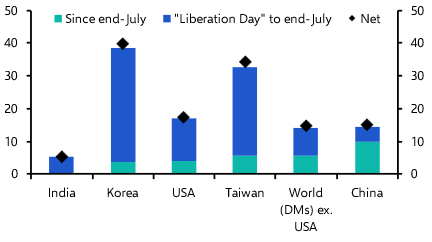

Drop-In: Which economies could gain if the US turns away from China?

Read: Will Asia benefit from China's plunging US exports?

Drop-In: The future of OPEC+, oil prices and the Gulf

Events and analysis referenced in this episode:

Global Drop-In: The Fed, Bank of England and ECB – Making sense of the latest rate decisions

Data: Central Bank Hub

Drop-In: Which economies could gain if the US turns away from China?

Read: Will Asia benefit from China's plunging US exports?

Drop-In: The future of OPEC+, oil prices and the Gulf