The emergence of DeepSeek, and BYD’s recent advances in EVs, have elevated awareness of China’s strength in innovation. For China’s leadership, they are also encouraging signs of success for a longstanding-strategy that, unusually for an emerging economy, prioritises competing at the technological cutting edge.

Advanced technology is central to Xi Jinping’s vision of China’s future. Over the next five years, according to the “Decisions” that were published after the Third Plenum last year, China will “mount a concerted push for breakthroughs in core technologies in key fields”. This push will mobilise China’s financial system, public research institutes and universities, and both state-owned and private firms to achieve breakthroughs in specified areas spanning a broad range of technologies. The core measure of success, according to Xi, will be a “substantial increase in total factor productivity.” He talks of “New Quality Productive Forces” as the drivers of this high-tech development.

This Focus considers the impact this push is having on China’s economic performance and, in particular, whether it is generating the productivity gains that Xi desires and that will be needed to close the gap with the most advanced economies. The emergence of advanced Chinese-made AI products and EVs has heightened awareness of China’s technological prowess. But we argue that, in terms of wider productivity growth, the current strategy is misfiring.

First imitate then innovate

China is unusual in having started its push for technological leadership while average incomes were still low.

For any economy, productivity growth can come from two sources: the adoption of technology and techniques from abroad, and domestic innovation. (Note that we’re following Xi in focusing here on total factor productivity – how effectively workers and capital are jointly employed.)

Emerging economies typically succeed by prioritising adoption since large productivity gaps with leading economies allow for large gains by making use of technologies that already exist abroad. As economies approach the technological frontier, the scope for further technological catch-up diminishes and economies that hope to succeed have to pay more attention to innovation.

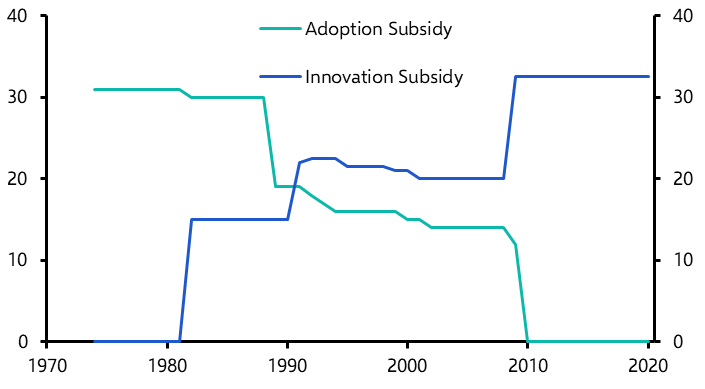

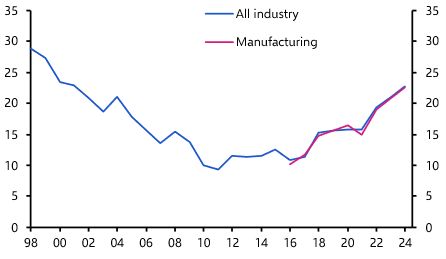

Korea provides a model of an economy that managed that transition from adoption to innovation well. In the 1970s and 1980s, when incomes were still low, its government prioritised the adoption of foreign know-how, providing tax credits that covered licensing fees and royalty payments for Korean firms utilising technology from abroad. As incomes rose during the 1980s, the adoption subsidy was scaled back and a transition began towards supporting domestic innovation. From the early-1990s, as Korea was on the cusp on high income, the subsidy was restricted to adoption of advanced technology. It was phased out altogether in 2010. Meanwhile, the government introduced tax credits for R&D in the 1980s. This innovation subsidy was stepped up in the 1990s and again in 2009, the year before the adoption subsidy was withdrawn. (See Chart 1.)

|

Chart 1: Government Subsidies in Korea (%) |

|

|

|

Source: Choi, Jaedo, and Younghun Shim (2024) |

The success of Korea’s approach in transitioning from imitation to innovation can be seen in its continued rapid growth. It crossed the threshold to high income on the World Bank definition in 1995. Korea’s GDP growth averaged 3.9% between 2000 and the onset of the pandemic. Average incomes are now higher in Korea than they are in Japan.

China’s early start on innovation

China is only now approaching the World Bank’s current high-income threshold (GNI per capita of $14,005) – the point Korea passed in 1995. But policy in China has already been geared primarily towards innovation rather than adoption for well over a decade.

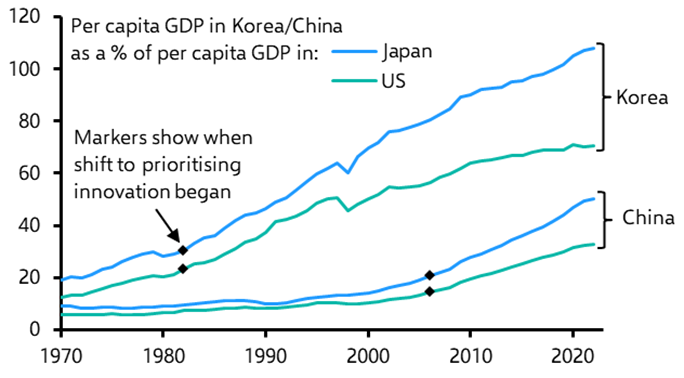

Indeed, the shift towards prioritising innovation began nearly two decades ago, in 2006, with the Medium and Long-Term Programme of Science and Technology (MLP), which emphasised “indigenous innovation” for the first time. The MLP set quantitative targets to reduce dependence on foreign technology, raise spending on R&D and the contribution of science and technology to economic growth, and to boost patents and citations of Chinese authored papers. The equivalent pivot to start encouraging innovation happened in Korea in the early 1980s when its per capita GDP was a third of that in Japan and a quarter of the level in the US. China only passed these relative income thresholds in the 2010s. (See Chart 2.)

|

Chart 2: Per Capita GDP in Korea & China (% of Japan & US) |

|

|

|

Sources: Maddison Project Database 2023, Capital Economics |

And China has pivoted much more rapidly to making innovation the centrepiece of policy.

Korea phased out the adoption subsidy gradually during the 1990s and 2000s. It wasn’t until 2010 that innovation became the sole focus. (See Chart 1 again). By that point, Korea had almost caught up with Japan in terms of income (and technology).

In China by contrast, innovation very rapidly became the main focus of industrial policy when the country was still a long way from the technological frontier. Support for indigenous innovation was ramped up in the stimulus response to the Global Financial Crisis. Then, in late 2009, the leadership identified a set of Strategic Emerging Industries – industries at the forefront of technological change that China should master.

In 2015, the Made in China 2025 policy laid out a path to turn China into a “manufacturing powerhouse” fuelled by “world-class” innovation. Subsequent roadmaps set targets to become the global technological leader across a range of industries.

China then pledged in the 13th Five-Year Plan (2016-2020) to “make significant breakthroughs in basic research and strategic advanced technology” (and added AI to its list of strategic industries). The current Five-Year Plan sets a target of “strategic emerging industries” generating more than 17% of GDP this year, from 8% a decade ago.

An array of instruments has been deployed in China to support innovation – grants, fiscal incentives, public procurement, collaboration between firms and research institutes, the creation of science and technology parks and state-funded incubators, loan guarantees, and state-financed venture capital schemes. The Third Plenum last year signalled an intention to continue to marshal government, financial sector and corporate resources to pursue its goals. (See Box 1.)

Box 1: How China intends to take the lead

At the Third Plenum, the leadership outlined a three-pronged strategy to develop advanced technology:

1) The government will develop “a financial system for scientific and technological innovation” and support “the investment of long-term capital in projects at the early stages, in small enterprises, over long time horizons, and in advanced and core technologies.” The goal will be to channel capital to “industries of the future”.

2) China’s national research institutes and laboratories and research universities will collaborate to ensure that innovation is “more systematic, well-organized, and coordinated” around national goals.

3) And the corporate sector will be mobilised. Capital, research support and talented workers will be channelled towards public and private companies that are working to achieve technological breakthroughs in areas that the government has identified as strategic priorities.

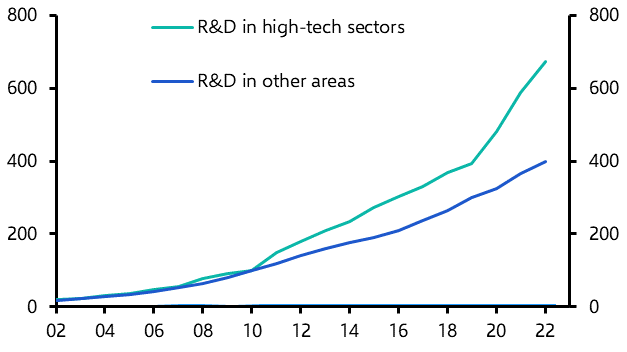

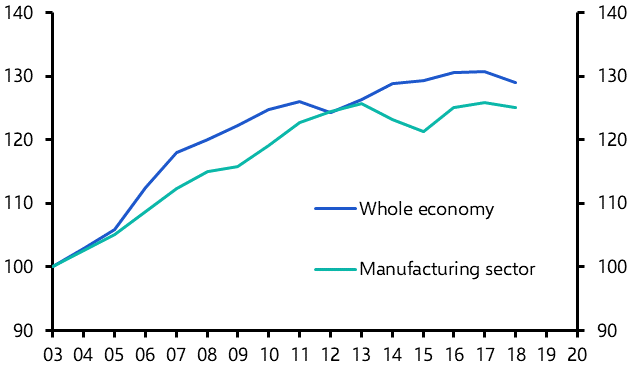

This intensity of focus has been reflected in a massive shift of resources towards innovation. Spending on research and development has ramped up and, increasingly, it has been directed to sectors designated as high-tech. (See Chart 3.) Again, this pivot to spending on R&D happened sooner than in Korea and has been ramped up faster. China spends as much on R&D now (relative to GDP) as Korea did in the mid-2000s, when Korea was already a high-income economy. Overall, China’s government has directed far more policy support towards innovation and started far earlier than Korea’s government did.

|

Chart 3: China R&D spending (RMB, 2010 = 100) |

|

|

|

Sources: |

Indeed, the scale of resources devoted to this industrial push may be unprecedented in modern times. As of 2022, at least 5,400 subsidy policies were in force across China, according to the IMF. By some estimates, industrial policy costs 5% of China’s GDP.

Innovative China

There is plenty of evidence in China today of impressive innovation across a wide range of sectors. DeepSeek’s low-cost, open-source AI models have taken the headlines recently. But in high-speed trains, nuclear reactors, renewable energy, electric vehicles and high-end consumer electronics, China has absorbed technologies that originated abroad and successfully indigenised and further developed them. Chinese firms are now successfully exporting products that use predominantly Chinese technologies in each of these sectors.

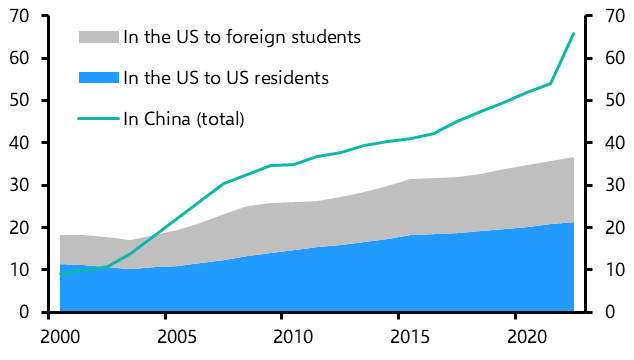

Elsewhere, Chinese firms are not only incrementally improving on technologies developed elsewhere but are breaking new ground. The Australian Strategic Policy Institute, a think tank, publishes a “Critical Technology Tracker” that identifies global research leadership across 44 areas of technology. It puts China in the lead in 37 of those 44 (the other seven are all led by the US). And the foundations appear to have been laid for continued success. Close to twice as many PhDs are now awarded each year in STEM subjects in China as in the US. (See Chart 4.)

|

Chart 4: Number of STEM PhDs awarded (thousands) |

|

|

|

Sources: |

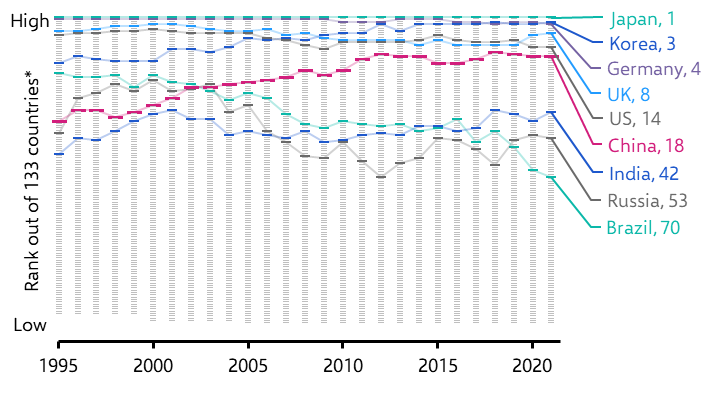

One measure of China’s technological achievement is that on the Harvard Atlas of Economic Complexity, China ranks 18th globally for the diversity and sophistication of its export basket, only a few places behind the US. (See Chart 5.)

|

Chart 5: Economic Complexity Ranking |

|

|

|

Source: |

Everywhere but in the productivity statistics

Yet this prowess hasn’t been translating into broader economic achievement. A paradox of China’s recent economic history is that it has become a leader in innovation far sooner than many had expected while its economy over the same period has slowed by far more than many had expected. The point when productivity growth began to disappoint coincides almost exactly with the pivot to prioritising technological leadership after the Global Financial Crisis.

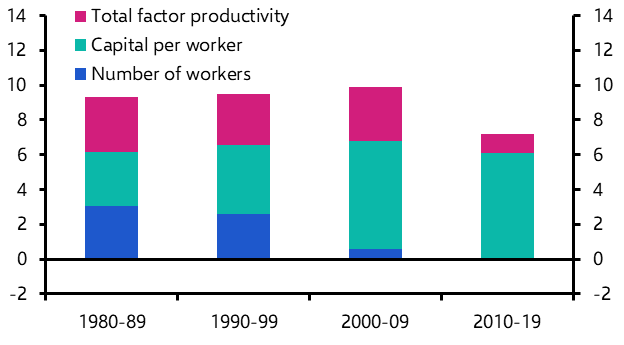

Chart 6 decomposes the drivers of China’s economic growth over recent decades. It shows that there were three engines in the 1980s and 1990s: a rising workforce and strong investment alongside productivity gains. The demographic boost faded in the 2000s but strong productivity growth was sustained. In the 2010s though, growth was almost entirely driven by capital formation. (See Chart 6.)

|

Chart 6: Drivers of Annual Growth in China’s Official GDP (%) |

|

|

|

Sources: Brandt, Loren, et al. “Recent productivity trends in China: Evidence from macro-and firm-level data.” China: An International Journal 20.1 (2022 |

Estimates of productivity growth can vary widely depending on underlying assumptions – for example, whether the official data are an accurate gauge of GDP growth. Chart 6 is based on the official GDP data: if these have overstated growth in recent years, then the resulting estimate of productivity growth will be exaggerated too. But all estimates for China show that productivity growth has slowed substantially since innovation became the focus of industrial policy around the time of the Global Financial Crisis.

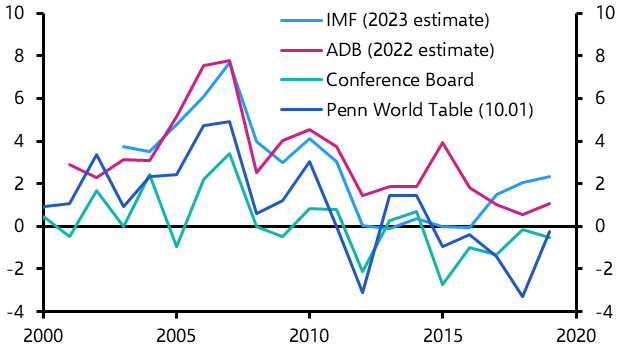

Chart 7 shows four recent annual estimates of productivity growth over the past 20~25 years from reputable bodies. The IMF takes the GDP data at face value and finds in a recent paper that productivity growth “sharply fell from 3.7 percent in the 2000s to 1.9% percent from 2010-19”. The most recent estimates in the Penn World Tables – which use alternative, lower estimate for China’s GDP growth – suggest that the level of productivity may even have declined.

|

Chart 7: Estimates of China’s Total Factor Productivity (% y/y) |

|

|

|

Sources: IMF, ADB, Conference Board, Penn World Tables, Capital Economics |

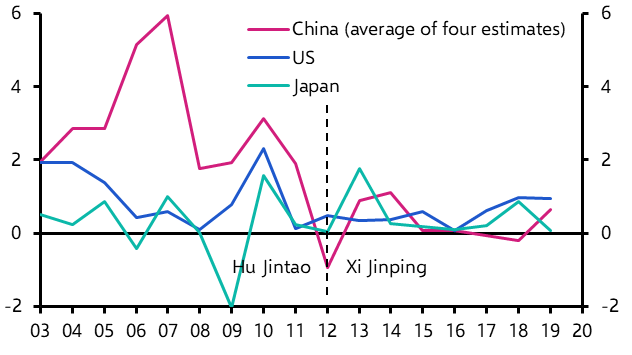

All of these productivity measures show that the pace at which China’s overall productivity is converging with the world leaders has slowed sharply. In fact, a simple average of the four estimates in Chart 7 suggests that productivity grew slower in China than in either the US or Japan between 2012, when Xi became leader, and the onset of the pandemic. (See Chart 8.)

|

Chart 8: Total Factor Productivity (% y/y) |

|

|

|

Sources: |

None of these estimates extend into the 2020s. But most observers have further scaled back their estimates of China’s potential growth in the last few years while capital accumulation has remained strong: the implication is that productivity growth has remained depressed.

The striking conclusion is that China has stopped closing the productivity gap with the global leaders under Xi Jinping and is instead now dropping further behind. The weakness of productivity growth in turn means that economic growth is being powered almost entirely by investment, despite diminishing returns and escalating debt.

Why hasn’t productivity been stronger?

What explains the failure of China’s technological successes to translate into broad productivity gains? One possibility is that the benefits of the focus on innovation haven’t yet become apparent but that they will, in time. It can take time for an economy to adapt to the new possibilities opened up by technological change. In the late 1980s, Robert Solow observed after two decades of strong investment in IT in the US that “You can see the computer age everywhere but in the productivity statistics.” But the gains did eventually materialise, in the 1990s. Perhaps a similar lag is still playing out in China.

However, that wouldn’t explain the more troubling shift over the past decade-and-a-half. It isn’t just that productivity growth hasn’t strengthened. Productivity growth has slowed substantially to rates no better, and possibly worse, than those in much richer economies. That implies that something in the structure of China’s economy has changed for the worse.

It is possible that total factor productivity, which is notoriously hard to pin down, is being mismeasured. Some argue, for example, that in an economy with rapid rates of industrial renewal, capital investment embodies productivity changes, making it futile to try to separate the impact on GDP growth of investment and productivity changes. But overall GDP still displays signs of strain. Per capita GDP growth and growth in output per worker have slowed by more than many had anticipated over the past decade and by more than it did in, for example, Korea, when it was at this stage in development.

Another explanation could be that gains in manufacturing productivity have been obscured by the surge of wasteful investment in real estate during the decade after the Global Financial Crisis. On this view, a dynamic manufacturing sector has been shackled to a sclerotic property sector that has been building assets that add nothing to GDP. If so, manufacturing’s strength should become more evident now that the property sector is shrinking.

But recent analysis from two economists at the IMF suggests that manufacturing has been struggling too. They construct an estimate of productivity changes in manufacturing using firm-level data. And they find that productivity growth has stalled in manufacturing since 2012. (See Chart 9.)

|

Chart 9: Total Factor Productivity in China |

|

|

|

Sources: Cerdeiro & Ruane, “China’s declining business dynamism”, Canadian Journal of Economics (2024), Capital Economics |

This bottom-up methodology is distinct from the usual top-down approach to estimating productivity that lies behind the estimates in Charts 6 and 7 and so we should be wary of comparing them directly.

But the IMF analysis suggests that productivity has grown at a slower rate in manufacturing than across the economy as a whole.

The IMF paper was published last year. Earlier research comes to similar conclusions. A 2022 paper that looked at changes in productivity before and after 2007 found that productivity growth had slowed in 24 of 28 sectors in industry, in many cases substantially. In a quarter of sectors, the level of productivity declined after 2007.

One drawback with these studies is they don’t look at recent developments. Even the 2024 IMF paper only extends its analysis to 2019. But a surge in the share of industrial firms that are losing money suggests that the sector’s health has only worsened in the past five years. (See Chart 10.) Even within manufacturing – the sector that Xi hopes will power China to prosperity – all is not well.

|

Chart 10: Share of Industrial Firms in China |

|

|

|

Sources: CEIC, Capital Economics |

Can governments mandate innovation?

Why has manufacturing productivity struggled? There is mounting evidence that industrial policy itself may be part of the problem.

There are several ways in which industrial policy could harm rather than help productivity:

- By slowing the exit of low productivity firms in sectors that are identified as strategic priorities.

- By encouraging the entry of low productivity firms into those sectors.

- By channelling resources (using subsidies, tax incentives, public procurement, bank loans or government-backed funds) from more to less productive firms.

- By creating incentives that result in worse productivity growth within firms, for example by encouraging them to shift business focus or simply to game the system.

A 2024 survey published by the NBER found evidence of all these policy failures in recent academic studies on the efficacy of industrial policy in China. The papers surveyed concluded that:

- Subsidies tend to go to less productive firms and to those with political connections, not to the most innovative.

- Instead of boosting productivity, subsidies have a negative impact on subsequent firm productivity. They also do not boost profits. Equipment upgrading programmes also do not raise productivity.

- Innovation subsidies do not improve the quality of patents. On the contrary, the existence of subsidies for patents incentivises firms to produce lower quality patents and less innovation overall. The subsidies have a negative return.

- However, industrial policy does boost the output and market share of firms that win support and is correlated with an increase in those firms’ employment. By contrast, firms in the same sector that do not receive subsidies are left worse off.

- The net impact of subsidies is lower productivity across China’s economy as a whole.

A failure of industrial policy – shipbuilding

One implication of the penultimate point is that industrial policy can boost market share while destroying value overall.

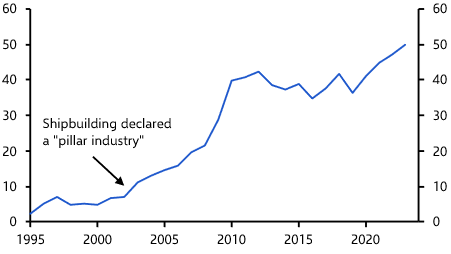

Shipbuilding is an example of a sector that China now dominates globally thanks to industrial policy, but only at huge cost. It has been a major target of industrial policy for two decades. It was declared a “pillar industry” in 2003, when China made around 10% of the world’s ships, and was singled out as a key sector of interest within manufacturing in the foundational Medium and Long-Term Programme of Science and Technology (MLP) in 2006.

China’s shipbuilders received RMB550bn in subsidies over the next eight years (2½% of 2006 GDP) against revenue for the entire sector of RMB1700bn over the same period. And if scale is what matters, the subsidies succeeded: China’s shipyards now build half the world’s ships. (See Chart 11.)

|

Chart 11: China’s Share of Global Ship Production (%, gross tonnage) |

|

|

|

Sources: USTR, Capital Economics |

But this scale and market share was achieved by inducing waves of inefficient entry to the sector. Many entrants failed at high cost and the huge increase in capacity that followed resulted in huge losses for incumbents both in China and abroad. An NBER study estimated that the subsidies cost five times the discounted value of the total profits that are likely to be generated by Chinese shipbuilders over the course of this entire century.

What is different about DeepSeek and BYD?

And yet the vitality of DeepSeek and BYD underlines that China does have highly innovative firms. What explains their success?

A closer look at DeepSeek points to a partial explanation. AI has been a Strategic Emerging Industry in China since 2016. The leading tech firms working on AI have had access to ample state support. But DeepSeek was not one of them and it does not appear to have been a major beneficiary. Instead, DeepSeek was spun out of a hedge fund that was building AI models for algorithmic trading. It also didn’t require outside financing. In other words, DeepSeek is an exception that perhaps proves the rule: in most cases, government support does not foster innovation. Innovation happens elsewhere. China’s expansion of industrial policy may have resulted in fewer DeepSeeks and more shipbuilders.

But there are industrial policy successes, most notably at the moment BYD. It has been a recipient of significant government support. According to Nikkei, it was the third largest listed recipient of subsidies last year (after Sinopec and CATL).

Support goes back a long way. Electric vehicles (subsequently “new energy vehicles”) were one of the original seven Strategic Emerging Industries announced in 2009. An “Energy-saving and New Energy Vehicle Industry Development Plan (2012-2020)” was produced in 2012 and succeeded by the current “New Energy Vehicle Industry Development Plan (2021-2035)” four years ago. And China’s EV sector now leads the world.

It might be that, as with shipbuilding, future analysis will conclude that the costs of subsidising the EV sector were never fully offset by the resulting economic gains.

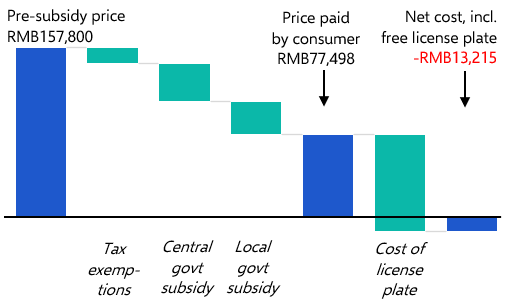

Support for the sector has been pared back but it is still sizeable. It was huge during the 2010s. For example, in 2017, a third of the price of that year’s best-selling battery-EV, the BAIC EC, was covered by a central government subsidy and tax exemptions. Local governments provided additional incentives, including in some cases a waiver of the fee to acquire a local license plate, which is needed to drive freely in the local area. In Shanghai, a license plate (acquired through an online auction) cost around RMB90,000 in 2017 (US$13,300 at the time). This was more than the post-subsidy cost of the BAIC EC. (See Chart 12.)

|

Chart 12: Cost of a BAIC EC Electric Vehicle in 2017 (local subsidy & license plate cost for Shanghai) |

|

|

|

Sources: Lee Branstetter & Guangwei Li, “The Challenges of Chinese Industrial Policy” (2024), Capital Economics |

In other words, car buyers in Shanghai – the largest EV market in China in 2017 – could purchase and drive the year’s best-selling EV for less than the cost of the license plate needed to drive a conventional ICE car.

As in shipbuilding, these incentives created a wave of domestic entrants to the sector. And despite the support, only a handful have ever made a profit. Many firms have already closed; many more are likely to in future. Reuters reported last week that more than half of China’s 169 automakers have less than a 0.1% market share.

These failures come with costs to creditors, to government finances from subsidies and from real resources squandered. Another cost to be put on the ledger against the success of BYD is the protectionist response that China’s industrial policy support for EVs has trigged overseas.

But there are good reasons to be optimistic that industrial support for EVs will prove to have been economically worthwhile over the long-term.

The economic case for subsidies and other forms of industrial policy is that they can correct market failures. Among these market failures is the inability of firms to coordinate. For example, firms may be reluctant to invest in the EV battery supply chain unless they are confident that carmakers will substantially expand auto production too – but carmakers won’t do that unless they are confident of their access to essential inputs. Government support – for example, a commitment to subsidising consumer demand – can bridge that gap. This coordinating role is particularly beneficial for sectors that are newly emerging and those with complex supply chains.

The case for industrial policy is also strong if there are likely to be lasting competitive advantages from being early to achieve scale. And if there are positive spillovers that individual firms can’t capture but which benefit the wider economy, subsidies can encourage firms to make investments they otherwise wouldn’t. All of these features describe EVs.

Shipbuilding by contrast was an established technology by the 2000s without much potential for spillovers, and the global market had already matured: after a surge in the early 2010s as Chinese shipyards ramped up production, the global tonnage of ships being built globally is now back to the levels of the mid-2000s, when China began to target the sector. By contrast, global EV sales have risen at an average annual rate of 50% over the past decade.

Why has industrial policy not lifted productivity?

Even so, BYD is not representative. Both the survey evidence of the impact of industrial policy across firms, and the macro evidence show that productivity has slowed.

We can identify three sets of reasons why industrial policy might not have boosted the wider manufacturing sector while it has boosted BYD.

First, the conditions for industrial policy to succeed – a market failure that the government can bridge – may not be that common. Where they don’t exist, subsidies reduce welfare overall: the resources would have been more productively used elsewhere.

The structure of incentives matters too. This was unusually market-friendly in the case of EVs since the allocation of EV subsidies depended largely on consumers’ purchasing decisions. Domestic producers still had to compete to offer cars that consumer wanted to buy. That set-up was unusual – in most sectors, policy support was and is allocated directly by officials rather than by market forces.

Second, although Xi Jinping says that faster productivity growth will be the measure of whether the push for technological leadership is succeeding, productivity seems in practice to be one of several considerations officials have in how industrial policy is implemented.

At the local level, support appears to be designed to shore up employment and help large and well-connected companies, even if this means keeping unproductive firms afloat.

Geopolitical security is a consideration in the overall design of industrial policy too. The “Made in China 2025” plan was explicitly intended to reduce China’s dependence on foreign inputs, whether that was foreign firms operating in China or imports. Xi Jinping’s Dual Circulation framework provides a rationale for wanting to dominate strategically-important sectors even if this isn’t economically-rational: China should be able to supply all its own needs in key areas, while also binding the rest of the world to supply chains in China. China would then be less exposed to geopolitical efforts to restrict its access to critical inputs.

This line of thinking may be a part of the reason why China pivoted so early in its development to focusing on cutting edge technology rather than catching up: by the time Xi Jinping became leader in 2012, China was concerned about the strategic vulnerability of being dependent on technology from abroad. There is an echo here of Korea’s experience: its shift away from technology adoption towards domestic innovation was precipitated in part by Korean firms finding that foreign companies were becoming more reluctant to license their technology as the Korean companies became a competitive threat. Xi Jinping seems to have concluded by the early-2010s that China would soon pose a threat to the global incumbents that was not just economic but geopolitical.

The third reason industrial policy has not boosted productivity is that its embrace in China has gone alongside an embrace of broader state intervention. Before the mid-2000s, economic policy in China had been designed to facilitate growth – by spending on infrastructure, for example – but not to dictate which sectors should benefit. By and large, that was left to market forces. (In this sense, the academic Barry Naughton argues that China didn’t have industrial policy before the MLP was adopted in 2006.) The new focus on promoting growth in sectors identified as priorities by the leadership went hand in hand with greater intervention across the economy. There is an inverse relationship between business dynamism and the size of the state sector in different parts of China. Broad state intervention under Xi intended to reshape the structure of the economy is likely to have had a dampening effect on productivity.

Pockets of innovation but productivity slowing

The picture that emerges from this analysis is of an economy with many beacons of innovation but a mounting productivity challenge.

Xi Jinping’s efforts to foster a more innovative manufacturing sector are backfiring. While there have been some successes, subsidies and other forms of industrial policy are resulting in less dynamism overall. China’s economy is diverse and the state doesn’t smother everything. There are many highly innovative private firms like DeepSeek that prosper away from the state and some that prosper with the state’s backing. But their successes are not shoring up productivity growth overall.

On its current path, China will succeed in its goal of becoming a global leader in core technologies but fail to achieve what Xi Jinping has set as the key goal: a substantial increase in total factor productivity.

We have seen this story before. Japan was at the technological cutting edge across a range of sectors in the 1980s. One influential book pointed out that “in semiconductors, cars, consumer electronics, optoelectronics, factory automation and even financial services, Japanese firms are incontrovertibly ahead of their American and European competitors” (Bill Emmott, “The sun also sets”, published in 1989). And at the time, Japanese industrial policy was widely believed to have been an important catalyst in this success. Later analysis suggested that wasn’t the case. As in China now, the policies were intended by their architects to support innovation. But the officials charged with implementing them prioritised employment and keeping economically weak but well-connected firms afloat. The best evidence suggests that industrial policy failed to lift Japanese productivity.

Japan’s macroeconomic weaknesses had been exposed by the mid-1990s. But it remained highly innovative and continued to be a global leader in some areas. In 1995, more than half of the world’s installed robots were in Japan. Its auto industry was ahead of the world – the world’s first mass-produced hybrid car, the Prius, was launched in 1997. In 2000, Japanese brands accounted for 28% of global auto sales. In consumer electronics too, Japanese firms were at the forefront. The Sony Playstation was launched in 1994 and the Nintendo 64 two years later. Lithium-ion batteries, digital cameras and 3G were all developed in the 1990s in Japan.

The lesson from Japan is that technological leadership doesn’t necessarily translate into macroeconomic success; but also that macroeconomic weakness can coexist with high levels of cutting-edge innovation.