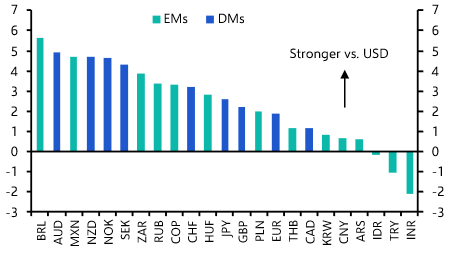

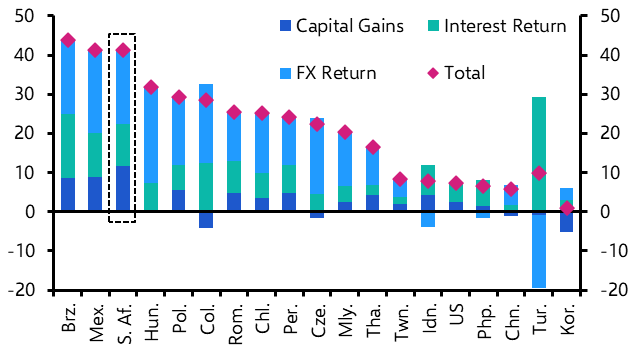

The first Fed rate cut of this cycle is now looking like a second-half event and EM investors – and policymakers – are having to adjust to the delay. EM currencies have weakened as fears about policy constraints have spread, but how vulnerable are these economies and how far will their policymakers go to offset the impact of market moves?

In a week of EM central bank decisions from Turkey to Indonesia, our EM and Markets teams held this special briefing on the impact of currency weakness on emerging market economies and policymaking.

Start date:

This content requires an active Capital Economics subscription to view. Please log into your account or contact support@capitaleconomics.com if you are interested in a complimentary access period.