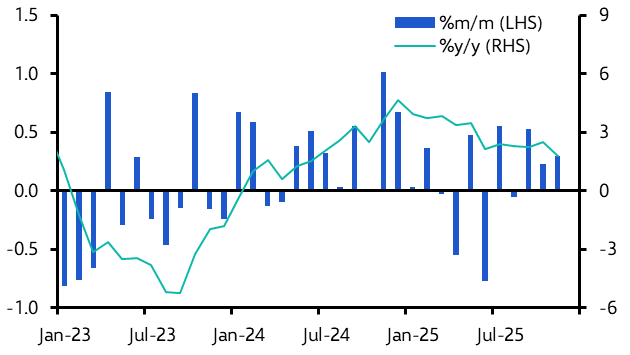

- Although Treasury yields have dropped back in recent weeks amid signs that inflation has peaked, we don’t think it makes sense to extend duration. Of course, the longer a bond’s remaining life, the greater the sensitivity of its price to a change in its yield. So, those with distant maturities would tend to deliver better returns if yields fell further alongside inflation, even if the curve bull steepened a bit. But we suspect there will be a considerable lag between peaks in inflation and yields, as there was in the early 1980s.

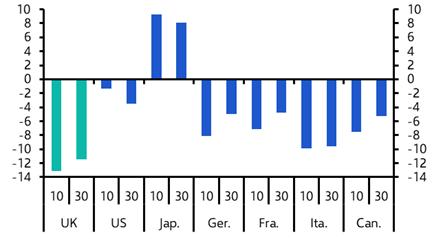

- Chart 1 plots ACM’s fitted 2-year and 10-year zero-coupon Treasury yields, using monthly data since June 1961. We have used these data to compute our own real return indices for generic 2-year and 10-year Treasuries with hypothetical annual coupons, assuming that reinvestment is made at the end of each month into new bonds with the same original maturities. Not surprisingly, Chart 2 shows how the real return from the index of 10-year Treasuries was worse than that from the index of 2-year Treasuries when yields were rising but better when they were falling. The bull steepening of the curve after yields peaked in 1981 was nowhere near enough to stop 10-year Treasuries from subsequently returning more than 2-year Treasuries.

Capital View